Answered step by step

Verified Expert Solution

Question

1 Approved Answer

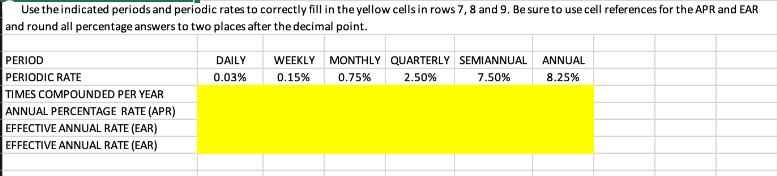

Use the indicated periods and periodic rates to correctly fill in the yellow cells in rows 7, 8 and 9. Be sure to use

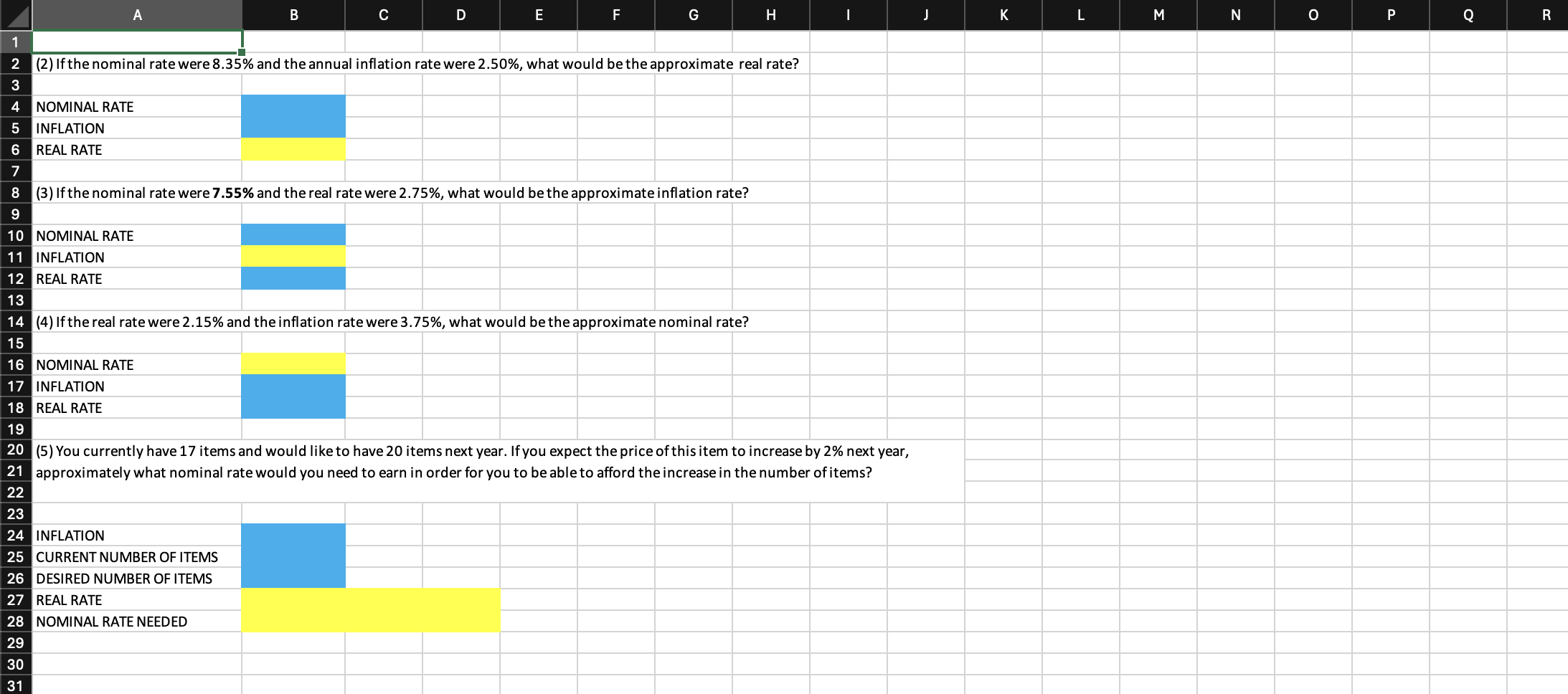

Use the indicated periods and periodic rates to correctly fill in the yellow cells in rows 7, 8 and 9. Be sure to use cell references for the APR and EAR and round all percentage answers to two places after the decimal point. PERIOD DAILY PERIODIC RATE 0.03% WEEKLY MONTHLY QUARTERLY SEMIANNUAL ANNUAL 0.15% 0.75% 2.50% 7.50% 8.25% TIMES COMPOUNDED PER YEAR ANNUAL PERCENTAGE RATE (APR) EFFECTIVE ANNUAL RATE (EAR) EFFECTIVE ANNUAL RATE (EAR) A B 0 D E F H | J K L M N P Q R 1 2 (2) If the nominal rate were 8.35% and the annual inflation rate were 2.50%, what would be the approximate real rate? 3 4 NOMINAL RATE 5 INFLATION 6 REAL RATE 7 8 (3) If the nominal rate were 7.55% and the real rate were 2.75%, what would be the approximate inflation rate? 9 10 NOMINAL RATE 11 INFLATION 12 REAL RATE 13 14 (4) If the real rate were 2.15% and the inflation rate were 3.75%, what would be the approximate nominal rate? 15 16 NOMINAL RATE 17 INFLATION 18 REAL RATE 19 20 (5) You currently have 17 items and would like to have 20 items next year. If you expect the price of this item to increase by 2% next year, 21 approximately what nominal rate would you need to earn in order for you to be able to afford the increase in the number of items? 22 23 24 INFLATION 25 CURRENT NUMBER OF ITEMS 26 DESIRED NUMBER OF ITEMS 27 REAL RATE 28 29 30 222235 NOMINAL RATE NEEDED

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started