Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use the info you have researched in each of the previous assignments below, summarize your decisions, and include the whys. Taxes, Treaties, Quotas: Scotch Whisky

Use the info you have researched in each of the previous assignments below, summarize your decisions, and include the whys.

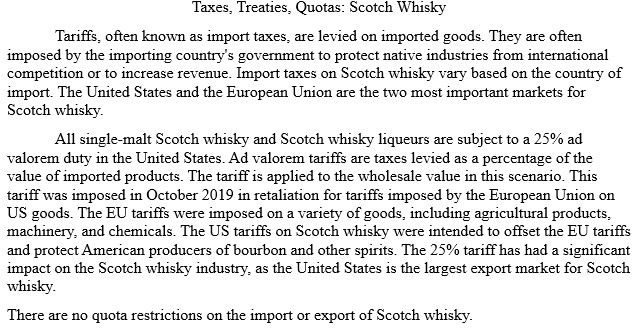

Taxes, Treaties, Quotas: Scotch Whisky Tariffs, often known as import taxes, are levied on imported goods. They are often imposed by the importing country's government to protect native industries from international competition or to increase revenue. Import taxes on Scotch whisky vary based on the country of import. The United States and the European Union are the two most important markets for Scotch whisky. All single-malt Scotch whisky and Scotch whisky liqueurs are subject to a 25% ad valorem duty in the United States. Ad valorem tariffs are taxes levied as a percentage of the value of imported products. The tariff is applied to the wholesale value in this scenario. This tariff was imposed in October 2019 in retaliation for tariffs imposed by the European Union on US goods. The EU tariffs were imposed on a variety of goods, including agricultural products, machinery, and chemicals. The US tariffs on Scotch whisky were intended to offset the EU tariffs and protect American producers of bourbon and other spirits. The 25% tariff has had a significant impact on the Scotch whisky industry, as the United States is the largest export market for Scotch whisky. There are no quota restrictions on the import or export of Scotch whisky.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The decision to import Scotch whisky involves several key aspects 1 Tariffs and Legislation The 25 a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started