Answered step by step

Verified Expert Solution

Question

1 Approved Answer

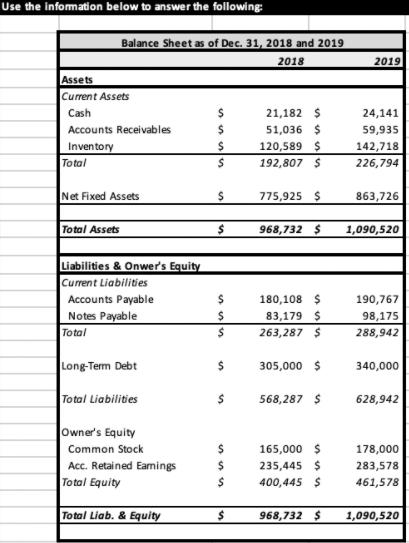

Use the Infomation below to answer the following: Balance Sheet as of Dec. 31, 2018 and 2019 2018 2019 Assets Current Assets Cash 21,182

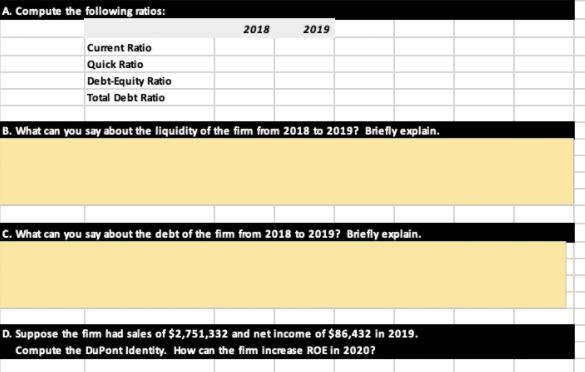

Use the Infomation below to answer the following: Balance Sheet as of Dec. 31, 2018 and 2019 2018 2019 Assets Current Assets Cash 21,182 $ 24,141 51,036 $ 120,589 $ Accounts Receivables %24 59,935 Inventory Total 142,718 192,807 $ 226,794 Net Fixed Assets 775,925 $ 863,726 Total Assets 968,732 $ 1,090,520 Liabilities & Onwer's Equity Current Liabilities Accounts Payable 180,108 $ 190,767 Notes Payable 83,179 $ 98,175 Total 263,287 $ 288,942 Long-Term Debt 305,000 $ 340,000 Total Liabilities 568,287 $ 628,942 Owner's Equity Common Stock 165,000 $ 178,000 Acc. Retained Eamings Total Equity 235,445 $ 283,578 %24 400,445 $ 461,578 Total Liab. & Equity %24 968,732 $ 1,090,520 A. Compute the following ratios: 2018 2019 Curent Ratio Quick Ratio Debt-Equity Ratio Total Debt Ratio B. What can you say about the liquidity of the fim from 2018 to 2019? Briefly explain. c. What can you say about the debt of the fim from 2018 to 20197 Briefly explain. D. Suppose the fim had sales of $2,751,332 and net income of $86,432 in 2019. Compute the DuPont Identity. How can the fim increase ROE in 2020?

Step by Step Solution

★★★★★

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a Current Ratio in 2018Current AssetsCurrent Liabilities 192807263287 073 Cur...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started