Answered step by step

Verified Expert Solution

Question

1 Approved Answer

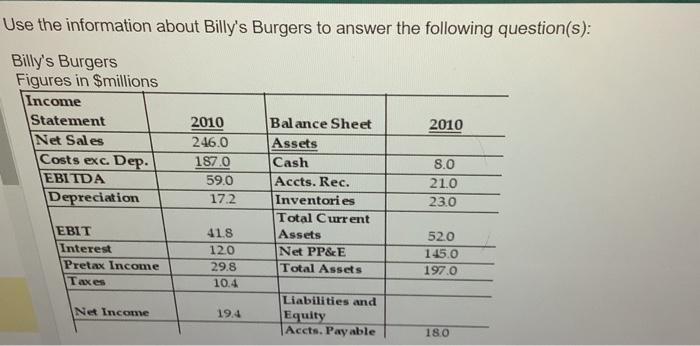

Use the information about Billy's Burgers to answer the following question(s): Billy's Burgers Figures in $millions Income Statement Net Sales Costs exc. Dep. EBITDA

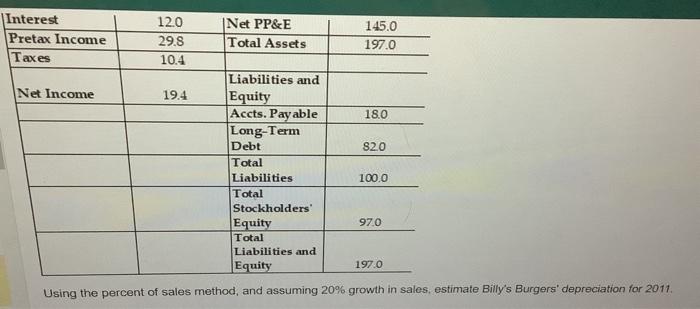

Use the information about Billy's Burgers to answer the following question(s): Billy's Burgers Figures in $millions Income Statement Net Sales Costs exc. Dep. EBITDA Depreciation EBIT Interest Pretax Income Taxes Net Income 2010 246.0 187.0 59.0 17.2 41.8 12.0 29.8 10.4 19.4 Balance Sheet Assets Cash Accts. Rec. Inventories Total Current Assets Net PP&E Total Assets Liabilities and Equity Accts. Payable 2010 8.0 21.0 23.0 52.0 145.0 197.0 180 Interest Pretax Income Taxes Net Income 12.0 29.8 10.4 19.4 Net PP&E Total Assets Liabilities and Equity Accts. Payable Long-Term Debt Total Liabilities Total Stockholders' Equity Total 145.0 197.0 18.0 82.0 100.0 97.0 Liabilities and Equity Using the percent of sales method, and assuming 20 % growth in sales, estimate Billy's Burgers' depreciation for 2011. 197.0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To estimate Billys Burgers depreciation for 2011 using the percent of sales method and assuming a 20 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started