Question

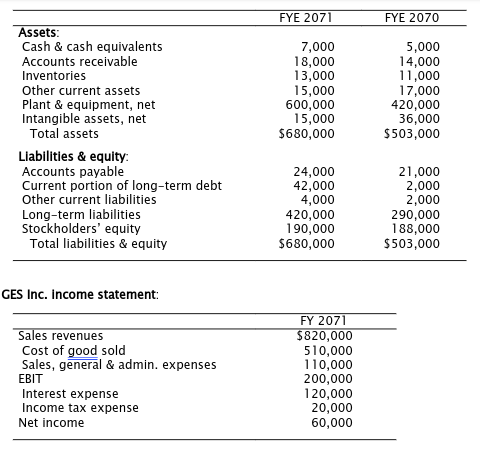

Use the information about GES Inc. provided above to answer questions (a) and (b). Calculate the firm's current ratio for FY 2070.

Use the information about GES Inc. provided above to answer questions (a) and (b). Calculate the firm's current ratio for FY 2070.

b. Calculate the current ratio for FY 2071 and provide the main reason for the change in the ratio from FY 2070 to FY 2071. Answer (show the steps/calculation toward your results):

c. Calculate the turnover ratios, respectively, for accounts receivable, inventories, and accounts payable for FY 2071. *Use average balance for B/S items

d. alculate the days accounts receivable, days inventory turnover, and days accounts payable.

FYE 2071 FYE 2070 Assets: Cash & cash equivalents Accounts receivable Inventories Other current assets Plant & equipment, net 7,000 5,000 18,000 14,000 13,000 11,000 15,000 17,000 600,000 420,000 Intangible assets, net 15,000 36,000 Total assets $680,000 $503,000 Liabilities & equity: Accounts payable 24,000 21,000 Current portion of long-term debt 42,000 2,000 Other current liabilities 4,000 2,000 Long-term liabilities 420,000 290,000 Stockholders' equity 190,000 188,000 Total liabilities & equity $680,000 $503,000 GES Inc. income statement: Sales revenues Cost of good sold Sales, general & admin. expenses EBIT Interest expense Income tax expense Net income FY 2071 $820,000 510,000 110,000 200,000 120,000 20,000 60,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started