Question

Use the information below. Comfin Company has estimates on its level of current and total assets for the next two years: a. Estimate the levels

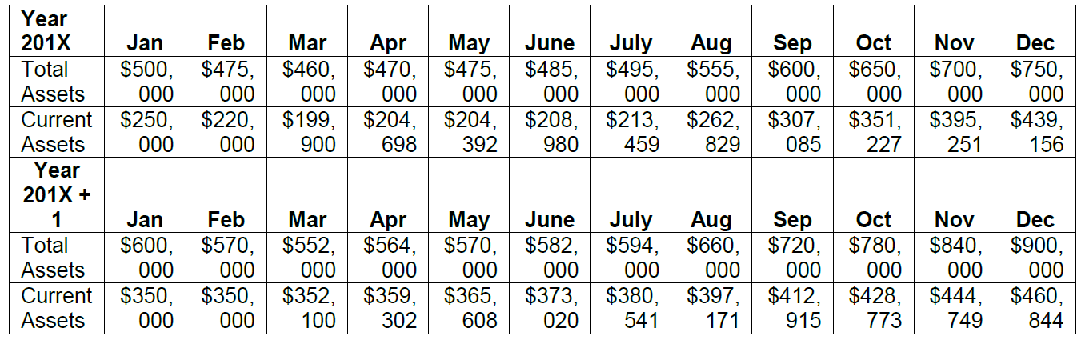

Use the information below. Comfin Company has estimates on its level of current and total assets for the next two years:

a. Estimate the levels of permanent and temporary current assets for Comfin over these months. Find the average amount for fixed assets, permanent current assets, and temporary current assets in the year 201X and year 201X + 1.

b. What average amounts of short-term and long-term financing should Comfin have during each year if it wants to follow a maturity-matching financing strategy over time?

c. What average amounts of short-term and long-term financing should Comfin have during each year if it wants to follow an aggressive financing strategy over time?

d. Suppose Comfins cost of short-term funds is 8 percent and its cost of long-term funds is 15 percent. Use your answers in (b) and (c) to compute the cost of each strategy.

Thanks!

Use the information below. Comfin Company has estimates on its level of current and total assets for the next two years: Estimate the levels of permanent and temporary current assets for Comfin over these months. Find the average amount for fixed assets, permanent current assets, and temporary current assets in the year 201X and year 201X + 1. What average amounts of short-term and long-term financing should Comfin have during each year if it wants to follow a maturity-matching financing strategy over time? What average amounts of short-term and long-term financing should Comfin have during each year if it wants to follow an aggressive financing strategy over time? Suppose Comfin's cost of short-term funds is 8 percent and its cost of long-term funds is 15 percent. Use your answers in (b) and (c) to compute the cost of each strategyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started