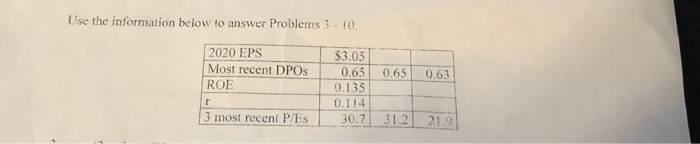

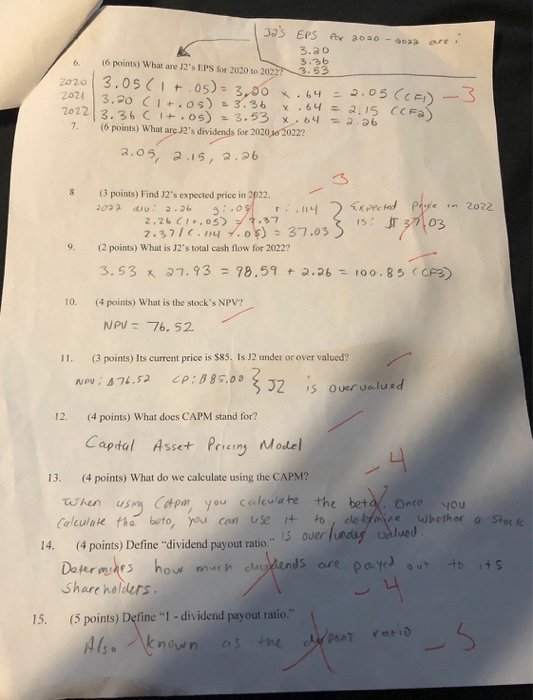

Use the information below to answer Problems 3-10 2020 EPS Most recent DPOs ROE 0.65 0.63 0.65 0.135 0.114 30.7 3 most recent P/ES 31.2 21.9 Jas EPS for 2010 - 20 ore. 3.20 3.25 6. (6 points) What are J2's EPS for 2020 to 2022/ 3.53 2020 |3.05(lt.05)= 3,60 x 64 = 2.05 (CFI) - ZOZI 3.20 C o s) 3.36 .64 = 2.15 (CF) 2022 3.361 .05) = 3.53 X.64 = 2.26 7. (6 points) What are 2's dividends for 2020 2022? 2.05, 2.15, 2.26 (3 points) Find J2's expected price in 2022. - 2022 aw: 2.26 gioos riolly 2 Expected Prople in 2022 2,26 (lt.os) 2.37 2.371.147.5) = 37.033 15: 3703 2 points) What is J2's total cash flow for 2022? 3.53 x 27.93 = 98.59 + 2.26 = 100.85 (CPB) 9. 10. (4 points) What is the stock's NPV? NPV = 76.52 II. (3 points) Its current price is $85. Is J2 under or over valued? NOU: 871,52 CP:885.003 J2 is over valued 12. (4 points) What does CAPM stand for? Capital Asset Pricing Model 13. (4 points) What do we calculate using the CAPM? When using Capm, you calculate the betd. Once you Calculate the beto, you can use it to, co kermine whether a Stock 14. (4 points) Define "dividend payout ratio is over lundes u ued Determines how much chusblends are payed out to its Shareholders 15. (5 points) Define "1 - dividend payout ratio." Also known as the oppont ratio Use the information below to answer Problems 3-10 2020 EPS Most recent DPOs ROE 0.65 0.63 0.65 0.135 0.114 30.7 3 most recent P/ES 31.2 21.9 Jas EPS for 2010 - 20 ore. 3.20 3.25 6. (6 points) What are J2's EPS for 2020 to 2022/ 3.53 2020 |3.05(lt.05)= 3,60 x 64 = 2.05 (CFI) - ZOZI 3.20 C o s) 3.36 .64 = 2.15 (CF) 2022 3.361 .05) = 3.53 X.64 = 2.26 7. (6 points) What are 2's dividends for 2020 2022? 2.05, 2.15, 2.26 (3 points) Find J2's expected price in 2022. - 2022 aw: 2.26 gioos riolly 2 Expected Prople in 2022 2,26 (lt.os) 2.37 2.371.147.5) = 37.033 15: 3703 2 points) What is J2's total cash flow for 2022? 3.53 x 27.93 = 98.59 + 2.26 = 100.85 (CPB) 9. 10. (4 points) What is the stock's NPV? NPV = 76.52 II. (3 points) Its current price is $85. Is J2 under or over valued? NOU: 871,52 CP:885.003 J2 is over valued 12. (4 points) What does CAPM stand for? Capital Asset Pricing Model 13. (4 points) What do we calculate using the CAPM? When using Capm, you calculate the betd. Once you Calculate the beto, you can use it to, co kermine whether a Stock 14. (4 points) Define "dividend payout ratio is over lundes u ued Determines how much chusblends are payed out to its Shareholders 15. (5 points) Define "1 - dividend payout ratio." Also known as the oppont ratio