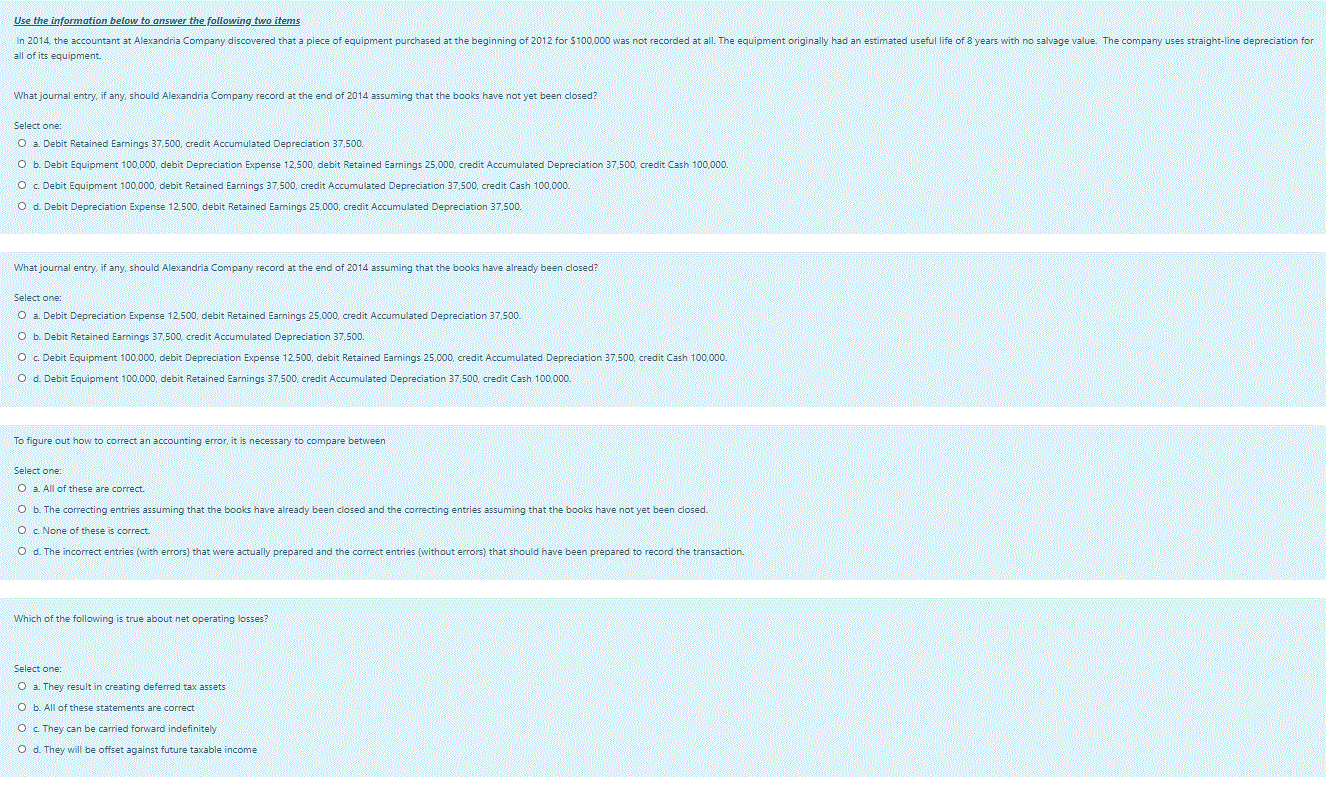

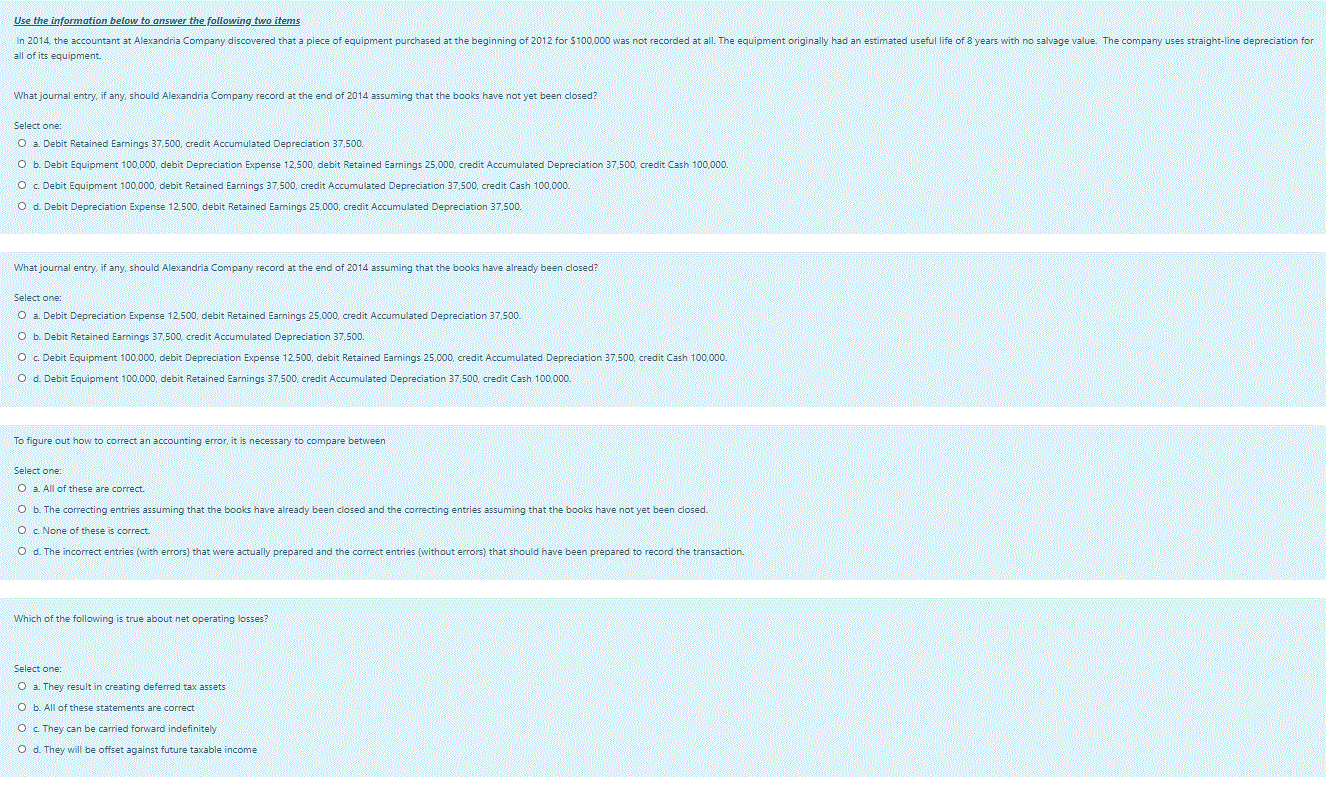

Use the information below to answer the following two items In 2014, the accountant at Alexandria Company discovered that a piece of equipment purchased at the beginning of 2012 for $100,000 was not recorded at all. The equipment originally had an estimated useful life of 8 years with no salvage value. The company uses straight-line depreciation for all of its equipment What journal entry, if any, should Alexandria Company record at the end of 2014 assuming that the books have not yet been closed? Select one: O a. Debit Retained Earnings 37.500, credit Accumulated Depreciation 37.500. O b. Debit Equipment 100,000, debit Depreciation Expense 12,500, debit Retained Eamings 25,000 credit Accumulated Depreciation 37 500, credit Cash 100,000. O c. Debit Equipment 100.000, debit Retained Earnings 37 500, credit Accumulated Depreciation 37.500, credit Cash 100,000. O d. Debit Depreciation Expense 12,500, debit Retained Earnings 25,000, credit Accumulated Depreciation 37.500. What journal entry, if any, should Alexandria Company record at the end of 2014 assuming that the books have already been closed? Select one: O a Debit Depreciation Expense 12.500, debit Retained Earnings 25,000. credit Accumulated Depreciation 37.500 O b. Debit Retained Earnings 37.500, credit Accumulated Depreciation 37.500. O c Debit Equipment 100,000, debit Depreciation Expense 12.500, debit Retained Earnings 25,000, credit Accumulated Depreciation 37.500. credit Cash 100,000. O d. Debit Equipment 100,000, debit Retained Earnings 37,500, credit Accumulated Depreciation 37 500, credit Cash 100,000. To figure out how to correct an accounting error, it is necessary to compare between Select one: O a. All of these are correct. O b. The correcting entries assuming that the books have already been closed and the correcting entries assuming that the books have not yet been closed. O c None of these is correct. O d. The incorrect entries (with errors) that were actually prepared and the correct entries (without errors) that should have been prepared to record the transaction Which of the following is true about net operating losses? Select one: O a. They result in creating deferred tax assets O b. All of these statements are correct O c They can be carried forward indefinitely O d. They will be offset against future taxable income