Answered step by step

Verified Expert Solution

Question

1 Approved Answer

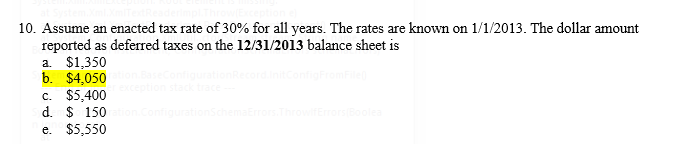

Use the information below to answer the question above. Can someone help me with this question, please? it shows the answer as b) $4050 but

Use the information below to answer the question above.

Can someone help me with this question, please? it shows the answer as b) $4050 but I dont know how it got that? is it a deferred tax asset or deferred tax liability? show your work and thanks in advance!

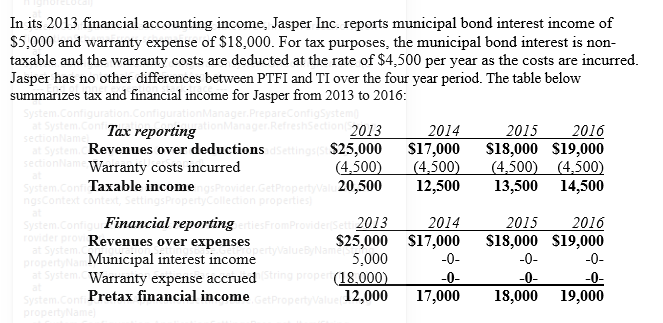

here PTFI is just abbreviation for pretax financial income and TI is an abbreviation for taxable income.

10. Assume an enacted tax rate of 30% for all years. The rates are known on 1/1/2013. The dollar amount reported as deferred taxes on the 12/31/2013 balance sheet is a $1,350 b. $4,050 c. $5,400 d. $ 150 e. $5,550 In its 2013 financial accounting income, Jasper Inc. reports municipal bond interest income of $5,000 and warranty expense of $18,000. For tax purposes, the municipal bond interest is non- taxable and the warranty costs are deducted at the rate of $4,500 per year as the costs are incurred. Jasper has no other differences between PTFI and TI over the four year period. The table below summarizes tax and financial income for Jasper from 2013 to 2016: y Tax reporting 2013 at System Revenues over deductions Settings $25,000 secondar Warranty costs incurred (4,500) System.Con Taxable income Provider. GetPropertywa 20,500 20,500 2014 $17,000 (4,500) 12,500 2015 2016 $18,000 $19.000 (4,500) (4,500) 13,500 14,500 System.Config Financial reportingtiesFromProvider Set 2013 Set 2013 Revenues over expenses $25,000 property Na Municipal interest income 5.000 at System Warranty expense accrued (18.000) System.Cor Pretax financial income Property Value 12,000 2014 $17,000 -0- -0- 17,000 2015 2016 $18,000 $19,000 -0- -0- -0 -0- 18,000 19,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started