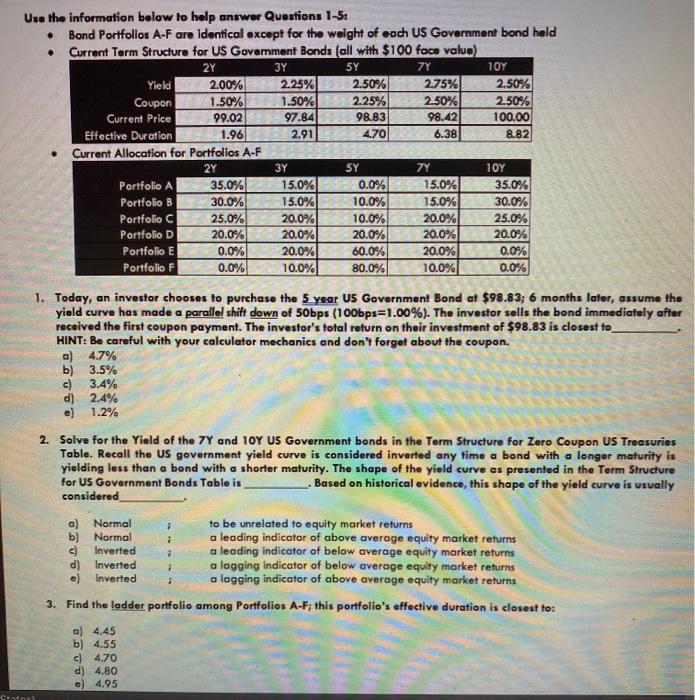

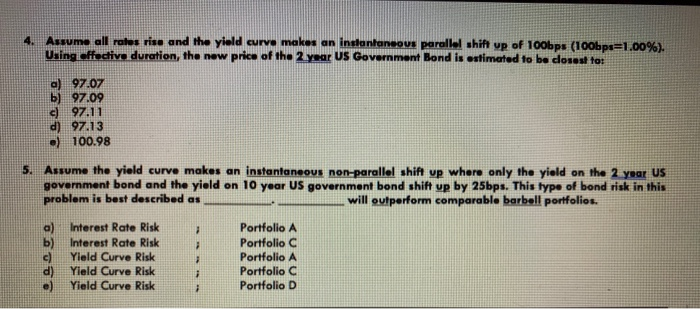

Use the information below to help answer Questions 1-5 Bond Portfolios A-F are identical except for the weight of each US Government bond held Current Term Structure for US Government Bonds (all with $100 foce value) 2Y 37 59 7Y 10Y Yield 2.00% 2.25% 2.50% 2.75% 2.50% Coupon 1.50% 1.50% 2.25% 2.50% 2.50% Current Price 9 9.02 9 7.84 98.83 9 8.42 100.00 Effective Duration 1.962.914706.388.82 Current Allocation for Portfolios A-F 2Y 3Y 5Y Y 10Y Portfolio A 3 5.0% 15.0% 0.0% 15.0% 35.0% Portfolio B 30.0% 15.0% 10.0% 15.0% 0.0% Portfolio 25.0% 20.0% 10.0% 20.0% 25.0% Portfolio D 2 0.0% 20.0% 20.0% 20.0% = 20.0% Portfolio 0.0% 20.0% 60.0% 20.0% 0.0% Portfolio F 2 0 .0% 10.0% 80.0% 0.0% 0.0% 1. Today, an investor chooses to purchase the 5 year US Government Bond at $98.83; 6 months later, assume the yield curve has made a parallel shift down of 50bps (100bps=1.00%). The investor sells the bond immediately after received the first coupon payment. The investor's total return on their investment of $98.83 is closest to HINT: Be careful with your calculator mechanics and don't forget about the coupon. a) 4.7% b) 3.5% c) 3.4% d) 2.4% e) 1.2% 2. Solve for the Yield of the 77 and 10Y US Government bonds in the Term Structure for Zero Coupon US Treasuries Table. Recall the US government yield curve is considered inverted any time a bond with a longer maturity is yielding less than a bond with a shorter maturity. The shape of the yield curve as presented in the Term Structure for US Government Bonds Table is Based on historical evidence, this shape of the yield curve is usually considered_ ng indicator of below average a) Normal b) Normal c) Inverted d) Inverted e) Inverted to be unrelated to equity market returns a leading indicator of above average equity market returns a leading indicator of below average equity market returns a lagging indicator of below average equity market returns a lagging indicator of above average equity market returns 3. Find the ladder portfolio among Portfolios A-F; this portfolio's effective duration is closest to: a) 4.45 b) 4.55 c) 4.70 d) 4.80 e) 4.95 4. Assume all rates rise and the yield curve makes an instantaneous perellel shift up of 100bps (100bps=1.00%). Uning effective duration, the new price of the 2 year US Government Bond is estimated to be dosest to a) 97.07 b) 97.09 c) 97.11 d) 97.13 .) 100.98 Assume the yield curve makes an instantaneous non-parallel shift up where only the yield on the 2 year US government bond and the yield on 10 year US government bond shift up by 25bps. This type of bond risk in this problem is best described as will outperform comparable barbell portfolios. a) b) Interest Rate Risk Interest Rate Risk Yield Curve Risk Yield Curve Risk Yield Curve Risk Portfolio A Portfolio C Portfolio A Portfolio C Portfolio D d) e)