Use the information below to prepare the individual income tax return for Helen and Robert Parr for the tax year ended December 31, 2018

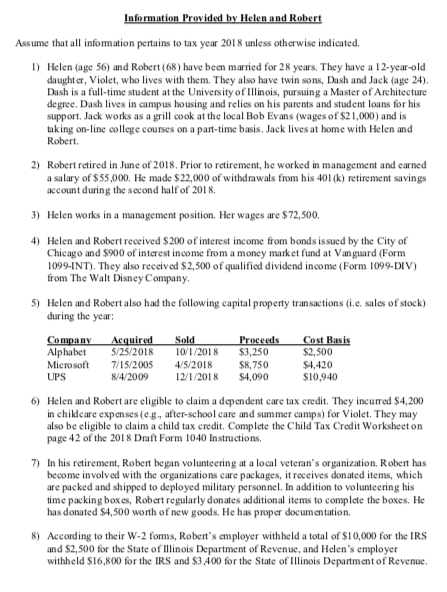

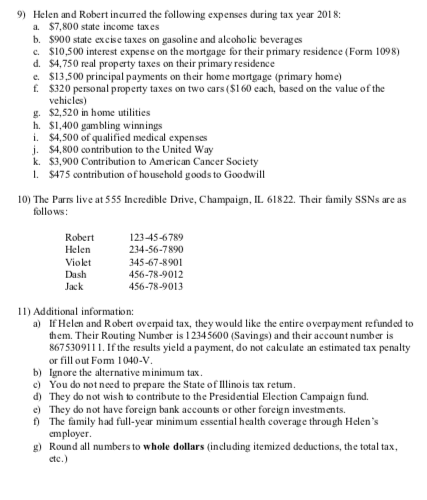

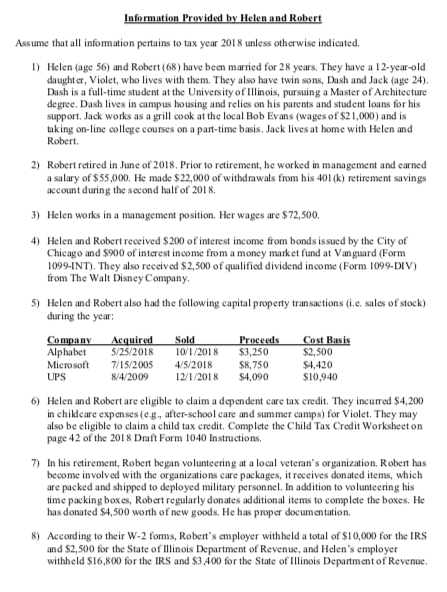

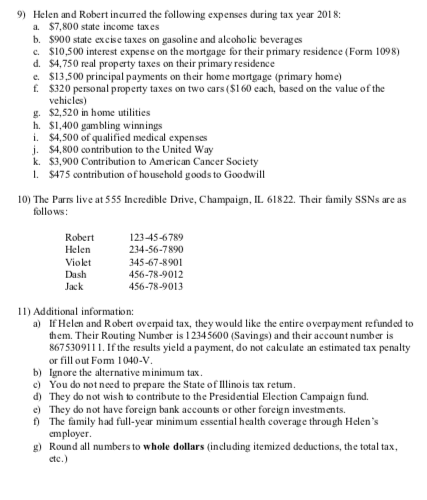

Assume that all infomation pertains to tax year 201 8 unless otherwise indicated. 1) Helen (age 56) and Robert (68) have been married for 28 years. They have a 12-year-old daughter, Violet, who lives with them. They also have twin sons, Dash and Jack (age 24 Dash is a full-time student at the University ofnois, pursuing a Master of Architecture degree. Dash lives in campus housing and relies on his parents and student loans for his support. Jack works as a grill cook at the local Bob Evans (wages of $21,000) and is taking on-line college courses on a part-time basis, Jack lives at home with Helen and Robert 2) Robert retied in June of 2018. Prior to retirement, he worked in management and earned a salary of $55,000. He made $22,000 of withdrawals from his 40l(k) retirement savings account during the second half of 2018. 3) Helen works in a management position. Her wages are $72,500. Helen and Robert received $200 of interest income from bonds issued by the City of Chicago and $900 of interest income from a money market fund at Vanguard (Form 1099-INT). They also received $2,500 of qualified dividend income (Form 1099-DIV) rom The Walt Disney Company 5) Helen and Robert also had the following capital property transactions (i.e. sales of stock) during the year: Alphabet 5/25 2018 2018 $3,250 Microsoft 7/15/2005 4/5/2018 $8,750 UPS $2,500 $4,420 $10,940 8/4/2009 12/1/2018 $4,090 6 Helen and Robert are eligible to claim a dependent care tax credit. They incurmed $4,200 in childeare expenses (eg, ater-school care and summer camps) for Violet. They may also be eligible to claim a child tax credit. Complete the Child Tax Credit Worksheet on page 42 of the 2018 Draft Form 1040 Instuctions. 7) In his retirement, Robert began volunteering at a local veteran's organization. Robert has become in volved with the organizations care packages, it receives donated items, which are packed and shipped to deployed military personnel. In addition to volunteering his ime packing boxes, Robert regularly donates additional items to complete the boxes. He has donated S4,500 wonth of new goods. He has proper documentation. 8) According to their W-2 foms, Robert's employer withheld a total of $10,000 for the IRS and $2,500 for the State of Ilinois Department of Revenue, and Helen's employer withheld S16,800 for the IRS and $3,400 for the State of linois Department of Revenue Assume that all infomation pertains to tax year 201 8 unless otherwise indicated. 1) Helen (age 56) and Robert (68) have been married for 28 years. They have a 12-year-old daughter, Violet, who lives with them. They also have twin sons, Dash and Jack (age 24 Dash is a full-time student at the University ofnois, pursuing a Master of Architecture degree. Dash lives in campus housing and relies on his parents and student loans for his support. Jack works as a grill cook at the local Bob Evans (wages of $21,000) and is taking on-line college courses on a part-time basis, Jack lives at home with Helen and Robert 2) Robert retied in June of 2018. Prior to retirement, he worked in management and earned a salary of $55,000. He made $22,000 of withdrawals from his 40l(k) retirement savings account during the second half of 2018. 3) Helen works in a management position. Her wages are $72,500. Helen and Robert received $200 of interest income from bonds issued by the City of Chicago and $900 of interest income from a money market fund at Vanguard (Form 1099-INT). They also received $2,500 of qualified dividend income (Form 1099-DIV) rom The Walt Disney Company 5) Helen and Robert also had the following capital property transactions (i.e. sales of stock) during the year: Alphabet 5/25 2018 2018 $3,250 Microsoft 7/15/2005 4/5/2018 $8,750 UPS $2,500 $4,420 $10,940 8/4/2009 12/1/2018 $4,090 6 Helen and Robert are eligible to claim a dependent care tax credit. They incurmed $4,200 in childeare expenses (eg, ater-school care and summer camps) for Violet. They may also be eligible to claim a child tax credit. Complete the Child Tax Credit Worksheet on page 42 of the 2018 Draft Form 1040 Instuctions. 7) In his retirement, Robert began volunteering at a local veteran's organization. Robert has become in volved with the organizations care packages, it receives donated items, which are packed and shipped to deployed military personnel. In addition to volunteering his ime packing boxes, Robert regularly donates additional items to complete the boxes. He has donated S4,500 wonth of new goods. He has proper documentation. 8) According to their W-2 foms, Robert's employer withheld a total of $10,000 for the IRS and $2,500 for the State of Ilinois Department of Revenue, and Helen's employer withheld S16,800 for the IRS and $3,400 for the State of linois Department of Revenue