Answered step by step

Verified Expert Solution

Question

1 Approved Answer

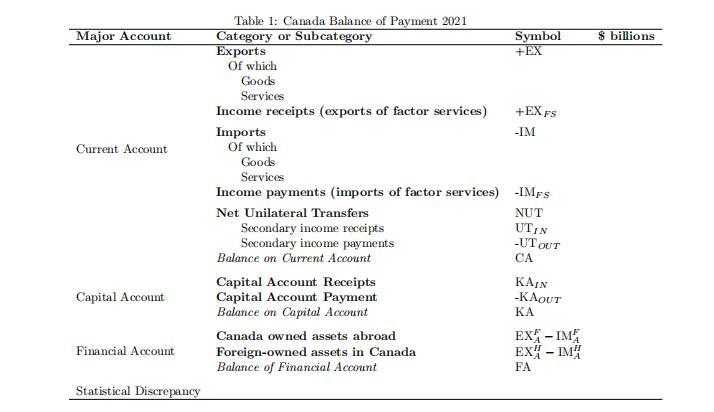

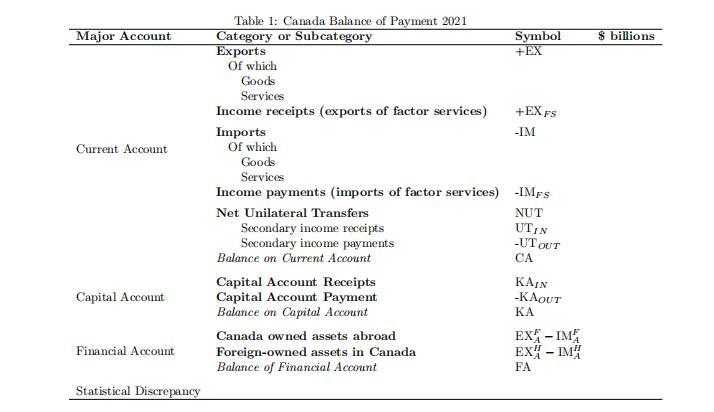

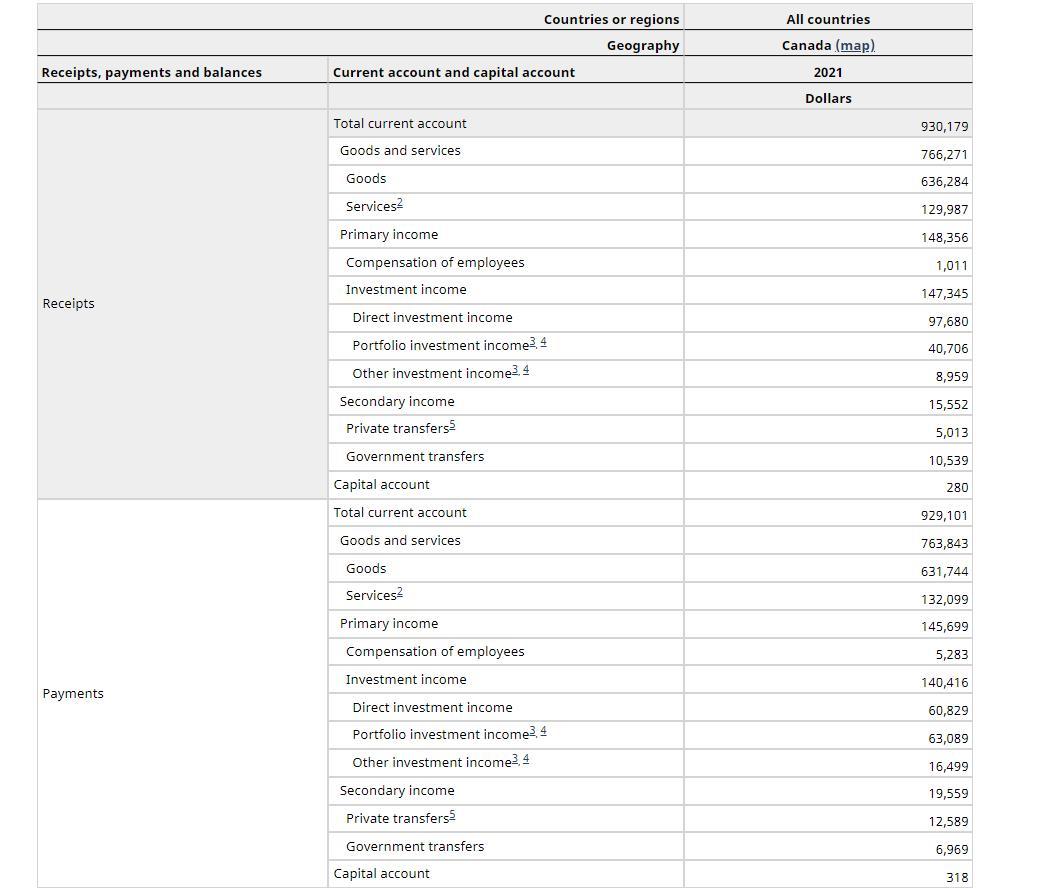

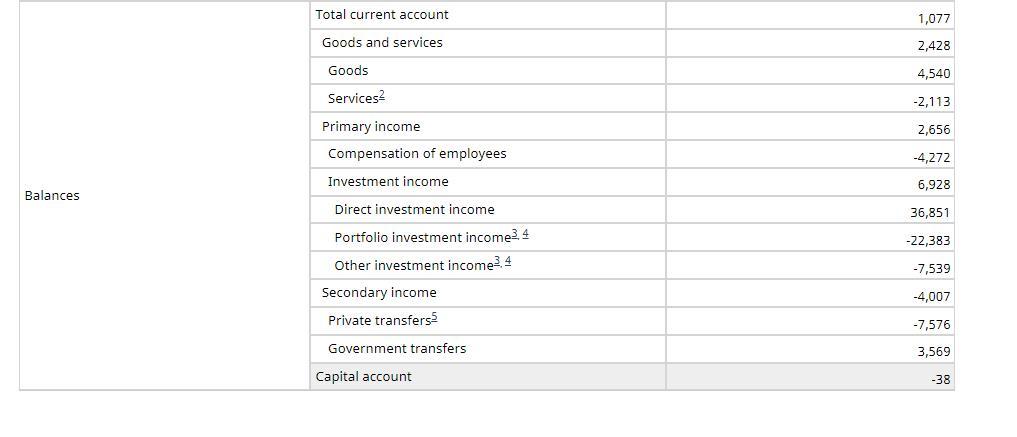

Use the information from 2021 to complete the amounts in Table 1 based on Statistics Canada's Current and Capital Account table and the financial accounts

Use the information from 2021 to complete the amounts in Table 1 based on Statistics Canada's Current and Capital Account table and the financial accounts table.

Major Account Current Account Capital Account Financial Account Statistical Discrepancy Table 1: Canada Balance of Payment 2021 Category or Subcategory Exports Of which Goods Services Income receipts (exports of factor services) Imports Of which Goods Services Net Unilateral Transfers Secondary income receipts Secondary income payments Balance on Current Account Income payments (imports of factor services) -IMFs NUT UTIN -UT OUT CA Capital Account Receipts Capital Account Payment Balance on Capital Account Symbol +EX Canada owned assets abroad. Foreign-owned assets in Canada Balance of Financial Account +EX FS -IM KAIN -KAOUT EXA - IMA EX - IM FA $ billions

Step by Step Solution

★★★★★

3.37 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Based on the information provided in the table we can complete the amounts for the balance of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started