Answered step by step

Verified Expert Solution

Question

1 Approved Answer

use the information from above to close revenues and expenses as well as to close the account retained earning. 1:02 61% Answer 1 of 1

use the information from above to close revenues and expenses as well as to close the account retained earning.

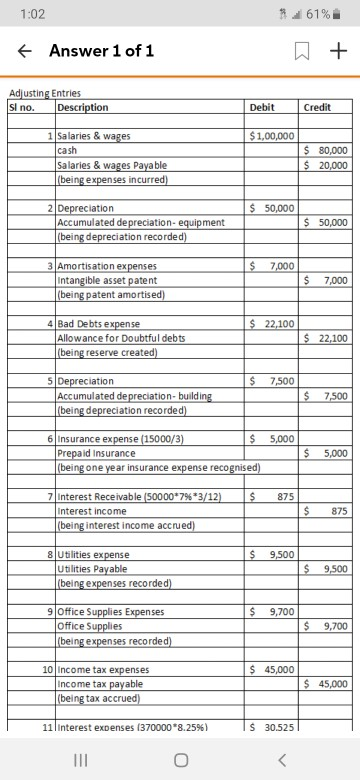

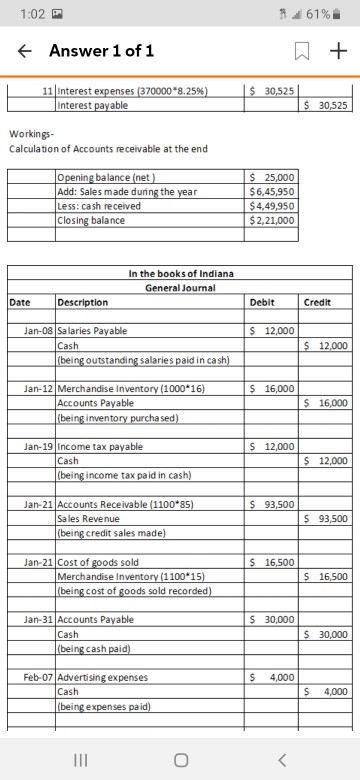

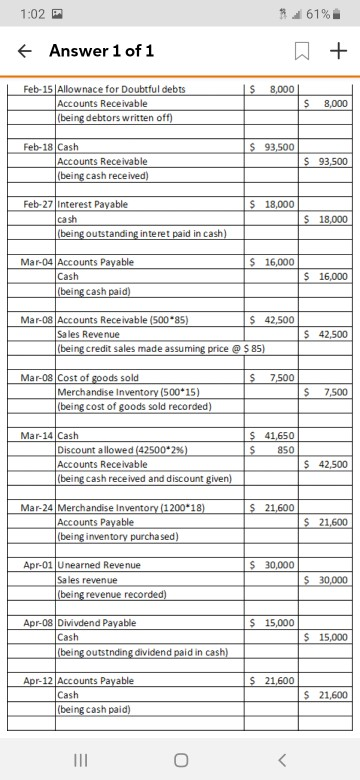

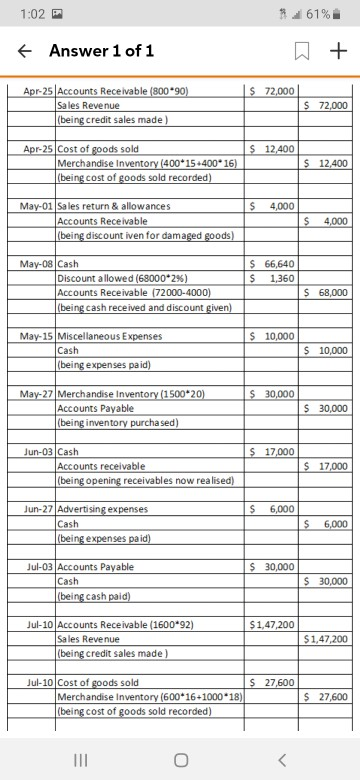

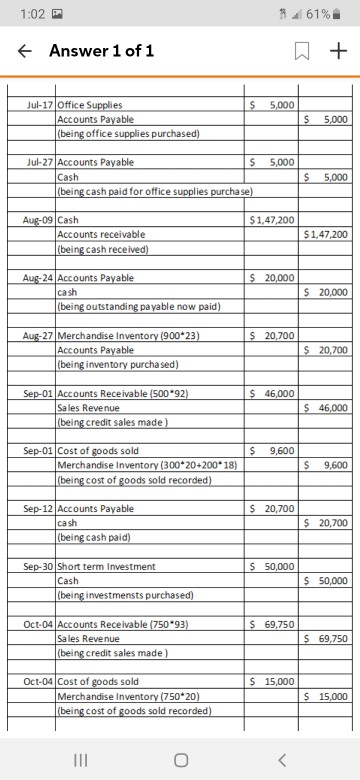

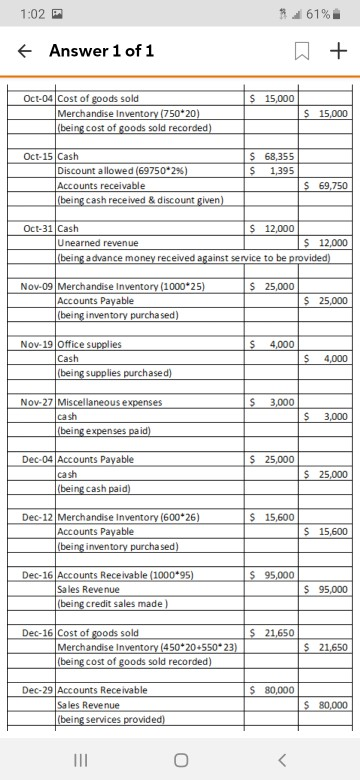

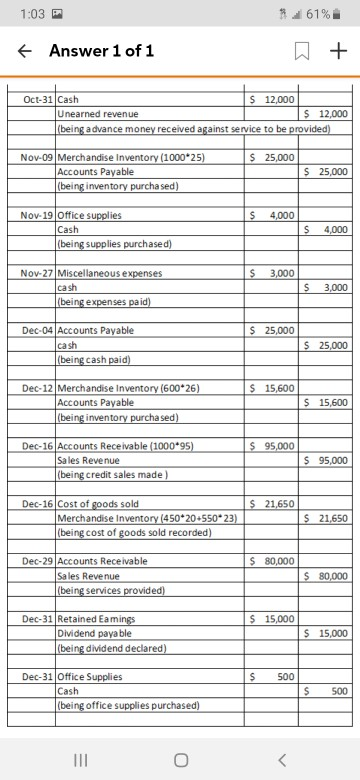

1:02 61% Answer 1 of 1 Adjusting Entries Sl no. Description Debit Credit 1Salaries & wages cash Salaries & wages Payable (being expenses incurred) $1,00,000 $ 80,000 $ 20,000 2 Depreciation Accumulated depreciation- equipment (being depreciation recorded) 50,000 $ 50,000 3 Amortisation expenses Intangible asset patent (being patent amortised) $ 7,000 7,000 4 Bad Debts expense Allowance for Doubtful debts (being reserve created) $ 22,100 $ 22,100 5 Depreciation Accumulated depreciation- building (being depreciation recorded) $ 7,500 7,500 6 Insurance expense (15000/3) Prepaid Insurance (being one year ins urance expense recognised) 5,000 $ 5,000 7 Interest Receivable (50000 7% 3 / 12 ) 875 875 Interest income (being interest income accrued) 8 Utlities expense Utilities Payable (being expenses recorded) 9,500 9,500 9 Office Supplies Expenses Office Supplies (being expenses recorded) $ 9,700 $ 9,700 10 Income tax expenses Income tax payable |(being tax accrued) $45,000 $45,000 11interest exDenses (370000*8.25 %) S 30.525 1:02 61% Answer 1 of 1 11 interest expenses (370000 *8.259%) Interest payable $ 30,525 $ 30,525 Workings- Calculation of Accounts receivable at the end Opening balance (net Add: Sales made during the year $ 25,000 $6,45,950 $4,49,950 $2,21,000 Less: cash received Closing balance In the books of Indiana General Journal Description Date Debit Credit Jan-08 Salaries Payable Cash |(being outstanding salaries paid in cash) S 12,000 S 12,000 Jan-12 Merchandise Inventory (1000 16) Accounts Payable (being inventory purcha sed) $ 16,000 $ 16,000 Jan-19 Income tax payable Cash (being income tax pa id in cash) S 12,000 S 12,000 Jan-21 Accounts Receivable (1100 85) Sa les Revenue (being credit sales made) S 93,500 S 93,500 Jan-21 Cost of goods sold Merchandise Inventory (1100 15) (being cost of goods sold recorded) S 16,500 S 16,500 Jan-31 Accounts Payable Cash (being cash paid) 30,000 S 30,000 Feb-07 Advertising expenses Cash (being expenses paid) 4,000 4,000 1:02 61% Answer 1 of 1 Feb-15 Allownace for Doubtful debts Accounts Receivable 8,000 8,000 (being debtors written off) $ 93,500 Feb-18 Cash Accounts Receivable (being cash received) S 93,500 Feb-27 Interest Payable ca sh (being outstanding interet paid in cash) $ 18,000 S 18,000 Mar-04 Accounts Payable Cash |(being cash paid) 16,000 S 16,000 Mar-08 Accounts Receivable (500 85) Sa les Revenue (being credit sales made assuming price@$ 85) $ 42,500 $ 42,500 Mar-08 Cost of goods sold 7,500 Merchandise Inventory (500*15) (being cost of goods sold recorded) 7,500 Mar-14 Cash S 41,650 Discount a llowed (42500 2 % ) Accounts Receivable (being cash rece ived and discount given) 850 S 42,500 Mar-24 Merchandise Inventory (1200 18) Accounts Payable (being inventory purcha sed) S 21,600 $ 21,600 Apr-01 Unearned Revenue Sales revenue (being revenue recorded) S 30,000 S 30,000 Apr-08 Divivdend Payable 15,000 Cash (being outstnding dividend paid in cash) 15,000 S 21,600 Apr-12 Accounts Payable Cash (being cash paid) 21,600 1:02 61% Answer 1 of 1 Apr-25 Accounts Rece ivable (800 90) Sa les Revenue |(being credit sales made) $ 72,000 S 72,000 Apr-25 Cost of goods sold Merchandise Inventory (400*15+400*16) (being cost of goods sold recorded) S 12400 S 12,400 May-01 Sales return & allowances Accounts Receivable (being discount iven for damaged goods) $ 4,000 4,000 $ 66,640 May-08 Cash Discount a llowed (68000 2 % ) Accounts Receivable (72000-4000) (being cash received and discount given) 1,360 S 68,000 May-15 Miscellaneous Expenses Cash (being expenses pa id) 10,000 $ 10,000 May-27 Merchandise Inventory (1500 20) Accounts Payable (being inventory purcha sed) $ 30,000 S 30,000 Jun-03 Cash Accounts receivable (being opening receivables now realised) S 17,000 $ 17,000 Jun-27 Advertising expenses 6,000 Cash 6,000 (being expenses pa id) Jul-03 Accounts Payable Cash |(being cash paid) 30,000 30,000 Jul-10 Accounts Receivable (1600 92) Sales Revenue (being credit sales made) $1,47,200 $1,47,200 Jul-10 Cost of goods sold Merchandise Inventory (600*16+1000 18) (being cost of goods sold recorded) $ 27,600 $ 27,600 1:02 61% Answer 1 of 1 Jul-17 Office Supplies Accounts Payable (being office supplies purchased) 5,000 5,000 Jul-27 Accounts Payable Cash (being cash paid for office supplies purchase) 5,000 5,000 Aug-09 Cash $1,47,200 Accounts receivable $1,47,200 (being cash received) Aug-24 Accounts Payable ca sh |(being outstanding payable now paid) S 20,000 $ 20,000 Aug-27 Merchandise Inventory (900 23) Accounts Payable being inventory purcha sed) S 20,700 S 20,700 Sep-01 Accounts Receivable (500 92) Sales Revenue (being credit sales made) $ 46,000 S 46,000 Sep-01 Cost of goods sold Merchandise Inventory (300 20+200 18) (being cost of goods sold recorded) 9,600 9,600 Sep-12 Accounts Payable ca sh (being cash paid) S 20,700 S 20,700 Sep-30 Short term Investment Cash (being investmensts purchased) S 50,000 S 50,000 Oct-04 Accounts Receivable (750 93) Sales Revenue (being credit sales made) S 69,750 S 69,750 Oct-04 Cost of goods sold Merchandise Inventory (750 20) (being cost of goods sold recorded) S 15,000 S 15,000 1:02 61% Answer 1 of 1 Oct-04 Cost of goods sold Merchandise Inventory (750*20) (being cost of goods sold recorded) 15,000 S 15,000 Oct-15 Cash Discount a llowed (69750 2% ) $ 68,355 1,395 Accounts receivable S 69,750 (being cash received & discount given) Oct-31 Cash S 12,000 Unearned revenue S 12,000 (being a dvance money received against service to be provided) Nov-09 Merchandise Inventory (1000 25) Accounts Payable (being inventory purcha sed) 25,000 25,000 Nov-19 Office supplies Cash (being supplies purchase d) 4,000 4,000 Nov-27 Miscellaneous expenses ca sh (being expenses paid) $ 3,000 3,000 Dec-04 Accounts Payable ca sh (being cash paid) 25,000 S 25,000 Dec-12 Merchandise Inventory (600 26) Accounts Payable (being inventory purcha sed) 15,600 $ 15,600 Dec-16 Accounts Receivable (1000 95) Sa les Revenue (being credit sales made) S 95,000 S 95,000 Dec-16 Cost of goods sold $ 21,650 Merchandise Inventory (450*20+550 23) (being cost of goods sold recorded) $ 21,650 Dec-29 Accounts Receivable Sales Revenue (being services provided) $ 80,000 $ 80,000 1:03 61% Answer 1 of 1 S 12,000 Oct-31 Cash Unearned revenue 12,000 (being a dvance money received against service to be provided) Nov-09 Merchandise Inventory (1000 25) Accounts Payable (being inventory purcha sed) $ 25,000 S 25,000 Nov-19 Office supplies 4,000 Cash (being supplies purchased) S 4,000 Nov-27 Miscellaneous expenses ca sh (being expenses paid) 3,000 3,000 Dec-04 Accounts Payable ca sh (being cash paid) $ 25,000 S 25,000 Dec-12 Merchandise Inventory (600 26) Accounts Payable (being inventory purcha sed) $ 15,600 S 15,600 Dec-16 Accounts Receivable (1000 95) Sales Revenue (being credit sales made) S 95,000 $ 95,000 $ 21,650 Dec-16 Cost of goods sold Merchandise Inventory (450*20+550* 23) |being cost of goods sold recorded) S 21,650 Dec-29 Accounts Receivable Sales Revenue being services provided) 80,000 S 80,000 Dec-31 Retained Eamings Dividend paya ble $ 15,000 S 15,000 (being dividend declared) Dec-31 Office Supplies Cash (being office supplies purchased) 500 500Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started