Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use the information given to answer the following 5 questions based on the case study Case Study You have been approached by a client who

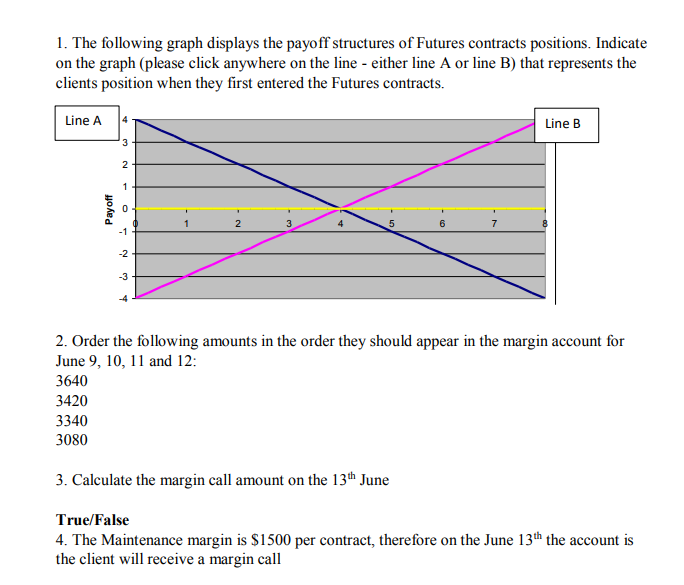

Use the information given to answer the following 5 questions based on the case study Case Study You have been approached by a client who believes that the gold price will increase over the next few days. They would therefore like to buy two gold futures contracts. The contracts are worth $400 per ounce. After some research you provide the client with the following information: The contract size is 100 ounces (the client has therefore bought 2 contracts 200 ounces - The initial margin is $2000 per contract The maintenance margin is $1500 per contract The contract is entered into on the morning of June 5 and will close on June 13 The client is happy and enters into this agreement. At the end of each trading day, the account is then mark-to-market At the end of trading on June 5th the futures price is now $397 per ounce. The futures prices on June 6 396.10 June 9 398.20 June 10 397.10 396.70 June 11 June 12 395.40 June 13 393.30 1. The following graph displays the payoff structures of Futures contracts positions. Indicate on the graph (please click anywhere on the line either line A or line B) that represents the clients position when they first entered the Futures contracts Line A Line B 3 2 2 3 4 5 6 7 -2 3 2. Order the following amounts in the order they should appear in the margin account for June 9, 10, 1 and 12 3640 3420 3340 3080 3. Calculate the margin call amount on the 13th June True/False 4. The Maintenance margin is $1500 per contract, therefore on the June 13th the account is the client will receive a margin call Payoff

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started