Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use the information here for Part a and b. Waves Realty reported the following accounts on its income statement: Commissions Revenue $57,000 Travel and

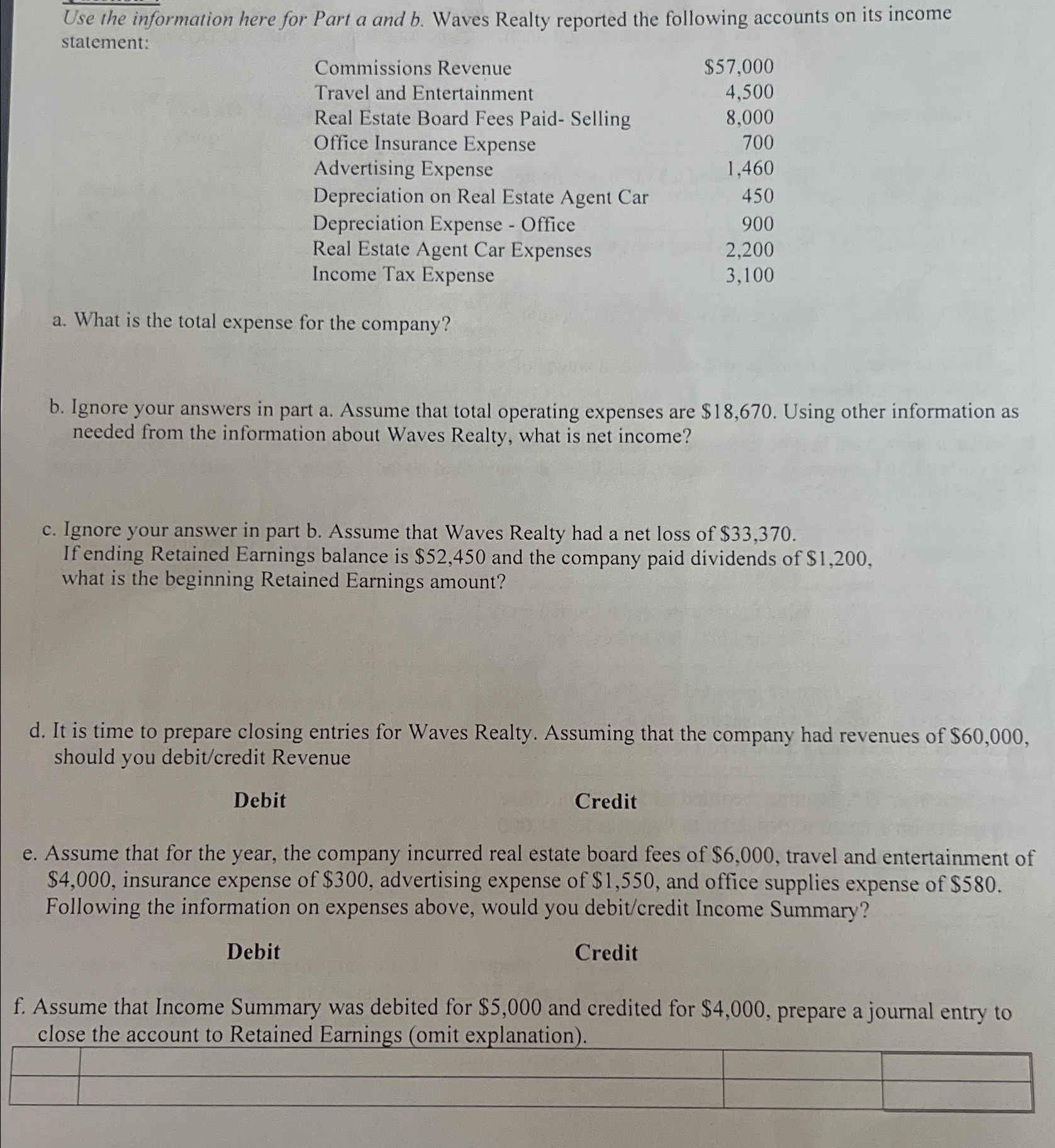

Use the information here for Part a and b. Waves Realty reported the following accounts on its income statement: Commissions Revenue $57,000 Travel and Entertainment 4,500 Real Estate Board Fees Paid- Selling 8,000 Office Insurance Expense 700 Advertising Expense 1,460 Depreciation on Real Estate Agent Car 450 Depreciation Expense - Office 900 Real Estate Agent Car Expenses Income Tax Expense 2,200 3,100 a. What is the total expense for the company? b. Ignore your answers in part a. Assume that total operating expenses are $18,670. Using other information as needed from the information about Waves Realty, what is net income? c. Ignore your answer in part b. Assume that Waves Realty had a net loss of $33,370. If ending Retained Earnings balance is $52,450 and the company paid dividends of $1,200, what is the beginning Retained Earnings amount? d. It is time to prepare closing entries for Waves Realty. Assuming that the company had revenues of $60,000, should you debit/credit Revenue Debit Credit e. Assume that for the year, the company incurred real estate board fees of $6,000, travel and entertainment of $4,000, insurance expense of $300, advertising expense of $1,550, and office supplies expense of $580. Following the information on expenses above, would you debit/credit Income Summary? Debit Credit f. Assume that Income Summary was debited for $5,000 and credited for $4,000, prepare a journal entry to close the account to Retained Earnings (omit explanation).

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the total expenses for Waves Realty we sum up all the expenses listed on the income s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started