Answered step by step

Verified Expert Solution

Question

1 Approved Answer

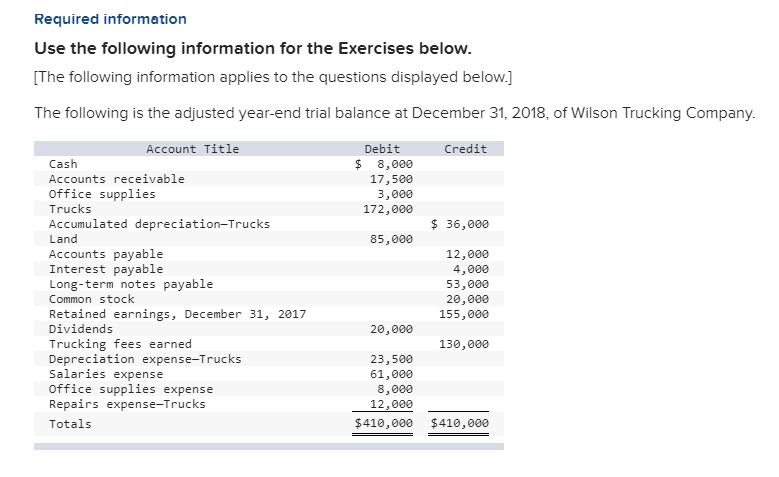

The following is the adjusted year-end trial balance at December 31, 2018, of Wilson Trucking Company. Account Title Debit Credit Cash $ 8,000 Accounts receivable

The following is the adjusted year-end trial balance at December 31, 2018, of Wilson Trucking Company.

| Account Title | Debit | Credit | ||||

| Cash | $ | 8,000 | ||||

| Accounts receivable | 17,500 | |||||

| Office supplies | 3,000 | |||||

| Trucks | 172,000 | |||||

| Accumulated depreciation—Trucks | $ | 36,000 | ||||

| Land | 85,000 | |||||

| Accounts payable | 12,000 | |||||

| Interest payable | 4,000 | |||||

| Long-term notes payable | 53,000 | |||||

| Common stock | 20,000 | |||||

| Retained earnings, December 31, 2017 | 155,000 | |||||

| Dividends | 20,000 | |||||

| Trucking fees earned | 130,000 | |||||

| Depreciation expense—Trucks | 23,500 | |||||

| Salaries expense | 61,000 | |||||

| Office supplies expense | 8,000 | |||||

| Repairs expense—Trucks | 12,000 | |||||

| Totals | $ | 410,000 | $ | 410,000 | ||

Required information Use the following information for the Exercises below. [The following information applies to the questions displayed below.] The following is the adjusted year-end trial balance at December 31, 2018, of Wilson Trucking Company. Account Title Debit Credit $ 8,000 17,500 3,000 172,000 Cash Accounts receivable Office supplies Trucks Accumulated depreciation-Trucks $ 36,000 Land 85,000 Accounts payable Interest payable Long-term notes payable 12,000 4,000 53,000 20,000 Common stock Retained earnings, December 31, 2017 Dividends 155,000 20,000 Trucking fees earned Depreciation expense-Trucks Salaries expense Office supplies expense Repairs expense-Trucks 130,000 23,500 61,000 8,000 12,000 Totals $410,000 $410,000

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Wilson Trucking Company Income Statement For the year ended ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started