Question

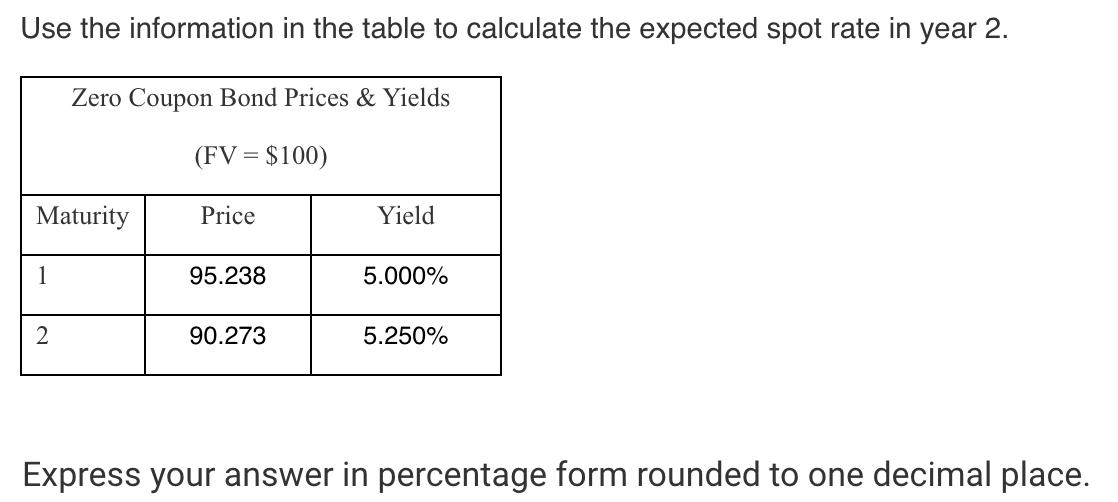

Use the information in the table to calculate the expected spot rate in year 2. Zero Coupon Bond Prices & Yields (FV = $100)

Use the information in the table to calculate the expected spot rate in year 2. Zero Coupon Bond Prices & Yields (FV = $100) Maturity 1 2 Price 95.238 90.273 Yield 5.000% 5.250% Express your answer in percentage form rounded to one decimal place.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the expected spot rate in year 2 we can ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Quantitative Investment Analysis

Authors: Richard A. DeFusco, Dennis W. McLeavey, Jerald E. Pinto, David E. Runkle

3rd edition

111910422X, 978-1119104544, 1119104548, 978-1119104223

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App