Question

Use the information provided below to answer the following questions. (Answers to ratios must be expressed to two decimal places.) 2.1 Compare and comment on

Use the information provided below to answer the following questions. (Answers to ratios must be expressed to two decimal places.)

2.1 Compare and comment on the profitability of both companies by using the following ratios:

2.1.1 Return on capital employed (4 marks)

2.1.2 Profit margin (Net profit margin) (4 marks)

2.2 Calculate the earnings retention ratio of both companies and explain how shareholders can benefit from a higher retention ratio. (6 marks)

2.3 Compare the two companies regarding the amount of debt that each company uses to finance its assets (as a percentage). (4 marks)

2.4 Suggest TWO (2) ways in which KLM Limited can improve its gross profit margin ratio, without increasing its selling prices. (2 marks)

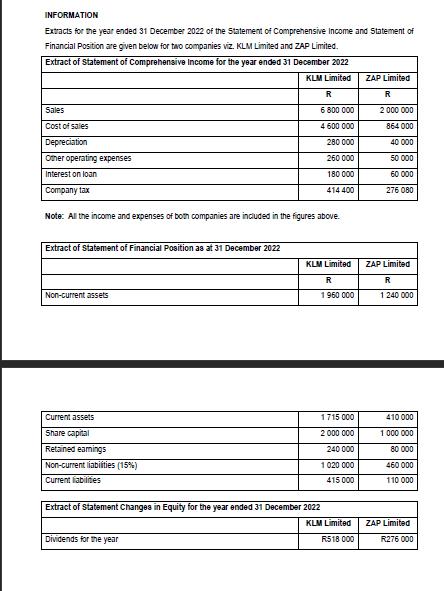

INFORMATION Extracts for the year ended 31 December 2022 of the Statement of Comprehensive Income and Statement of Financial Position are given below for two companies viz. KLM Limited and ZAP Limited. Extract of Statement of Comprehensive Income for the year ended 31 December 2022 KLM Limited Sales Cost of sales Depreciation Other operating expenses Interest on loan Company tax Extract of Statement of Financial Position as at 31 December 2022 Note: All the income and expenses of both companies are included in the figures above. Non-current assets Current assets Share capital Retained earings Non-current liabilities (15%) Current liabilites R 6 800 000 600 000 280 000 260 000 180 000 414 400 4 Dividends for the year KLM Limited R 1960 000 1715 000 2 000 000 240 000 1 020 000 415 000 Extract of Statement Changes in Equity for the year ended 31 December 2022 KLM Limited R518 000 ZAP Limited R 2 000 000 864 000 40 000 50 000 60 000 276 080 ZAP Limited R 1 240 000 410 000 1 000 000 80 000 460 000 110 000 ZAP Limited R276 000

Step by Step Solution

3.28 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

21 Compare and Comment on Profitability 211 Return on Capital Employed ROCE ROCE measures the profitability of a company relative to the capital employed to generate that profit It is calculated as fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started