Answered step by step

Verified Expert Solution

Question

1 Approved Answer

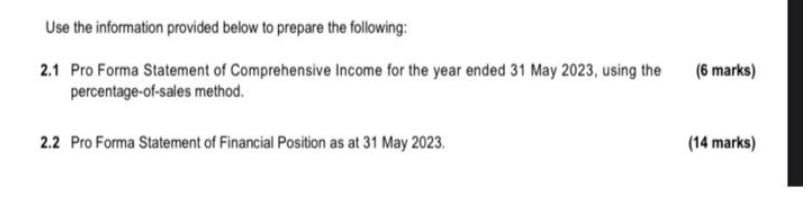

Use the information provided below to prepare the following: 2.1 Pro Forma Statement of Comprehensive Income for the year ended 31 May 2023, using

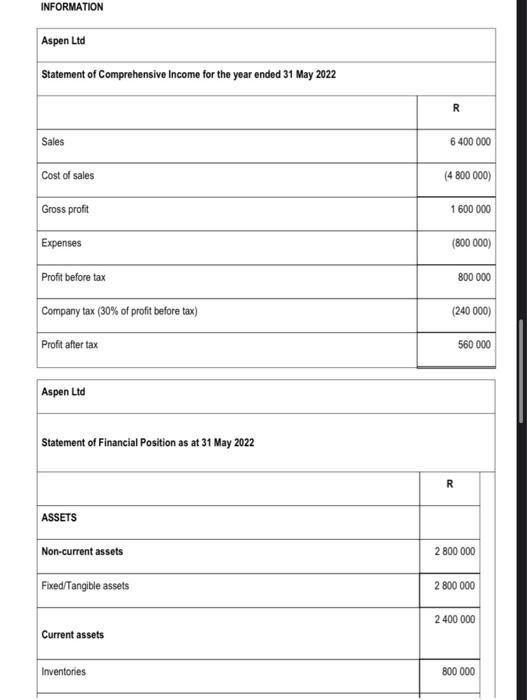

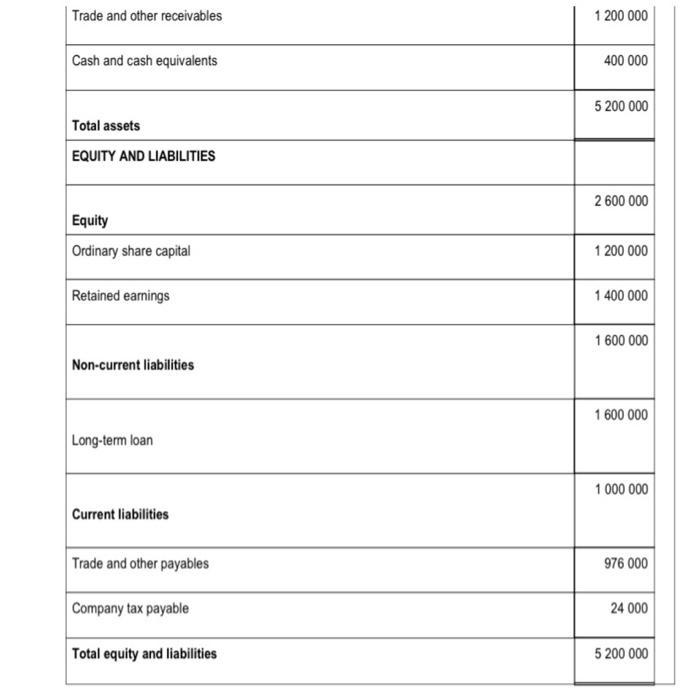

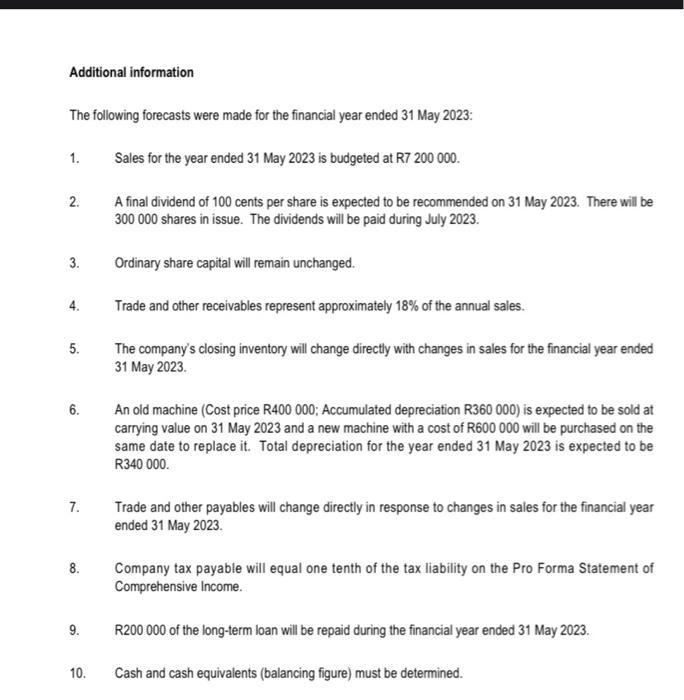

Use the information provided below to prepare the following: 2.1 Pro Forma Statement of Comprehensive Income for the year ended 31 May 2023, using the percentage-of-sales method. 2.2 Pro Forma Statement of Financial Position as at 31 May 2023. (6 marks) (14 marks) INFORMATION Aspen Ltd Statement of Comprehensive Income for the year ended 31 May 2022 Sales Cost of sales Gross profit Expenses Profit before tax Company tax (30% of profit before tax) Profit after tax Aspen Ltd Statement of Financial Position as at 31 May 2022 ASSETS Non-current assets Fixed/Tangible assets Current assets Inventories R 6400 000 (4 800 000) 1 600 000 (800 000) 800 000 (240 000) R 560 000 2 800 000 2 800 000 2 400 000 800 000 Trade and other receivables Cash and cash equivalents Total assets EQUITY AND LIABILITIES Equity Ordinary share capital Retained earnings Non-current liabilities Long-term loan Current liabilities Trade and other payables Company tax payable Total equity and liabilities 1 200 000 400 000 5 200 000 2 600 000 1 200 000 1 400 000 1 600 000 1 600 000 1 000 000 976 000 24 000 5 200 000 Additional information The following forecasts were made for the financial year ended 31 May 2023: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Sales for the year ended 31 May 2023 is budgeted at R7 200 000. A final dividend of 100 cents per share is expected to be recommended on 31 May 2023. There will be 300 000 shares in issue. The dividends will be paid during July 2023. Ordinary share capital will remain unchanged. Trade and other receivables represent approximately 18% of the annual sales. The company's closing inventory will change directly with changes in sales for the financial year ended 31 May 2023. An old machine (Cost price R400 000; Accumulated depreciation R360 000) is expected to be sold at carrying value on 31 May 2023 and a new machine with a cost of R600 000 will be purchased on the same date to replace it. Total depreciation for the year ended 31 May 2023 is expected to be R340 000. Trade and other payables will change directly in response to changes in sales for the financial year ended 31 May 2023. Company tax payable will equal one tenth of the tax liability on the Pro Forma Statement of Comprehensive Income. R200 000 of the long-term loan will be repaid during the financial year ended 31 May 2023. Cash and cash equivalents (balancing figure) must be determined.

Step by Step Solution

★★★★★

3.23 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started