Answered step by step

Verified Expert Solution

Question

1 Approved Answer

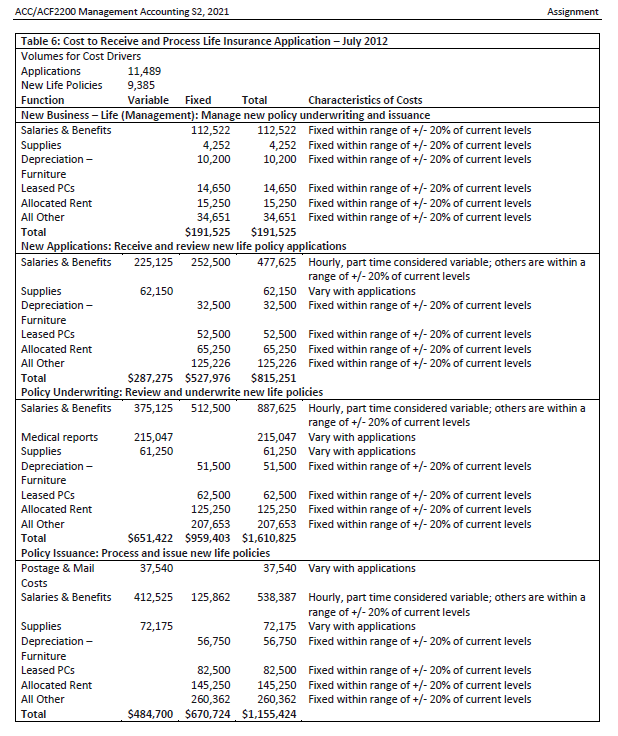

Use the information provided in Table 6 to calculate the cost to issue a life insurance policy, including receiving and processing applications for each product.

Use the information provided in Table 6 to calculate the cost to issue a life insurance policy, including receiving and processing applications for each product.

An activity-based costing system would provide AXE Life with an understanding of the costs to develop, sell, and service its products. How can AXE Life use this information to improve the efficiency and cost-effectiveness of its operations?

ACC/ACF2200 Management Accounting $2, 2021 Table 6: Cost to Receive and Process Life Insurance Application - July 2012 Volumes for Cost Drivers Applications 11,489 New Life Policies 9,385 Function Variable New Business - Life (Management): Manage new policy underwriting and issuance 112,522 Fixed within range of +/- 20% of current levels 4,252 Fixed within range of +/- 20% of current levels 10,200 Fixed within range of +/-20% of current levels Salaries & Benefits Supplies Depreciation- Furniture Leased PCs Allocated Rent Fixed Total Characteristics of Costs 112,522 4,252 10,200 14,650 15,250 34,651 14,650 15,250 34,651 Fixed within range of +/- 20% of current levels Fixed within range of +/- 20% of current levels Fixed within range of +/- 20% of current levels Assignment All Other Total $191,525 $191,525 New Applications: Receive and review new life policy applications Salaries & Benefits 225,125 252,500 477,625 Hourly, part time considered variable; others are within a Supplies range of +/-20% of current levels Depreciation- Furniture Leased PCs Allocated Rent All Other 62,150 62,150 vary with applications 32,500 32,500 Fixed within range of +/- 20% of current levels 52,500 65,250 125,226 52,500 Fixed within range of +/- 20% of current levels 65,250 Fixed within range of +/- 20% of current levels 125,226 Fixed within range of +/- 20% of current levels $815,251 Medical reports Supplies 215,047 61,250 Total $287,275 $527,976 Policy Underwriting: Review and underwrite new life policies Salaries & Benefits 375,125 512,500 887,625 Hourly, part time considered variable; others are within a range of +/-20% of current levels 215,047 Vary with applications 61,250 Vary with applications Depreciation- 51,500 51,500 Fixed within range of +/- 20% of current levels Furniture Leased PCs Allocated Rent All Other 62,500 125,250 207,653 Total 62,500 Fixed within range of +/- 20% of current levels 125,250 Fixed within range of +/- 20% of current levels 207,653 Fixed within range of +/- 20% of current levels $651,422 $959,403 $1,610,825 Policy Issuance: Process and issue new life policies Postage & Mail 37,540 37,540 vary with applications Costs Salaries & Benefits 412,525 125,862 Supplies 72,175 Depreciation- 56,750 538,387 Hourly, part time considered variable; others are within a range of +/- 20% of current levels 72,175 Vary with applications 56,750 Fixed within range of +/- 20% of current levels Furniture Leased PCs Allocated Rent All Other Total 82,500 82,500 145,250 145,250 260,362 260,362 Fixed within range of +/- 20% of current levels Fixed within range of +/- 20% of current levels Fixed within range of +/- 20% of current levels $484,700 $670,724 $1,155,424

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started