Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use the information provided to answer the following questions regarding the Nelson family. NELSON FAMILY CASE SCENARIO DAVID AND DANA NELSON As of January

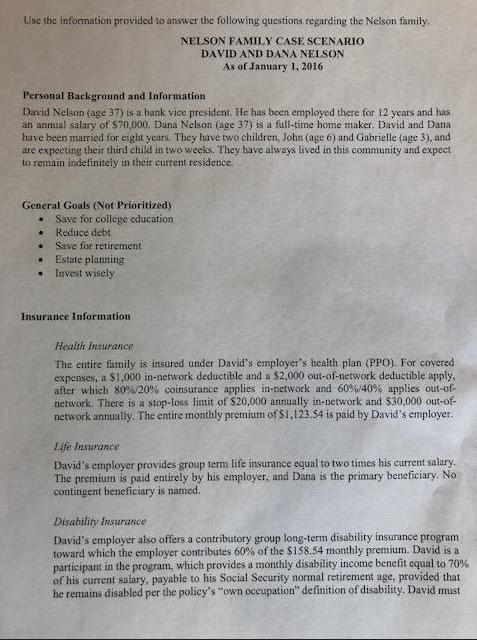

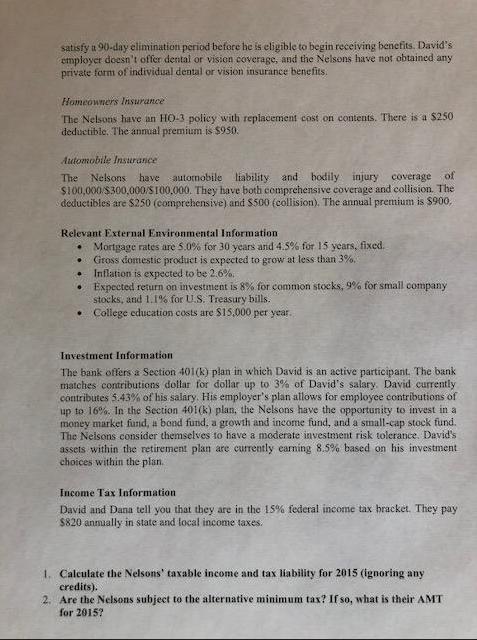

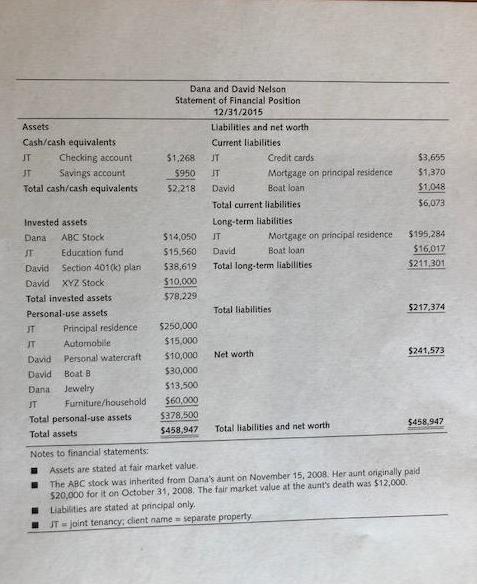

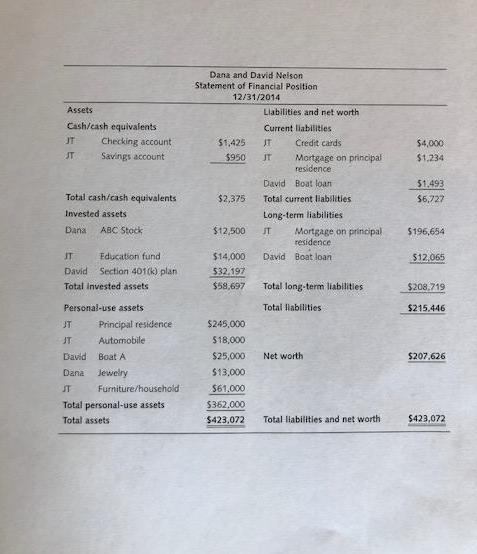

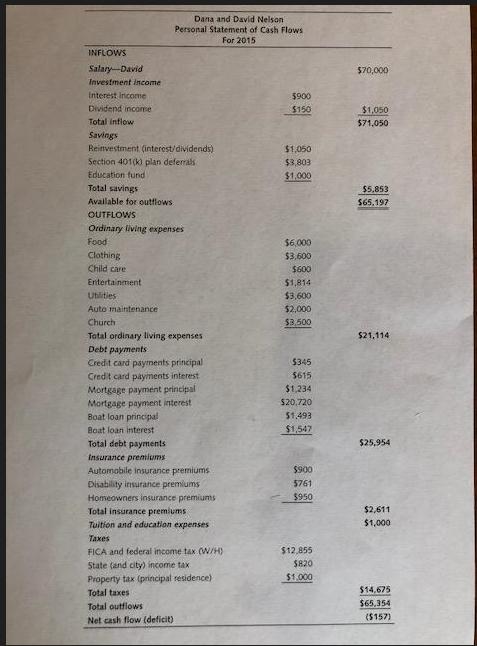

Use the information provided to answer the following questions regarding the Nelson family. NELSON FAMILY CASE SCENARIO DAVID AND DANA NELSON As of January 1, 2016. Personal Background and Information David Nelson (age 37) is a bank vice president. He has been employed there for 12 years and has an annual salary of $70,000. Dana Nelson (age 37) is a full-time home maker. David and Dana have been married for eight years. They have two children, John (age 6) and Gabrielle (age 3), and are expecting their third child in two weeks. They have always lived in this community and expect to remain indefinitely in their current residence. General Goals (Not Prioritized) Save for college education . Reduce debt . @ Save for retirement Estate planning Invest wisely Insurance Information. Health Insurance The entire family is insured under David's employer's health plan (PPO). For covered expenses, a $1,000 in-network deductible and a $2,000 out-of-network deductible apply, after which 80%/20% coinsurance applies in-network and 60%/40% applies out-of- network. There is a stop-loss limit of $20,000 annually in-network and $30,000 out-of- network annually. The entire monthly premium of $1,123.54 is paid by David's employer. Life Insurance David's employer provides group term life insurance equal to two times his current salary. The premium is paid entirely by his employer, and Dana is the primary beneficiary. No contingent beneficiary is named. Disability Insurance David's employer also offers a contributory group long-term disability insurance program. toward which the employer contributes 60% of the $158.54 monthly premium. David is a participant in the program, which provides a monthly disability income benefit equal to 70% of his current salary, payable to his Social Security normal retirement age, provided that he remains disabled per the policy's "own occupation" definition of disability. David must satisfy a 90-day elimination period before he is eligible to begin receiving benefits. David's employer doesn't offer dental or vision coverage, and the Nelsons have not obtained any private form of individual dental or vision insurance benefits. Homeowners Insurance The Nelsons have an HO-3 policy with replacement cost on contents. There is a $250 deductible. The annual premium is $950. Automobile Insurance The Nelsons have automobile liability and bodily injury coverage of $100,000/$300,000/S100,000. They have both comprehensive coverage and collision. The deductibles are $250 (comprehensive) and $500 (collision). The annual premium is $900, Relevant External Environmental Information . Mortgage rates are 5.0% for 30 years and 4.5% for 15 years, fixed. Gross domestic product is expected to grow at less than 3%. Inflation is expected to be 2.6%. Expected return on investment is 8% for common stocks, 9% for small company stocks, and 1.1% for U.S. Treasury bills. College education costs are $15,000 per year. Investment Information The bank offers a Section 401(k) plan in which David is an active participant. The bank matches contributions dollar for dollar up to 3% of David's salary. David currently contributes 5.43% of his salary. His employer's plan allows for employee contributions of up to 16%. In the Section 401(k) plan, the Nelsons have the opportunity to invest in a money market fund, a bond fund, a growth and income fund, and a small-cap stock fund. The Nelsons consider themselves to have a moderate investment risk tolerance. David's assets within the retirement plan are currently earning 8.5% based on his investment choices within the plan. Income Tax Information David and Dana tell you that they are in the 15% federal income tax bracket. They pay $820 annually in state and local income taxes. 1. 2. Are the Nelsons subject to the alternative minimum tax? If so, what is their AMT for 2015? Calculate the Nelsons' taxable income and tax liability for 2015 (ignoring any credits). Assets Cash/cash equivalents Checking account JT JT Savings account Total cash/cash equivalents Invested assets Dana ST David David XYZ Stock Total invested assets Personal-use assets. ABC Stock ST Principal residence JT Automobile David Personal watercraft David Boat B Dana Jewelry Education fund Section 401(k) plan H JT Total personal-use assets Total assets = m Furniture/household Notes to financial statements: Dana and David Nelson Statement of Financial Position 12/31/2015 $1,268 JT Credit cards $950 JT Mortgage on principal residence 52.218 David Boat loan Total current liabilities Long-term liabilities $14,050 $15,560 $38,619 $10,000 $78,229 Liabilities and net worth Current liabilities. $250,000 $15,000 $10,000 $30,000 $13,500 $60,000 $378,500 $458,947 JT Mortgage on principal residence David Boat loan Total long-term liabilities Total liabilities Net worth. Total liabilities and net worth $3,655 $1,370 $1,048 $6,073 $195,284 $16,017 $211,301 $217,374 $241,573 $458,947 Assets are stated at fair market value. The ABC stock was inherited from Dana's aunt on November 15, 2008. Her aunt originally paid $20,000 for it on October 31, 2008. The fair market value at the aunt's death was $12,000. Liabilities are stated at principal only. JT=joint tenancy; client name separate property Assets Cash/cash equivalents JT ST Checking account Savings account Total cash/cash equivalents Invested assets Dana ABC Stock JT Education fund David Section 401(k) plan Total invested assets Personal-use assets JT JT Principal residence Automobile David Boat A Dana Jewelry Furniture/household ST Total personal-use assets Total assets Dana and David Nelson Statement of Financial Position 12/31/2014 $1,425 $950 $2,375 $12,500 $14,000 $32,197 $58,697 $245,000 $18,000 $25,000 $13,000 $61,000 $362,000 $423,072 Liabilities and net worth Current liabilities JT JT Credit cards Mortgage on principal residence David Boat loan Total current liabilities. Long-term liabilities JT Mortgage on principal residence David Boat loan Total long-term liabilities Total liabilities Net worth Total liabilities and net worth $4,000 $1,234 $1.493 $6,727 $196,654 $12,065 $208,719 $215,446 $207,626 $423,072 INFLOWS Salary-David Investment income Interest income Dividend income Total inflow Savings Reinvestment (interest/dividends) Dana and David Nelson Personal Statement of Cash Flows For 2015 Section 401(k) plan deferrals. Education fund Total savings Available for outflows OUTFLOWS Ordinary living expenses Food Clothing Child care Entertainment Utilities Auto maintenance Church Total ordinary living expenses Debt payments Credit card payments principal Credit card payments interest Mortgage payment principal i Mortgage payment interest Boat loan principal Boat loan interest Total debt payments Insurance premiums Automobile insurance premiums Disability insurance premiums Homeowners insurance premiums Total insurance premiums Tuition and education expenses Taxes FICA and federal income tax (W/H) State (and city) income tax. Property tax (principal residence) Total taxes Total outflows Net cash flow (deficit) $900 $150 $1,050 $3,803 $1,000 $6,000 $3,600 $600 $1,814 $3,600 $2,000 $3,500 $345 $615 $1,234 $20,720 $1.493 $1,547 $900 5761 $950 $12,855 $820 $1,000 $70,000 $1,050 $71,050 $5,8531 $65.197 $21,114 $25,954 $2,611 $1,000 $14.675 $65,354 ($157)

Step by Step Solution

★★★★★

3.30 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

1 To calculate the Nelsons taxable income and tax liability for 2015 ig...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started