Answered step by step

Verified Expert Solution

Question

1 Approved Answer

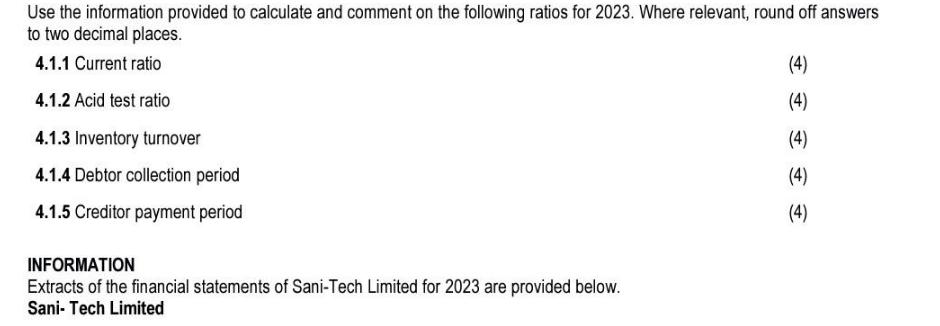

Use the information provided to calculate and comment on the following ratios for 2023. Where relevant, round off answers to two decimal places. 4.1.1

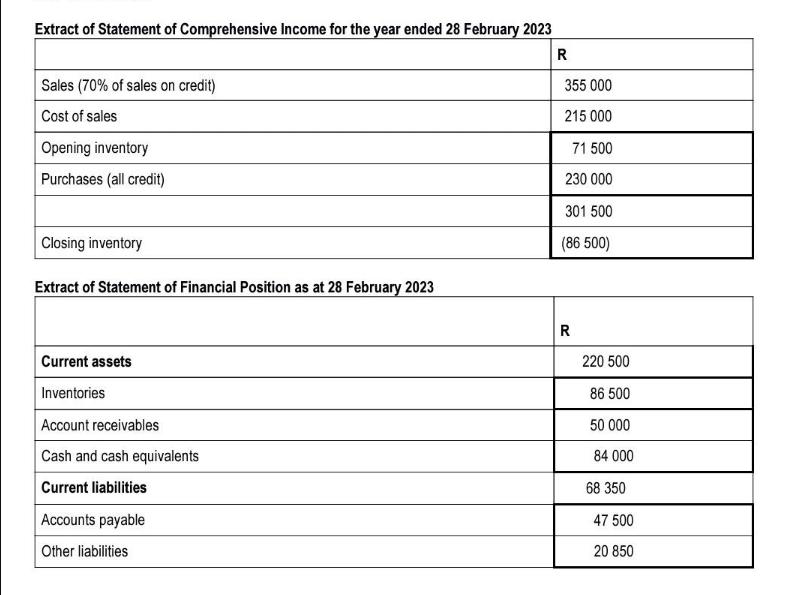

Use the information provided to calculate and comment on the following ratios for 2023. Where relevant, round off answers to two decimal places. 4.1.1 Current ratio 4.1.2 Acid test ratio 4.1.3 Inventory turnover 4.1.4 Debtor collection period 4.1.5 Creditor payment period INFORMATION Extracts of the financial statements of Sani-Tech Limited for 2023 are provided below. Sani-Tech Limited (4) (4) (4) (4) (4) Extract of Statement of Comprehensive Income for the year ended 28 February 2023 R Sales (70% of sales on credit) Cost of sales Opening inventory Purchases (all credit) Closing inventory Extract of Statement of Financial Position as at 28 February 2023 Current assets Inventories Account receivables Cash and cash equivalents Current liabilities Accounts payable Other liabilities 355 000 215 000 71 500 230 000 301 500 (86 500) R 220 500 86 500 50 000 84 000 68 350 47 500 20 850

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the requested ratios well use the following formulas 411 Current ratio Current assets Current liabilities 412 Acid test ratio Current assets Inventory Current liabilities 413 Inventory tu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started