Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use the international 5 parities and explain why you choice the one being used by choice in order to solve the questions. 10) You are

Use the international 5 parities and explain why you choice the one being used by choice in order to solve the questions.

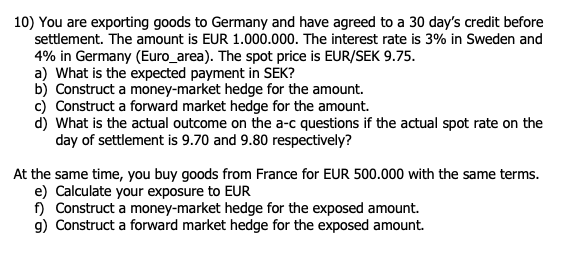

10) You are exporting goods to Germany and have agreed to a 30 day's credit before settlement. The amount is EUR 1.000 .000 . The interest rate is 3% in Sweden and 4% in Germany (Euro_area). The spot price is EUR/SEK 9.75. a) What is the expected payment in SEK? b) Construct a money-market hedge for the amount. c) Construct a forward market hedge for the amount. d) What is the actual outcome on the a-c questions if the actual spot rate on the day of settlement is 9.70 and 9.80 respectively? At the same time, you buy goods from France for EUR 500.000 with the same terms. e) Calculate your exposure to EUR f) Construct a money-market hedge for the exposed amount. g) Construct a forward market hedge for the exposed amountStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started