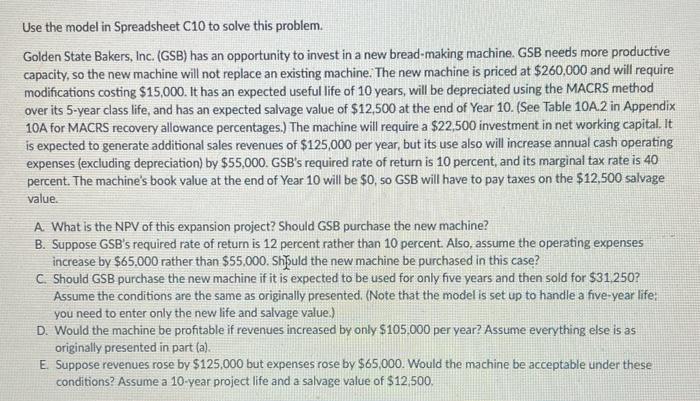

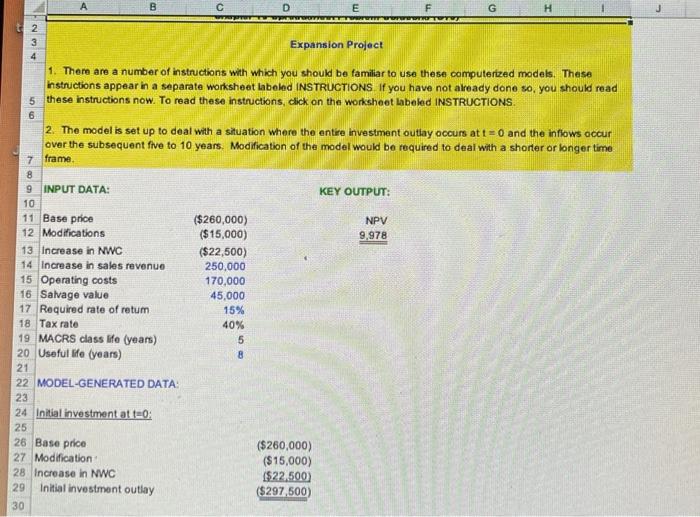

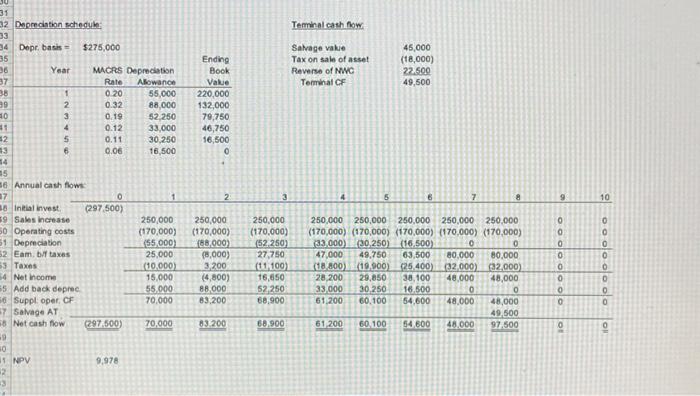

Use the model in Spreadsheet C10 to solve this problem. Golden State Bakers, Inc. (GSB) has an opportunity to invest in a new bread-making machine. GSB needs more productive capacity, so the new machine will not replace an existing machine. The new machine is priced at $260,000 and will require modifications costing $15,000. It has an expected useful life of 10 years, will be depreciated using the MACRS method over its 5-year class life, and has an expected salvage value of $12,500 at the end of Year 10. (See Table 10A.2 in Appendix 10A for MACRS recovery allowance percentages.) The machine will require a $22,500 investment in net working capital. It is expected to generate additional sales revenues of $125,000 per year, but its use also will increase annual cash operating expenses (excluding depreciation) by $55,000. GSB's required rate of return is 10 percent, and its marginal tax rate is 40 percent. The machine's book value at the end of Year 10 will be $0,50GSB will have to pay taxes on the $12,500 salvage value. A. What is the NPV of this expansion project? Should GSB purchase the new machine? B. Suppose GSB's required rate of return is 12 percent rather than 10 percent. Also, assume the operating expenses increase by $65,000 rather than $55,000. Sh\uld the new machine be purchased in this case? C. Should GSB purchase the new machine if it is expected to be used for only five years and then sold for $31,250 ? Assume the conditions are the same as originally presented. (Note that the model is set up to handle a five-year life: you need to enter only the new life and salvage value.) D. Would the machine be profitable if revenues increased by only $105,000 per year? Assume everything else is as originally presented in part (a). E. Suppose revenues rose by $125,000 but expenses rose by $65,000. Would the machine be acceptable under these conditions? Assume a 10-year project life and a salvage value of $12.500. Expansion Project 1. There are a number of instructions with which you should be familiar to use these computerized models. These instructions appear in a separate worksheet labeled INSTRUCTIONS. If you have not already done so, you should read these instructions now. To read these instructions, click on the worksheet labeled INSTRUCTIONS. 2. The model is set up to deal with a situation where the entire investment outiay occurs at t=0 and the inflows occur over the subsequent five to 10 years. Modification of the model would be required to deai with a shorter or longer time frame. MODEL-GENERATED DATA: Deprecintion scheduk: Teminaleash fow \begin{tabular}{|rrrr|} \hline Dopr. basis = & 5275,000 & & \\ Yeat & MuCrs Deprocistson & Ending \\ & Book \\ Rate & Alowance & Value \\ \hline 1 & 0.20 & 55,000 & 220,000 \\ 2 & 0.32 & 88,000 & 132,000 \\ 3 & 0.19 & 52,250 & 79,750 \\ 4 & 0.12 & 33,000 & 46,750 \\ 5 & 0.11 & 30,250 & 16,500 \\ 6 & 0.06 & 16,500 & 0 \end{tabular} Annual cath flow: NPV 9.978