Answered step by step

Verified Expert Solution

Question

1 Approved Answer

- Use the Net income for tax purposes Federal tax payable before tax credit (Gross tax) Tax credits available Federal tax payable for 2020.

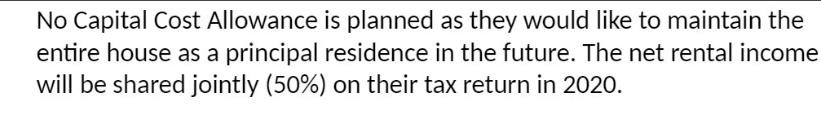

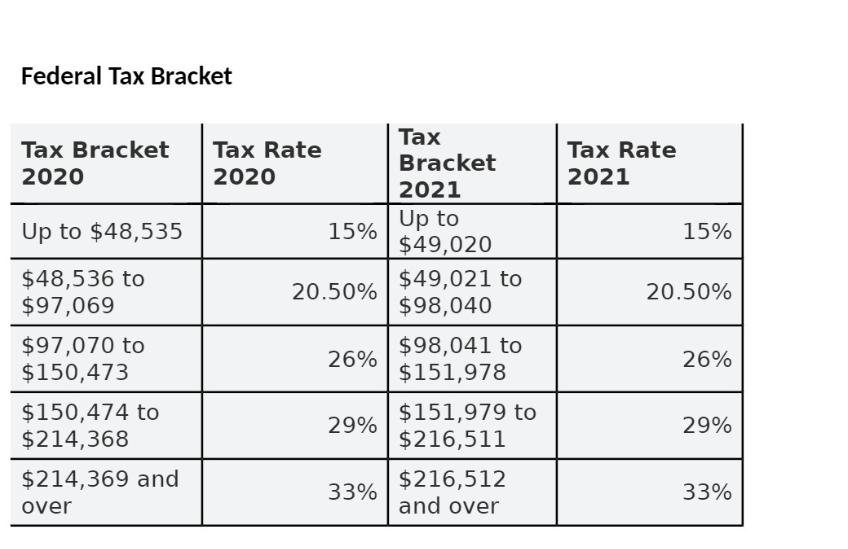

- Use the Net income for tax purposes Federal tax payable before tax credit (Gross tax) Tax credits available Federal tax payable for 2020. (Do not consider provincial tax payable) information to determine Tanya and Bob's No Capital Cost Allowance is planned as they would like to maintain the entire house as a principal residence in the future. The net rental income will be shared jointly (50%) on their tax return in 2020. Federal Tax Bracket Tax Bracket 2020 Up to $48,535 $48,536 to $97,069 $97,070 to $150,473 $150,474 to $214,368 $214,369 and over Tax Rate 2020 15% 20.50% 26% 29% 33% Tax Bracket 2021 Up to $49,020 $49,021 to $98,040 $98,041 to $151,978 $151,979 to $216,511 $216,512 and over Tax Rate 2021 15% 20.50% 26% 29% 33%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Net Income for Tax Purposes The question states that the net rental income will be shared jointly 50 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started