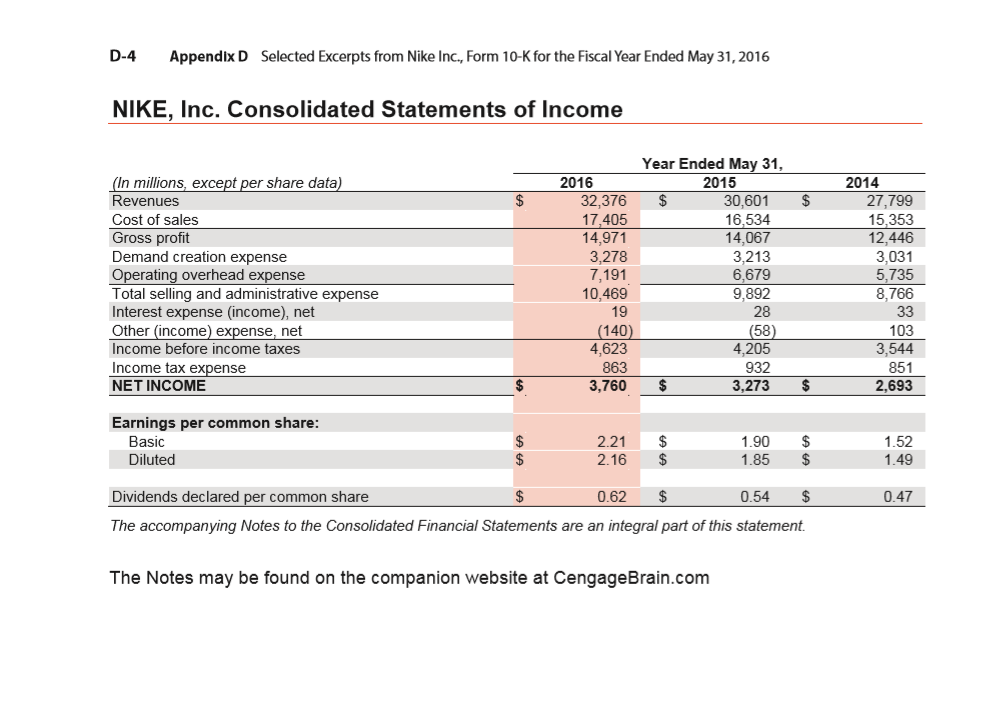

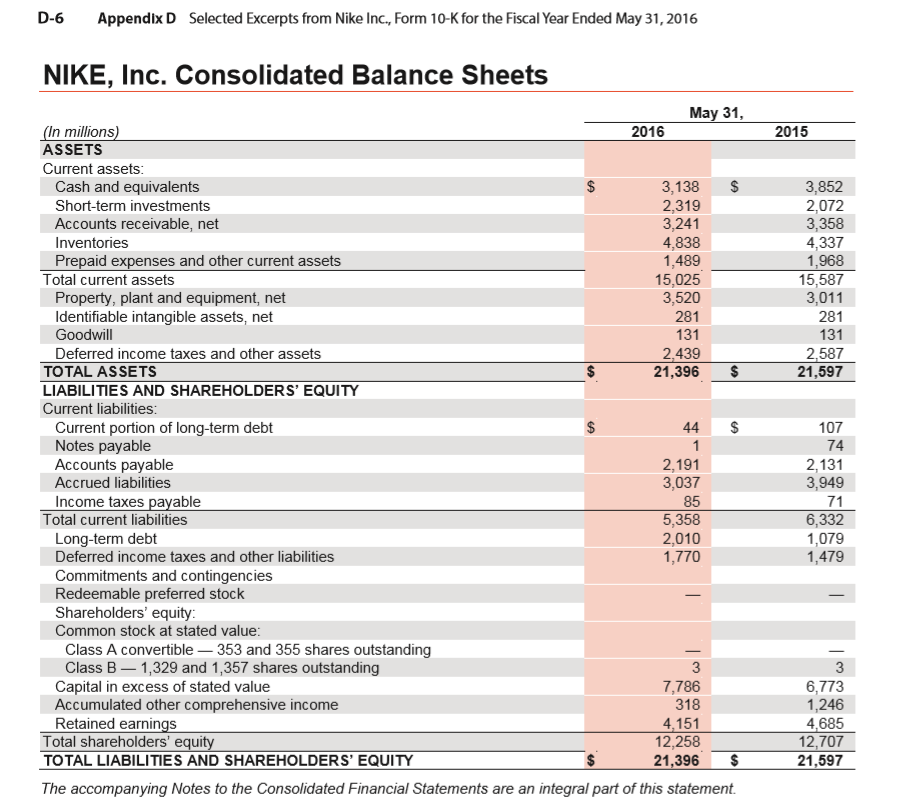

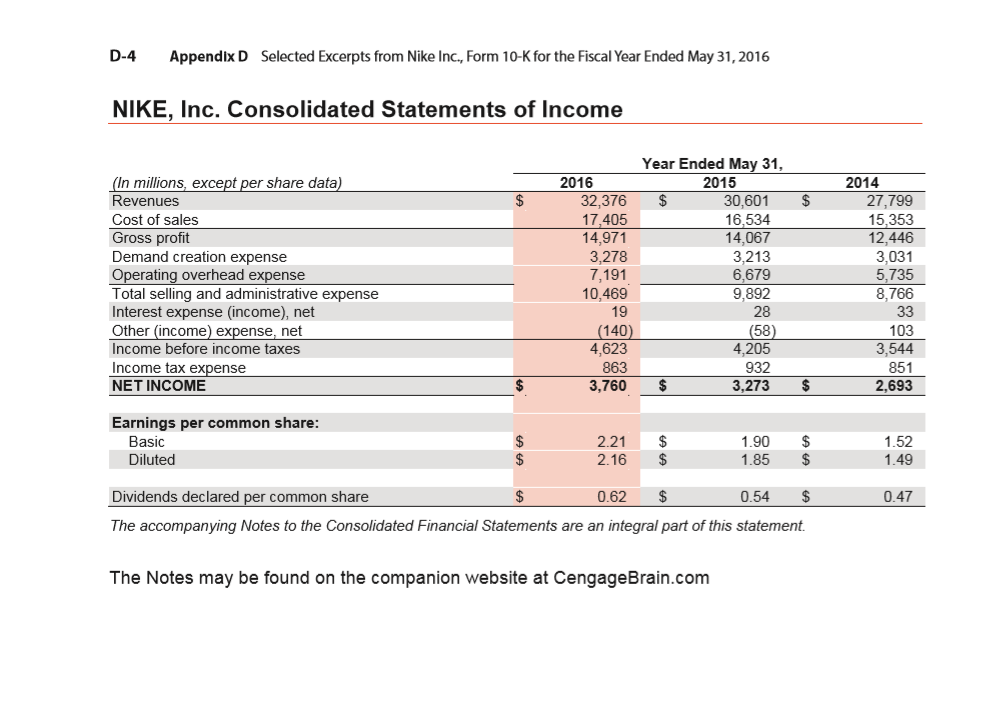

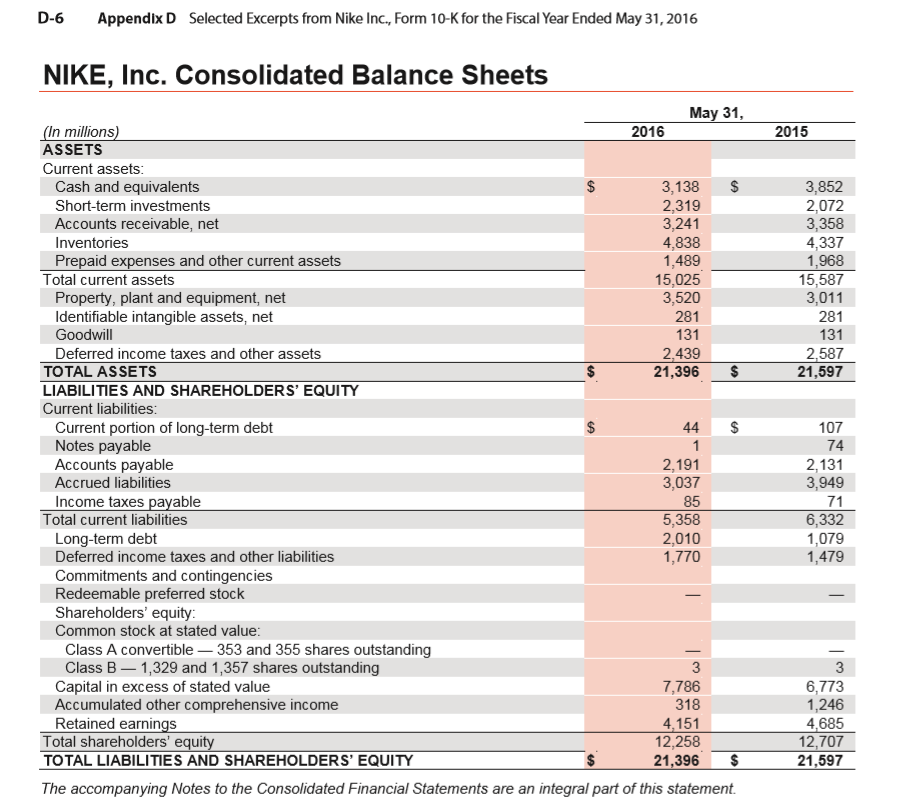

Use the NIKE's financial statements, Appendix D in the text book to answer the following questions. The ending balance of inventory 2014 was $4,025:

a. Calculate the inventory turnover for 2016 and 2015. Round to 2 decimal places.

b. Calculate the days' sales in inventory for 2016 and 2015 using 365 days.

c. Is the change in the inventory turnover and the days' sales in inventory form 2015 to 2016 favorable or unfavorable?

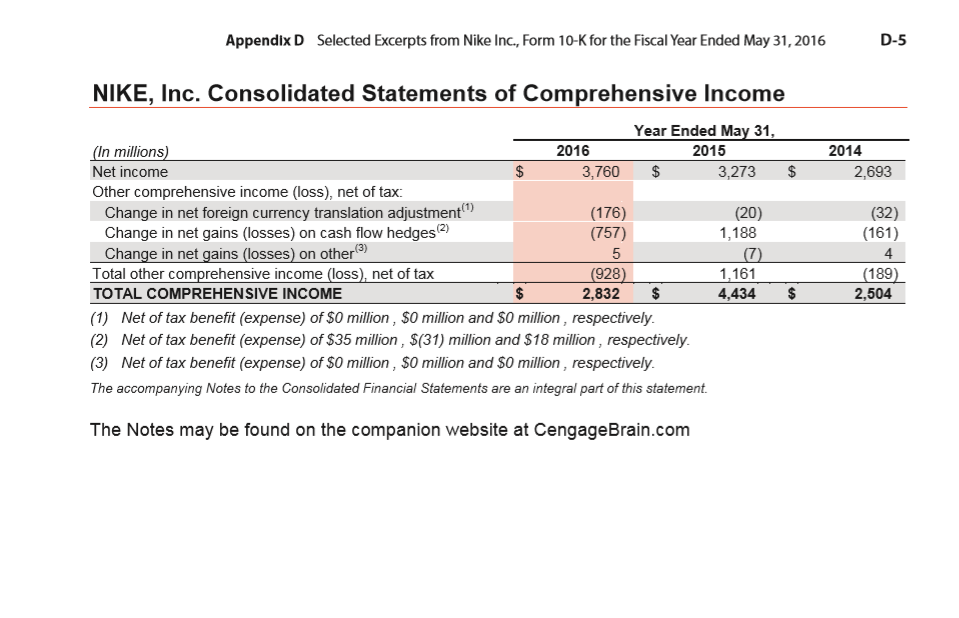

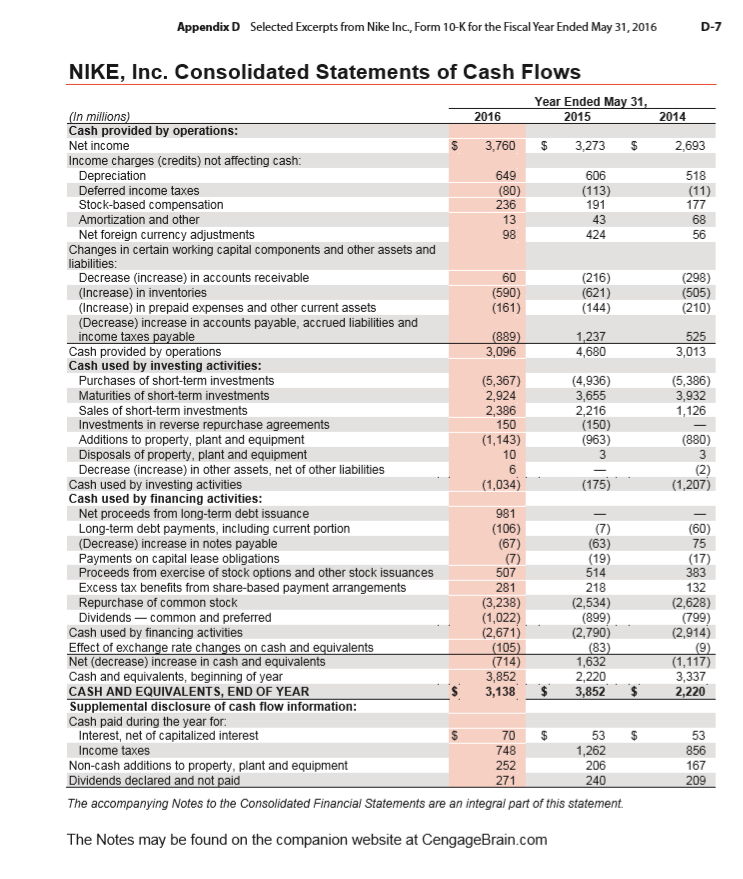

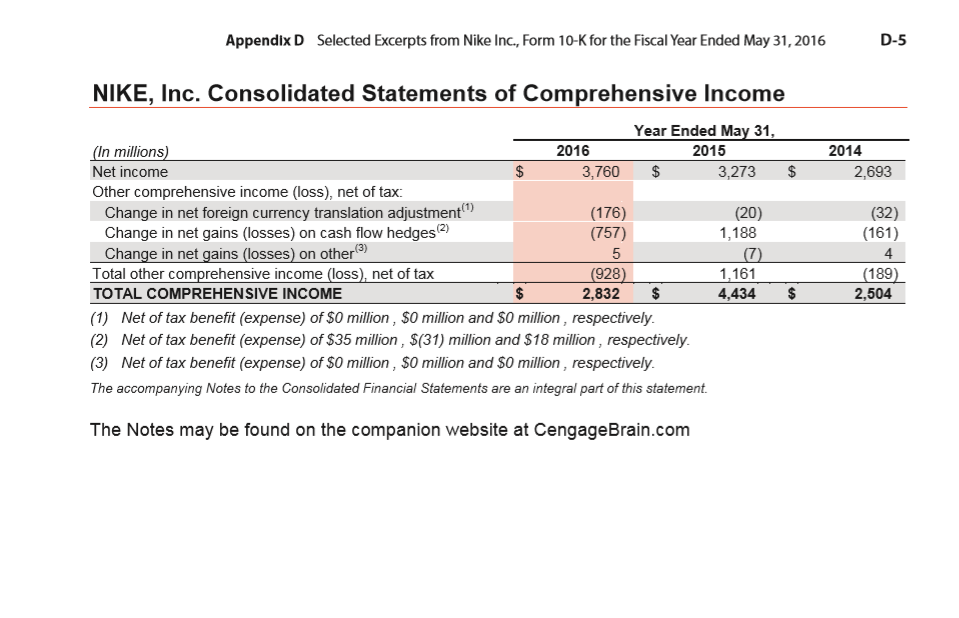

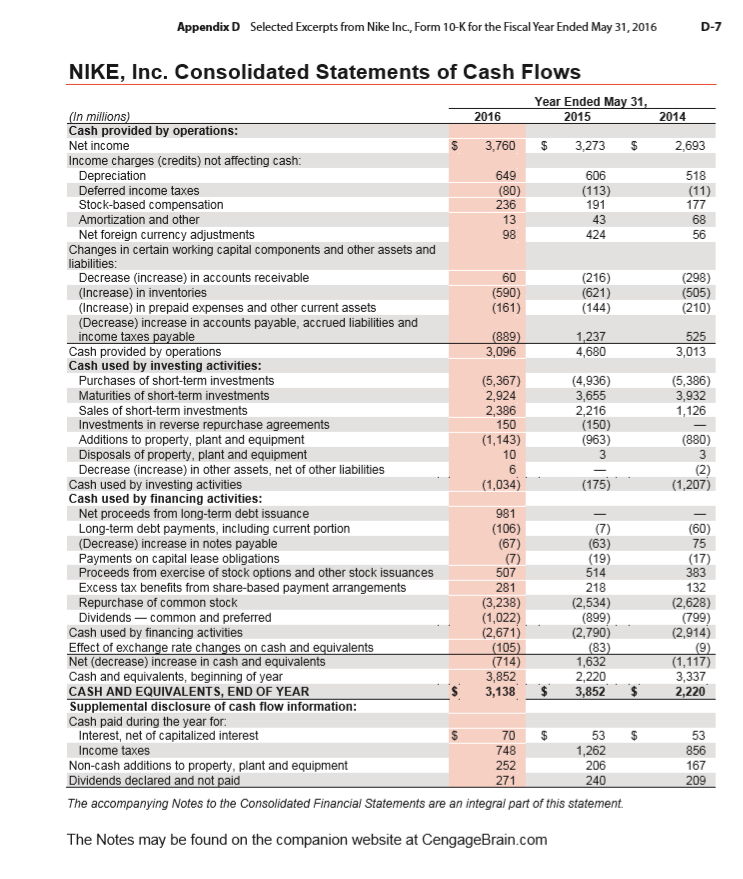

D-4 Appendix D Selected Excerpts from Nike Inc., Form 10-K for the Fiscal Year Ended May 31, 2016 NIKE, Inc. Consolidated Statements of Income $ $ (In millions, except per share data) Revenues Cost of sales Gross profit Demand creation expense Operating overhead expense Total selling and administrative expense Interest expense (income), net Other income) expense, net Income before income taxes Income tax expense NET INCOME 2016 32,376 17,405 14.971 3,278 7,191 10,469 19 (140) 4,623 863 3,760 Year Ended May 31, 2015 $ 30,601 16,534 14.067 3,213 6.679 9,892 28 (58) 4.205 932 $ 3,273 2014 27,799 15,353 12,446 3,031 5,735 8,766 33 103 3,544 851 2,693 $ Earnings per common share: Basic Diluted $ $ 2.21 2.16 $ $ 1.90 1.85 $ $ 1.52 1.49 0.47 Dividends declared per common share $ 0.62 $ 0.54 $ The accompanying Notes to the Consolidated Financial Statements are an integral part of this statement. The Notes may be found on the companion website at CengageBrain.com Appendix D Selected Excerpts from Nike Inc., Form 10-K for the Fiscal Year Ended May 31, 2016 D-5 2014 2,693 NIKE, Inc. Consolidated Statements of Comprehensive Income Year Ended May 31, (In millions) 2016 2015 Net income 3,760 $ 3,273 $ Other comprehensive income (loss), net of tax: Change in net foreign currency translation adjustment") (176) (20) Change in net gains (losses) on cash flow hedges(2) (757) 1,188 Change in net gains (losses) on other(3) 5 (o Total other comprehensive income (loss), net of tax (928) 1,161 TOTAL COMPREHENSIVE INCOME $ 2,832 $ 4,434 (1) Net of tax benefit (expense) of $0 million, $0 million and $0 million, respectively. (2) Net of tax benefit (expense) of $35 million, $(31) million and $18 million, respectively. (3) Net of tax benefit (expense) of $0 million, $0 million and $0 million, respectively. The accompanying Notes to the Consolidated Financial Statements are an integral part of this statement. (32) (161) 4 (189) 2,504 $ The Notes may be found on the companion website at CengageBrain.com D-6 Appendix D Selected Excerpts from Nike Inc., Form 10-K for the Fiscal Year Ended May 31, 2016 NIKE, Inc. Consolidated Balance Sheets 2015 $ 3,852 2,072 3,358 4,337 1,968 15,587 3,011 281 131 2,587 21,597 $ $ $ GA May 31, (In millions) 2016 ASSETS Current assets: Cash and equivalents $ 3,138 Short-term investments 2,319 Accounts receivable, net 3,241 Inventories 4,838 Prepaid expenses and other current assets 1,489 Total current assets 15,025 Property, plant and equipment, net 3,520 Identifiable intangible assets, net 281 Goodwill 131 Deferred income taxes and other assets 2,439 TOTAL ASSETS 21,396 LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Current portion of long-term debt 44 Notes payable Accounts payable 2,191 Accrued liabilities 3,037 Income taxes payable 85 Total current liabilities 5,358 Long-term debt 2,010 Deferred income taxes and other liabilities 1,770 Commitments and contingencies Redeemable preferred stock Shareholders' equity: Common stock at stated value: Class A convertible 353 and 355 shares outstanding Class B 1,329 and 1,357 shares outstanding 3 Capital in excess of stated value 7,786 Accumulated other comprehensive income 318 Retained earnings 4.151 Total shareholders' equity 12,258 TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY 21,396 The accompanying Notes to the Consolidated Financial Statements are an integral part of this statement 1 107 74 2,131 3,949 71 6,332 1,079 1,479 3 6,773 1,246 4,685 12,707 21,597 Appendix D Selected Excerpts from Nike Inc, Form 10-K for the Fiscal Year Ended May 31, 2016 D-7 2014 2,693 518 (11) 177 68 56 (298) (505) (210) 525 3,013 (5,386) 3,932 1,126 NIKE, Inc. Consolidated Statements of Cash Flows Year Ended May 31, (In millions) 2016 2015 Cash provided by operations: Net income 3,760 $ 3,273 $ Income charges (credits) not affecting cash: Depreciation 649 606 Deferred income taxes (80) (113) Stock-based compensation 236 191 Amortization and other 13 43 Net foreign currency adjustments 98 424 Changes in certain working capital components and other assets and liabilities: Decrease increase) in accounts receivable 60 (216) (Increase) in inventories (590) (621) (Increase) in prepaid expenses and other current assets (161) (144) (Decrease) increase in accounts payable, accrued liabilities and income taxes payable (889) 1,237 Cash provided by operations 3,096 4,680 Cash used by investing activities: Purchases of short-term investments (5,367) (4,936) Maturities of short-term investments 2,924 3,655 Sales of short-term investments 2,386 2,216 Investments in reverse repurchase agreements 150 (150) Additions to property, plant and equipment (1,143) (963) Disposals of property, plant and equipment 10 Decrease increase) in other assets, net of other liabilities 6 Cash used by investing activities (1,034) (175) Cash used by financing activities: Net proceeds from long-term debt issuance 981 Long-term debt payments, including current portion (106) (Decrease) increase in notes payable (67) (63) Payments on capital lease obligations (7) (19) Proceeds from exercise of stock options and other stock issuances 507 514 Excess tax benefits from share-based payment arrangements 281 218 Repurchase of common stock (3,238) (2,534) Dividends - common and preferred (1,022) (899) Cash used by financing activities (2,671) (2,790) Effect of exchange rate changes on cash and equivalents (105) (83) Net (decrease) increase in cash and equivalents (714) 1,632 Cash and equivalents, beginning of year 3,852 2,220 CASH AND EQUIVALENTS, END OF YEAR 3,138 3,852 Supplemental disclosure of cash flow information: Cash paid during the year for Interest, net of capitalized interest 70 53 Income taxes 748 1,262 Non-cash additions to property, plant and equipment 252 206 Dividends declared and not paid 271 240 The accompanying Notes to the Consolidated Financial Statements are an integral part of this statement 3 (880) 3 (2) (1,207) (60) 75 (17) 383 132 (2.628) (799) (2.914) (9) (1,117) 3,337 2,220 $ 53 856 167 209 The Notes may be found on the companion website at CengageBrain.com