Question

Use the NPV Method to determine whether Preston Products should invest in the following projects: - Project A: Costs $295,000 and offers eight annual net

Use the NPV Method to determine whether Preston Products should invest in the following projects:

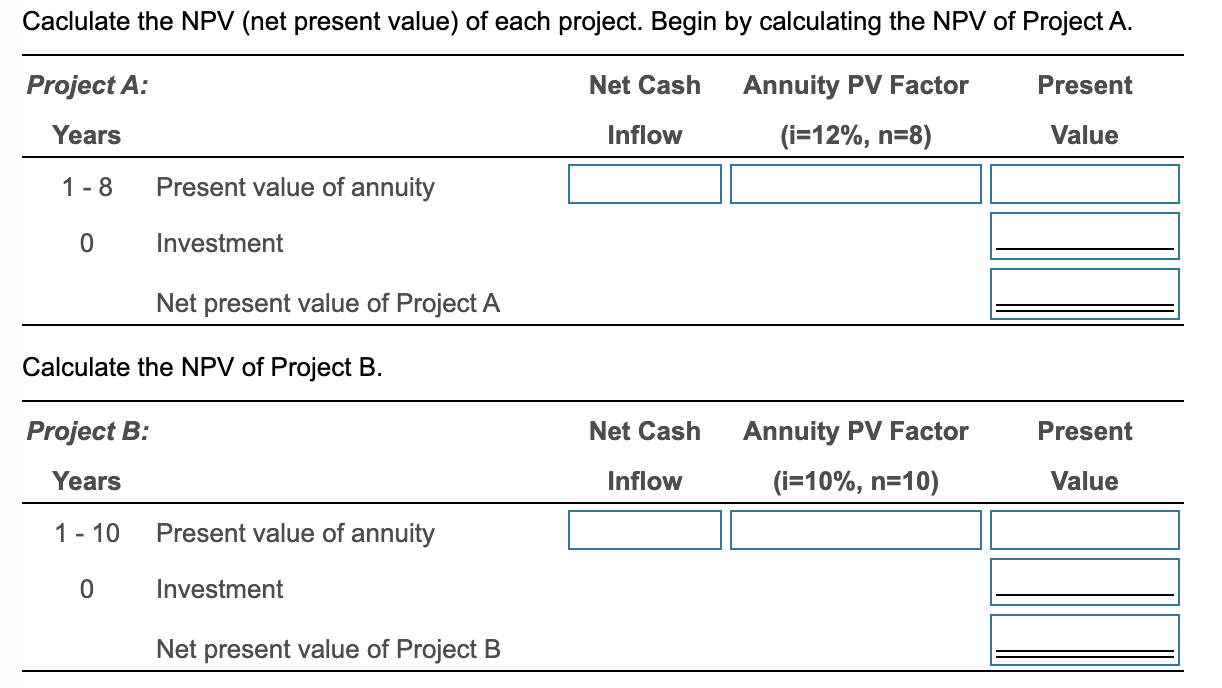

- Project A: Costs $295,000 and offers eight annual net cash inflows of $53,000. Preston Products requires an annual return of 12% on investments of this nature.

-Project B: Costs $385,000 and offers 10 annual net cash inflows of $72,000. Preston Products demands an annual return of 10% on investments of this nature.

Requirement 1. What is the NPV of each project? Assume neither project has a residual value. Round to two decimal places. (to 3 decimal places)

Requirement 1. What is the NPV of each project? Assume neither project has a residual value. Round to two decimal places. (to 3 decimal places)

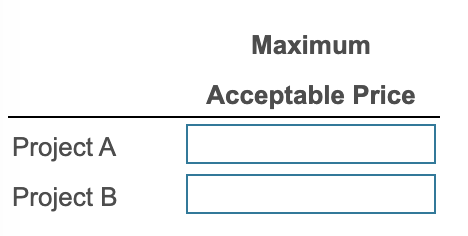

Requirement 2. What is the maximum acceptable price to pay for each project?

Requirement 2. What is the maximum acceptable price to pay for each project?

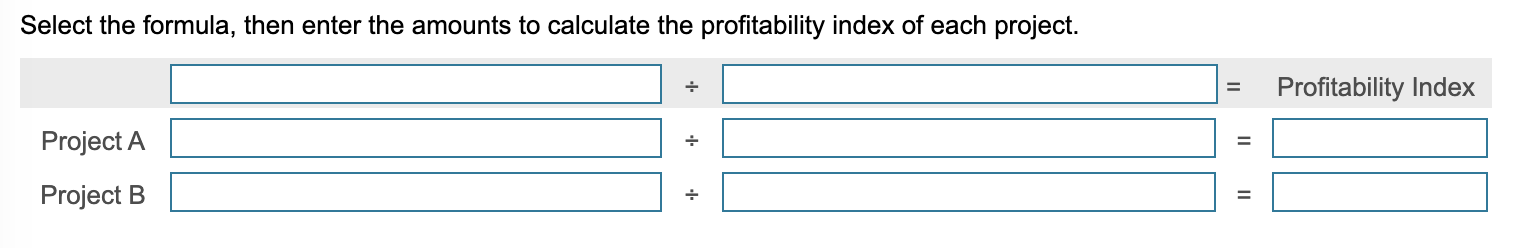

Requirement 3. What is the profitability index of each project? (round to 2 decimal places)

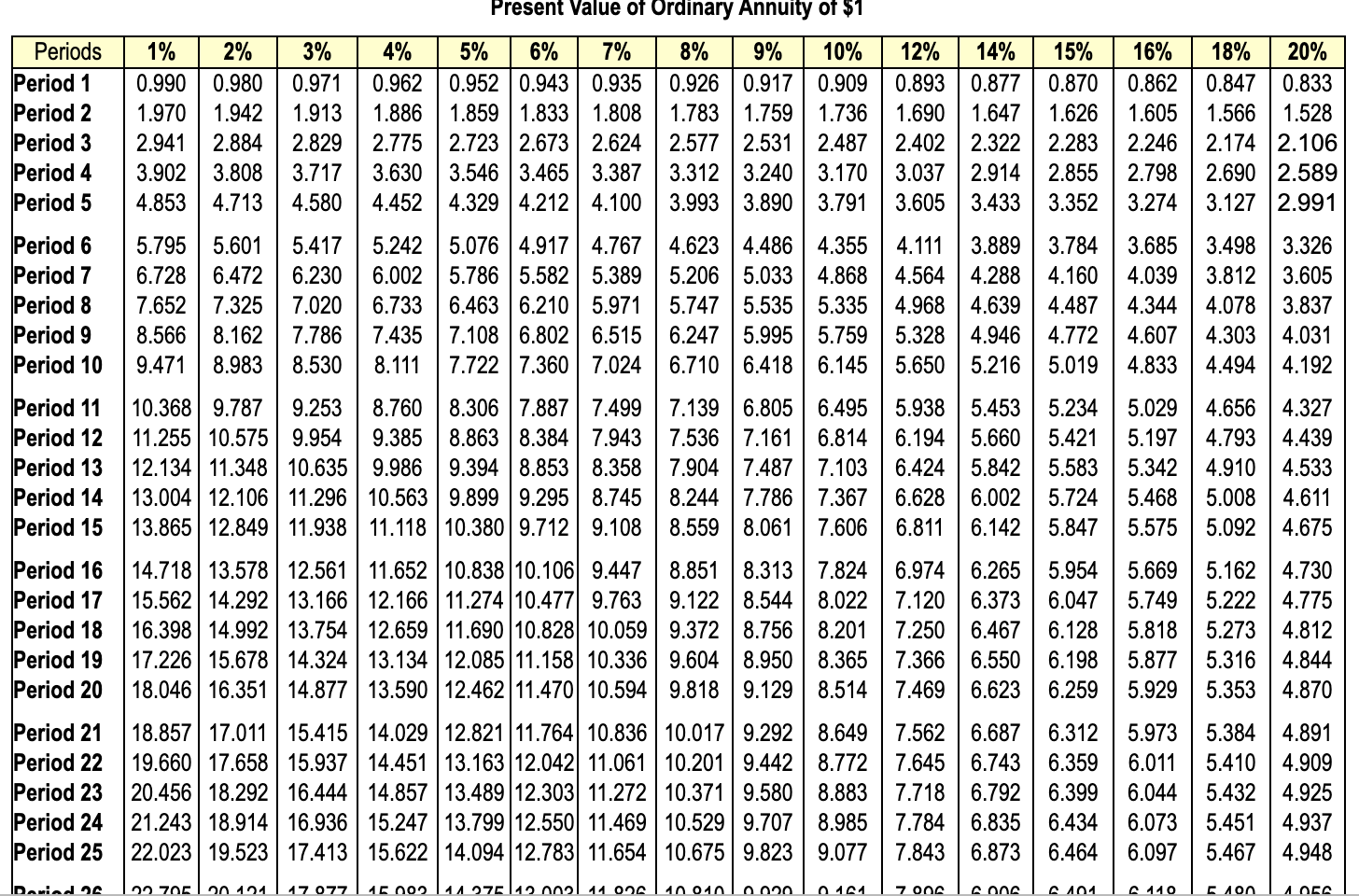

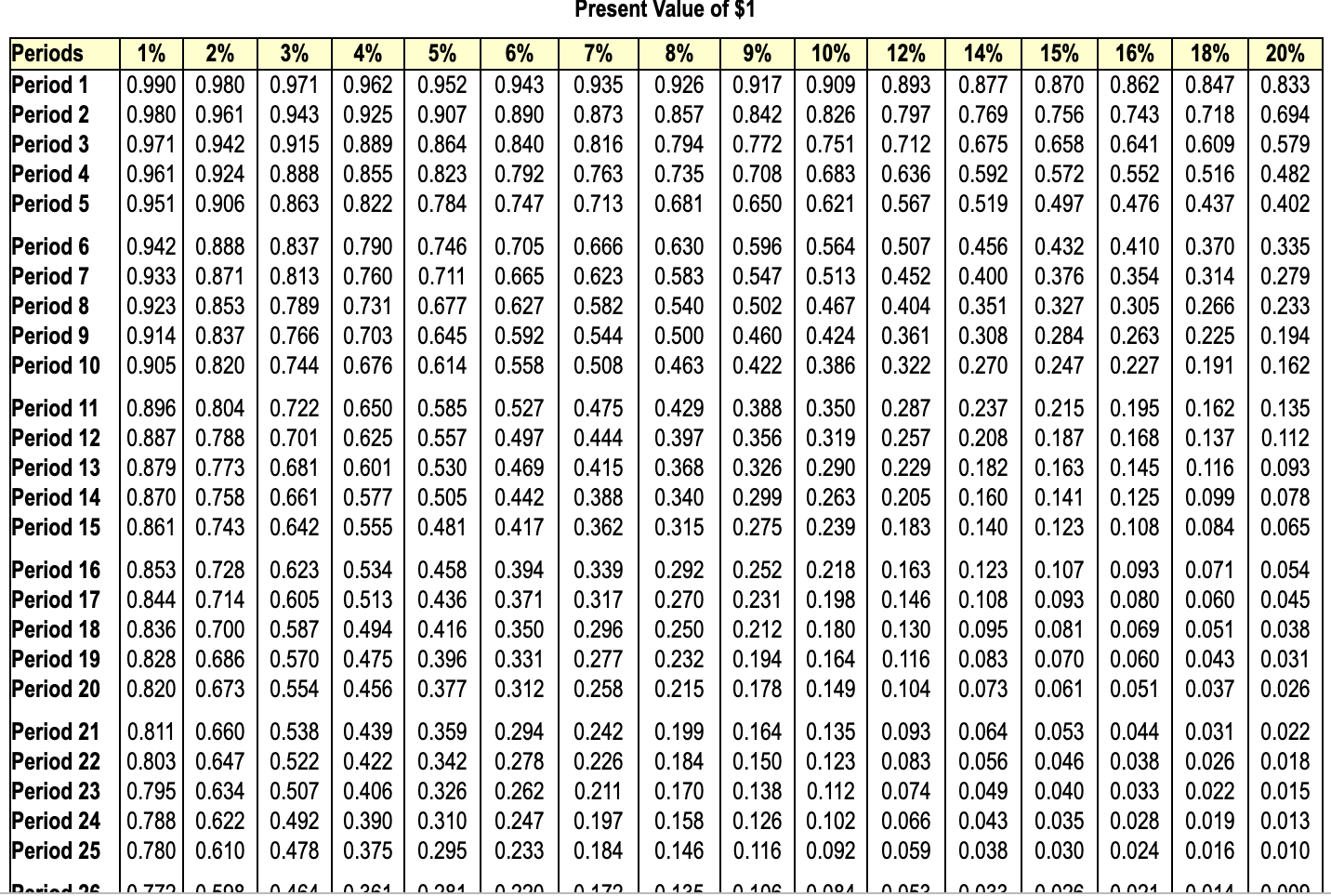

Periods Period 1 Period 2 Period 3 Period 4 Period 5 1% 2% 3% 0.990 0.980 0.971 1.970 1.942 1.913 2.941 2.884 2.829 3.902 3.808 3.717 4.853 4.713 4.580 Present Value of Ordinary Annuity of $1 4% 5% 6% 7% 8% 9% 10% 12% 14% 15% 16% 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.893 0.877 0.870 0.862 1.886 1.859 1.833 1.808 1.783 1.759 1.736 1.6901.647 1.626 1.605 2.775 2.723 2.673 2.624 2.577 2.531 2.487 2.402 2.322 2.283 2.246 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.037 2.914 2.855 2.798 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.605 3.433 3.352 3.274 18% 20% 0.847 0.833 1.566 1.528 2.174 2.106 2.690 2.589 3.127 2.991 Period 6 Period 7 Period 8 Period 9 Period 10 5.795 6.728 7.652 8.566 9.471 5.601 6.472 7.325 8.162 8.983 5.417 6.230 7.020 7.786 8.530 5.242 5.076 4.917 4.767 6.002 5.786 5.582 5.389 6.733 6.463 6.210 5.971 7.435 7.108 6.802 6.515 8.111 7.722 7.360 7.024 4.623 4.486 4.355 4.111 3.889 5.206 5.033 4.868 4.564 4.288 5.747 5.535 5.335 4.968 4.639 6.247 5.995 5.759 5.328 4.946 6.710 6.418 6.145 5.6505.216 3.784 4.160 4.487 4.772 5.019 3.685 4.039 4.344 4.607 4.833 3.498 3.812 4.078 4.303 4.494 3.326 3.605 3.837 4.031 4.192 Period 11 Period 12 Period 13 Period 14 Period 15 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 5.938 5.453 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 | 7.161 6.814 6.1945.660 12.134 11.348 10.635 9.986 9.394 8.853 8.358 7.904 7.487 7.103 6.424 5.842 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.2447.786 7.3676.6286.002 13.865 12.849 11.938 11.118 10.380 9.712 9.108 8.559 8.061 7.606 6.811 6.142 5.234 5.421 5.583 5.724 5.847 5.029 5.197 5.342 5.468 5.575 4.656 4.793 4.910 5.008 5.092 4.327 4.439 4.533 4.611 4.675 Period 16 Period 17 Period 18 Period 19 Period 20 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.313 7.824 6.974 6.265 15.562 14.292 13.166 12.166 11.274 10.4771 9.763 9.122 8.544 8.022 7.120 6.373 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 8.756 8.201 7.250 6.467 17.226 | 15.678 14.324 13.134 12.085 11.158 10.336 9.604 8.950 8.365 | 7.366 6.550 18.046 | 16.351 14.877 13.590 12.462 11.470 10.594 | 9.818 9.129 8.514 7.469 6.623 5.954 6.047 6.128 6.198 6.259 5.669 5.749 5.818 5.877 5.929 5.162 5.222 5.273 5.316 5.353 4.730 4.775 4.812 4.844 4.870 Period 21 Period 22 Period 23 Period 24 Period 25 18.857 17.011 15.415 14.029 12.821 11.764 10.836 10.017 9.292 8.649 7.562 6.687 19.660 17.658 15.937 14.451 13.163 12.042 11.061 10.2019.442 8.772 7.645 6.743 20.456 18.292 16.444 14.857 13.489 12.303 11.272 10.371 9.580 8.883 7.718 6.792 21.243 18.914 16.936 15.247 13.799 12.550 11.469 10.529 9.707 8.985 7.7846.835 22.023 19.523 17.413 | 15.622 14.094 12.783 11.654 10.675 9.8239.077 7.8436.873 6.312 6.359 6.399 6.434 6.464 5.973 6.011 6.044 6.073 6.097 5.384 5.410 5.432 5.451 5.467 4.891 4.909 4.925 4.937 4.948 Daviad 90 29 705 00421 17077 15002 44 2701120l 14 000 10010 000 0101 7 000 cong 201 110 E non 100 Present Value of $1 6% Periods Period 1 Period 2 Period 3 Period 4 Period 5 1% 2% 3% 4% 5% 0.990 0.9800.971 0.962 0.952 0.943 0.980 0.961 0.943 0.925 0.907 0.890 0.971 0.942 0.915 0.889 0.864 0.840 0.961 0.924 0.888 0.855 0.823 0.792 0.951 0.906 0.863 0.822 0.784 0.747 7% 0.935 0.873 0.816 0.763 0.713 8% 9% 10% 0.926 0.917 0.909 0.857 0.842 0.826 0.794 0.772 0.751 0.735 0.708 0.683 0.681 0.650 0.621 12% 0.893 0.797 0.712 0.636 0.567 14% 15% 16% 18% 20% 0.877 0.870 0.862 0.847 0.833 0.769 0.756 0.743 0.7180.694 0.675 0.658 0.641 0.609 0.579 0.592 0.572 0.552 0.516 0.482 0.519 0.497 0.476 0.437 0.402 Period 6 0.942 0.888 0.837 0.790 0.746 Period 7 0.933 0.871 0.813 0.760 0.711 Period 8 0.923 0.853 0.789 0.731 0.677 Period 9 0.914 0.837 0.766 0.703 0.645 Period 10 0.905 0.820 0.744 0.676 0.614 0.705 0.665 0.627 0.592 0.558 0.666 0.623 0.582 0.544 0.508 0.630 0.583 0.540 0.500 0.463 0.596 0.564 0.547 0.513 0.502 0.467 0.460 0.424 0.422 0.386 0.507 0.456 0.432 0.410 0.370 0.335 0.452 0.400 0.376 0.354 0.314 0.279 0.404 0.351 0.327 0.305 0.266 0.233 0.361 0.308 0.284 0.263 0.225 0.194 0.322 0.270 0.247 0.227 0.191 0.162 Period 11 0.896 0.804 0.722 0.650 0.585 0.527 Period 12 0.887 0.788 0.701 0.625 0.557 0.497 Period 13 0.879 0.773 0.681 0.601 0.530 0.469 Period 14 0.870 0.758 0.661 0.577 0.505 0.442 Period 15 0.861 0.743 0.642 0.555 0.481 0.417 0.475 0.444 0.415 0.388 0.362 0.429 0.388 0.350 0.397 0.356 0.319 0.368 0.326 0.290 0.340 0.299 0.263 0.315 0.275 0.239 0.287 0.257 0.229 0.205 0.183 0.237 0.215 0.195 0.162 0.135 0.208 0.187 0.168 0.137 0.112 0.182 0.163 0.145 0.116 0.093 0.160 0.141 0.125 0.099 0.078 0.140 0.123 0.108 0.084 0.065 Period 16 0.853 0.7280.623 0.534 0.458 Period 17 0.844 0.714 0.605 0.513 0.436 Period 18 0.836 0.700 0.587 0.494 0.416 Period 19 0.828 0.686 0.570 0.475 0.396 Period 20 0.820 0.673 0.554 0.456 0.377 0.394 0.371 0.350 0.331 0.312 0.339 0.317 0.296 0.277 0.258 0.292 0.252 0.218 0.270 0.231 0.198 0.250 0.212 0.180 0.232 0.194 0.164 0.215 0.178 0.149 0.163 0.123 0.107 0.093 0.071 0.054 0.146 0.108 0.093 0.080 0.060 0.045 0.130 0.095 0.081 0.069 0.051 0.038 0.116 0.083 0.070 0.060 0.043 0.031 0.104 0.073 0.061 0.051 0.037 0.026 Period 21 0.811 0.660 0.538 0.439 0.359 0.294 Period 22 0.803 0.647 0.522 0.422 0.342 0.278 Period 23 0.795 0.634 0.507 0.4060.326 0.262 Period 24 0.788 0.622 0.492 0.390 0.310 0.247 Period 25 0.780 0.610 0.478 0.375 0.295 0.233 0.242 0.226 0.211 0.197 0.184 0.199 0.184 0.170 0.158 0.146 0.1640.135 0.093 0.150 0.123 0.083 0.138 0.112 0.074 0.126 0.102 0.066 0.116 0.092 0.059 0.064 0.053 0.056 0.046 0.049 0.040 0.043 0.035 0.038 0.030 0.044 0.031 0.022 0.038 0.026 0.018 0.033 0.022 0.015 0.028 0.019 0.013 0.024 0.016 0.010 IDeviad A 770 no n01 non 170 n 125 ning nn nn22 nn21 nn14 nnnn Caclulate the NPV (net present value) of each project. Begin by calculating the NPV of Project A. Project A: Net Cash Present Annuity PV Factor (i=12%, n=8) Years Inflow Value 1-8 Present value of annuity 0 Investment Net present value of Project A Calculate the NPV of Project B. Project B: Net Cash Present Annuity PV Factor (i=10%, n=10) Years Inflow Value 1 - 10 Present value of annuity 0 Investment Net present value of Project B Maximum Acceptable Price Project A Project B Select the formula, then enter the amounts to calculate the profitability index of each project. + = Profitability Index Project A II Project B

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started