Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use the NPV method to determine whether Root Products should invest in the foilowing projects: Project A: Costs $275.000 and offers aight annual net

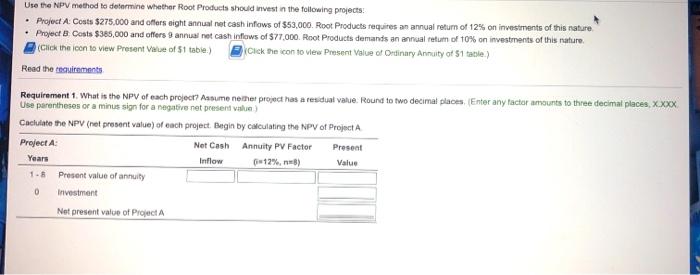

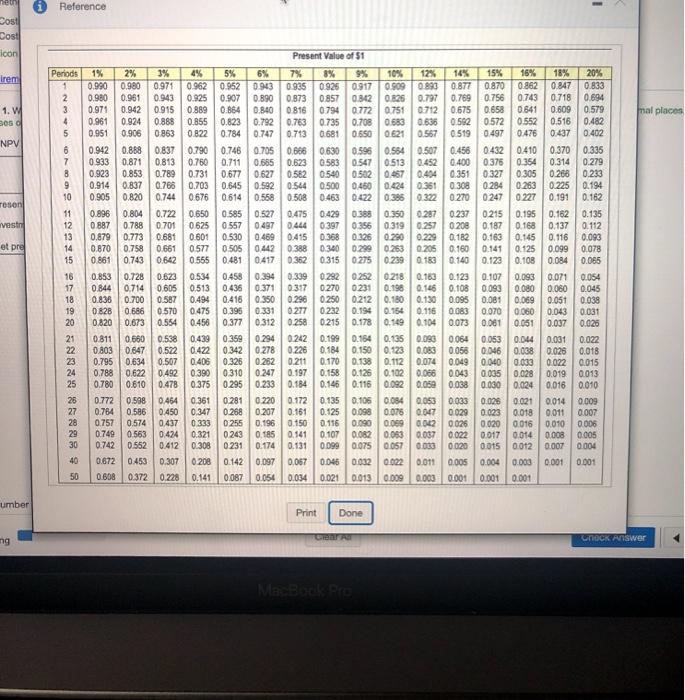

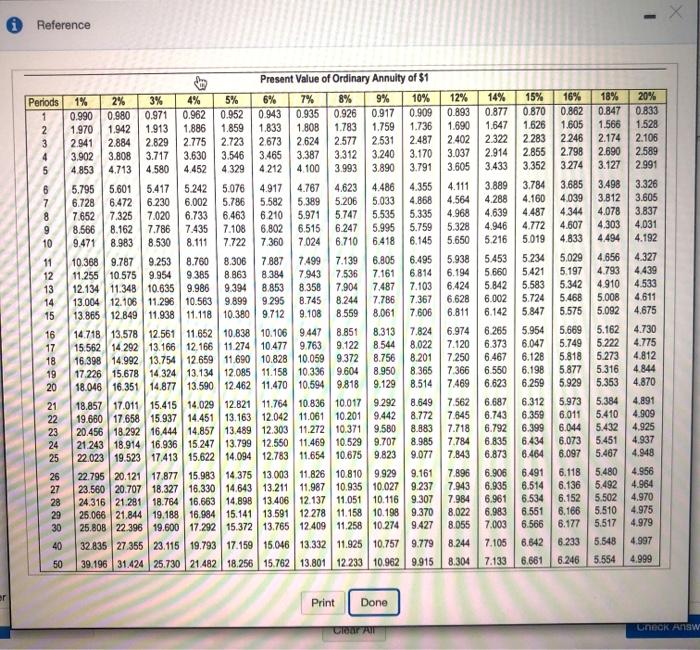

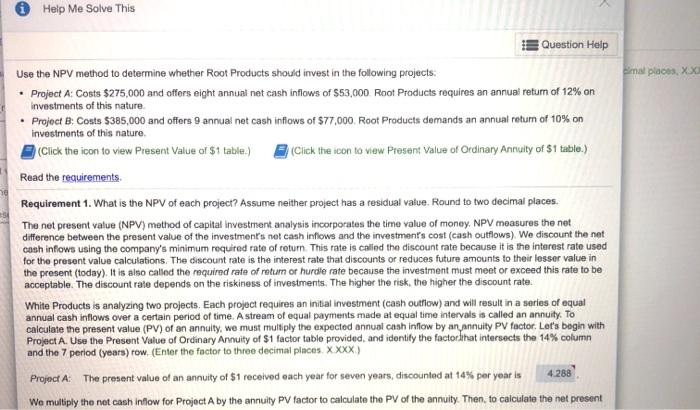

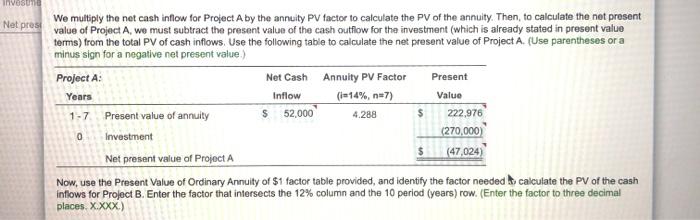

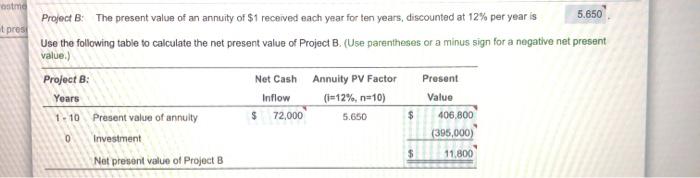

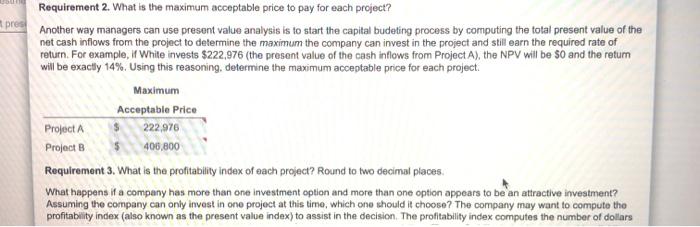

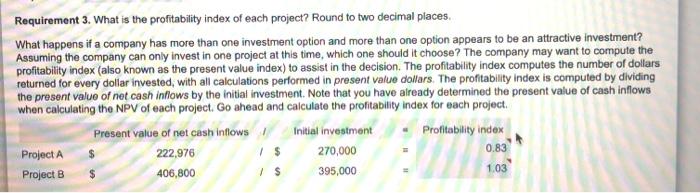

Use the NPV method to determine whether Root Products should invest in the foilowing projects: Project A: Costs $275.000 and offers aight annual net cash infows of $53,000. Root Products requires an annual return of 12% on investments of this nature. Project B Costs $385,000 and offers 9 annual net cash inflows of $71,000. Root Products demands an annual retum of t10% on investments of this nature. (Click the icon to view Present Value of $1 tabie.) Clck the icon to view Present Value of Ordinary Annuity of $1 table.) Read the teauirements Requirement 1. What is the NPV of each project? Assume neher project has a residual value. Round to two decimal places. (Enter any factor amounts to three decimal places, XXXX Use parentheses or a minus sign for a negative net present value) Caclulate the NPV (net present value) of each project. Begin by calculating the NPV of Project A Project A: Net Cash Annuity PV Factor Present Years Inflow G12%, n8) Value 1-8 Present value of annuity Investment Net present value of Project A neth Reference Cost Cost icon Present Value of $1 Periods 1% 2% 3% 15% 16% 18% 20% 0.833 0.694 0.579 0.482 0.402 4% 5% 6% 0.943 7% 8% 9% 10% 12% 14% irem 0.870 0.990 0.980 0.971 0.961 0.980 0.961 0.942 0.971 0.943 0.915 0.962 0.925 0.889 0.855 0.823 0.952 0.907 0.864 0935 0.925 0.873 0816 0.792 0.763 0.713 0.909 0.826 0.751 0.683 0.621 0.893 0.877 0.797 0.769 0.712 0.675 0.636 0.562 0.862 0.743 0.917 0.847 2 0.890 0.857 0.756 0.718 0.342 0.772 0.708 0.650 mal places 1. W ses o 0.609 0.516 0.437 3 0.840 0794 0.658 0.641 0.572 0.552 0.497 0476 4. 0.924 0.888 0.735 0.681 0.951 0.906 0.863 0.822 0.784 0.747 0.567 0.519 NPV 0.942 0 933 0.923 0.914 0.905 0.868 0.871 0.853 0.837 0.820 0.837 0.813 0.789 0.766 0.744 0.790 0.760 0.731 0.746 0.711 0.677 0.705 0.666 0.630 0.665 0.623 0.627| 0.582 0.645 0.592 0.544 0.614 0.558 0.508 0.507 0.452 0.404 0.361 0.322 0.456 0.400 0.351 0.308 0.270 0432 | 0.410 0.376 0.327 0.370 0.335 0.279 0.233 0.194 0.162 0.596 0.564 0.513 0.467 0.424 7. 0.354 0.314 0.583 0.540 0.500 0.547 0.305 0.502 0.460 0.266 0.263 | 0.225 0227 0.191 0.703 0.284 10 0.676 0.463 0.422 0.386 0247 resen 0.722 0.650 0625 0.601 0.577 0.55 0.585 0.527 0.475 0.557 0.530 0.469 0.505 0.442 0.481 0417 11 0.896 0.804 0.429 0.397 0.368 0.388 0.356 0.326 0.299 0275 0.350 0.319 0.290 0.263 0.239 0.287 0.257 0.229 0.205 0.183 0.237 0208 0.182 0.160 0.140 0215 0.195 0.135 0.112 0.116 0.093 0.099 0.078 0.084 0.065 0.162 0 497 0.444 0.415 0.388 0.362 vestn 12 0.887 0.788 0.701 0.187 0.168 0.137 13 0,879 0.870 0.861 0.773 0.681 0.661 0.642 0.163 0.145 0.125 et pre 14 0.758 0.340 0.141 15 0.743 0.315 0.123 0.108 0.458 0.394 0.436 0.371 0.416 0350 0.396 0331 0.377 0312 0.163 0.123 0.146 0.130 0.116 16 0.853 0.728 0.623 0.534 0.339 0.292 0252 0218 0.107 0.093 0.071 0.060 0.051 0.043 0.037 0.054 0.045 0.038 17 0.844 0,714 0.605 0.513 0.317 0.296 0270 0.250 0231 0212 0.198 0.180 0.164 0.149 0.108 0.093 0.080 18 0.836 0.700 0.587 0.494 0.095 0.081 0 828 0.686 0.820 0.673 0.554 0.069 0.060 0.051 19 0.570 0.475 0277 0232 0.194 0.083 0.073 0.070 0.031 20 0.456 0.258 0215 0.178 0.104 0.061 0.025 0.660 0.647 0.795 0.634 0.622 0.610 0.359 0.294 0.342 0.326 | 0.262 0310 0247 0295 0.233 0.093 0.064 0.083 0.056 0.074 0.049 0.066 21 0.811 0.538 0.439 0.422 0.406 0.390 0.375 0.242 0.199 0.164 0.150 0.135 0.053 0.044 0.031 0.022 22 0.278 0.226 0.184 0.170 0.123 0.112 0.102 0.092 0803 0.522 0.038 0.033 0.028 0.059 0.038 0.030 0.024 0.016 0.010 0.046 0.507 0.492 0.478 0.026 0.022 0.019 0.018 0.015 0.013 23 0.211 0.138 0.040 24 0.788 0.780 0.197 0.184 0.043 0.035 0.158 0.126 0.116 25 0.146 0.281 0220 0.207 0.196 0.185 26 0.772 0.598 0.586 0.574 0.563 0.552 0.464 0.361 0.172 0.161 0.150 0.141 0.131 0.135 0.106 0.084 0.076 0.053 0.047 0.042 0.037 0.033 0.033 0.026 0.029 0.021 0.014 0.009 27 0.764 0.268 0.450 0.437 0.424 0.347 0.333 0.321 0.308 0.125 0.098 0.090 0.082 0.075 0.023 0.018 0.016 0.014 0020 0015 0.012 0.007 0.004 0.004 0.003 0.001 0.011 0.010 0.008 0.007 0.006 0.005 28 0.757 0.749 0255 0.116 0.069 0.026 0.020 0.022 0.017 29 0243 0231 0.107 0.099 0.063 0.057 30 0.742 0.412 0.174 40 0.672 0.453 0.307 0.208 0.142 0.097 0,067 0.046 0.032 0.022 0.011 0.005 0.001 50 0.608 0.372 0.228 0.141 0.087 0.054 0.034 0.021 0.013 009 0.003 0.001 0.001 0.001 umber Print Done CearA Check Answer ng MacBook Pro Reference Present Value of Ordinary Annuity of $1 4% 6% 7% 8% 9% 10% 12% 14% 15% 16% 18% 20% 2% 0.980 Periods 1% 3% 5% 0.935 0.862 0.847 0.833 0.926 1.783 0.917 1.759 0.893 1.690 0.877 0.870 1.626 0.909 0.962 1.886 0.952 1.859 0.943 1.833 0.971 0.990 1.970 2.941 3.902 1.605 2246 1.566 2.174 1.647 1.528 1.736 2.487 1.942 1.913 1.808 2283 2.855 2.106 2.589 2.884 2.531 2.402 2.322 2.723 3.546 2.673 2.624 2.577 2.829 3.717 4.580 2.775 3.630 4.452 3 2.690 3.127 3.170 2.798 3.037 3.605 2.914 3.465 4 212 3.240 3.890 4 3.808 3.387 3.312 4.713 4.100 3.993 3.791 3.433 3.352 3.274 2.991 5. 4.853 4.329 3.784 3.685 3.498 3.326 4.917 5.582 6210 4.767 5.389 5.971 6.515 7.024 3.889 4.288 5.601 5.417 5.242 5.076 4.623 4.486 4.355 4.111 5.795 6.728 4.564 4.160 4.039 3.812 3.605 6.472 7.652 7.325 8.162 8.983 7 6.230 6.002 5.786 5.206 5.033 4.868 3.837 4.344 4.607 4.078 4.303 4.639 5.535 5.995 6.418 4.487 4.772 5.335 6.463 7.108 4.968 5.328 7.020 5.747 6.733 7.435 4.031 4.192 8.566 5.759 4.946 6.802 7.360 7.786 6.247 9. 10 8.530 8.111 6.710 6.145 5.650 5.216 5.019 4.833 4.494 9.471 7.722 4.656 4.327 4.439 4.533 4.611 6.805 6.495 5.453 5.234 5.029 5.938 6.194 6.424 6.628 10.368 9.787 9.253 7.499 7.139 8.760 9.385 11 8.306 7.887 5.197 5.342 5.468 4.793 11.255 10.575 9.954 12.134 11.348 10.635 9.986 13.004 12.106 11.296 10.563 9.899 13.865 12.849 11.938 11.118 10.380 9.712 5.660 5.842 6.002 6.142 5.421 5.583 5.724 12 8.863 8.384 7.943 7.536 7.161 6.814 7.904 4.910 7,487 7.786 8.061 8.853 7.103 8.358 8.745 9.108 13 9.394 7.367 7.606 5.008 5.092 14 9.295 8.244 8.559 6.811 5.847 5.575 4.675 15 6.265 6.373 6.467 6.550 5.669 5.162 5.222 5.273 5.316 6.974 4.730 5.954 6.047 6.128 6.198 6.259 8.313 8544 7.824 8.022 8.201 8.365 8.514 16 14.718 13.578 12.561 11.652| 10.838 10.106 9447 8.851 15.562 14.292 13.166 12.166 11.274 10.477 9.763 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 5.749 5.818 5.877 5.929 4.775 4.812 4.844 4.870 17 9.122 7.120 18 8.756 7.250 19 17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 8.950 7.366 20 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.129 7.469 6.623 5.353 6.312 6.359 6.399 6.434 6.464 5.973 6.011 6.044 6.073 6.097 5.384 4.891 5.410 4.909 4.925 4.937 4.948 8.649 7.562 6.687 21 18.857 17.011 15.415 14.029 12.821 11.764 10.836 10.017 9.292 7.645 6.743 8.772 8.883 22 19.660 17.658 15.937 14.451 13.163 12.042 11.061 10.201 9.442 23 20.456 18.292 16.444 14.857 13.489 12.303 11.272 10.371 9.580 7.718 6.792 5.432 5.451 21.243 18.914 16.936 15.247 13.799 12.550 11.469 10.529 9.707 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 | 9.823 8.985 7.784 6.835 24 9.077 7.843 6.873 5.467 25 6.906 6.935 6.961 6.983 7.003 5.480 5.492 5.502 5.510 6.177 5.517 4.956 6.491 6.514 6.534 6.551 6.566 26 22.795 20.121 17.877 15.983 14.375 13.003 11.826 10.810 9.929 9.161 7.896 6.118 27 23.560 20.707 18.327 16.330 14.643 13.211 11.987 10.935 10.027 9.237 7.943 6.136 4.964 4.970 4.975 4.979 24.316 21.281 18.764 16.663 14.898 13.406 12.137 11.051 10.116 9.307 7.984 6.152 28 29 25.066 21.844 19.188 16.984 15.141 13.591 12.278 11.158 10.198 9.370 8.022 6.166 30 25.808 22.396 19.600 17.292 15.372 13.765 12.409 11.258 10.274 9.427 8.055 6.233 5.548 6.246 5.554 32.835 27.355 23.115 19.793 17.159 15.046 13.332 11.925 10.757 9.779 8.244 7.105 6.642 4.997 40 50 39.196 31.424 25.730 21.482 18.256 15.762 13.801 12.233 10.962 9.915 8.304 7.133 6.661 4.999 or Print Done Clear All Check Answ 123 S O Help Me Solve This Question Help Use the NPV method to determine whether Root Products should invest in the following projects: mal places, XXI Project A: Costs $275,000 and offers eight annual net cash inflows of $53,000. Root Products requires an annual returm of 12% on investments of this nature. Project B: Costs $385,000 and offers 9 annual net cash inflows of $77,000. Root Products demands an annual return of 10% on investments of this nature. (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) Read the requirements. Requirement 1. What is the NPV of each project? Assume neither project has a residual value. Round to two decimal places. The net present value (NPV) method of capital investment analysis incorporates the time value of money. NPV measures the net difference between the present value of the investment's net cash inflows and the investment's cost (cash outflows). We discount the net cash inflows using the company's minimum required rate of return. This rate is called the discount rate because it is the interest rate used for the present value calculations. The discount rate is the interest rate that discounts or reduces future amounts to their lesser value in the present (today). It is also called the required rate of return or hurdle rate because the investment must meet or exceed this rate to be acceptable. The discount rate depends on the riskiness of investments. The higher the risk, the higher the discount rate. White Products is analyzing two projects. Each project requires an initial investment (cash outflow) and will result in a series of equal annual cash inflows over a certain period of time. A stream of equal payments made at equal time intervals is called an annuity. To calculate the present value (PV) of an annuity, we must multiply the expected annual cash inflow by an annuity PV factor. Let's begin with Project A. Use the Present Value of Ordinary Annuity of $1 factor table provided, and identify the factorihat intersects the 14% column and the 7 period (years) row. (Enter the factor to three decimal places. XXXX) 4.288 Project A The present value of an annuity of $1 received each year for seven years, discounted at 14% per year is Wa multiply the net cash inflow for Project A by the annuity PV factor to calculate the PV of the annuity. Then, to calculate the net present We multiply the net cash inflow for Project A by the annuity PV factor to calculate the PV of the annuity. Then, to calculate the net present value of Project A, we must subtract the present value of the cash outflow for the investment (which is already stated in present value terms) from the total PV of cash inflows. Use the following table to calculate the net present value of Project A. (Use parentheses or a minus sign for a negative net present value.) Net presi Project A: Net Cash Annuity PV Factor Present Inflow (i=14%, n=7) Years Value 1-7. Present value of annuity 222,976 52,000 4.288 (270,000) Investment (47,024) Net present value of Project A Now, use the Present Value of Ordinary Annuity of $1 factor table provided, and identify the factor needed calculate the PV of the cash inflows for Project B. Enter the factor that intersects the 12% column and the 10 period (years) row. (Enter the factor to three decimal places. X.XXX.) estme Project B: The present value of an annuity of $1 received each year for ten years, discounted at 12% per year is 5.650 t presi Use the following tabile to calculate the net present value of ProjectB. (Use parentheses or a minus sign for a negative net present value.) Project B: Net Cash Annuity PV Factor Present (i=12%, n=10) Years Inflow Value 1-10 Present value of annuity 72,000 5.650 $ 406,800 (395,000) Investment $4 11.800 Net presont value of Project B Requirement 2. What is the maximum acceptable price to pay for each project? t pres Another way managers can use present value analysis is to start the capital budeting process by computing the total present value of the net cash inflows from the project to determine the maximum the company can invest in the project and still earn the required rate of return. For example, if White invests $222,976 (the present value of the cash inflows from Project A), the NPV will be $0 and the retum will be exactly 14%. Using this reasoning, determine the maximum acceptable price for each project. Maximum Acceptable Price Project A 222.976 Project B 406,800 Requirement 3. What is the profitability index of each project? Round to two decimal places. What happens if a company has more than one investment option and more than one option appears to be an attractive investment? Assuming the company can only invest in one project at this time, which one should it choose? The company may want to compute the profitablity index (also known as the present value index) to assist in the decision. The profitability index computes the number of dollars Requirement 3. What is the profitability index of each project? Round to two decimal places. What happens if a company has more than one investment option and more than one option appears to be an attractive investment? Assuming the company can only invest in one project at this time, which one should it choose? The company may want to compute the profitability index (also known as the present value index) to assist in the decision. The profitability index computes the number of dollars returned for every dollar invested, with all calculations performed in present value dollars. The profitability index is computed by dividing the present value of net cash inflows by the initial investment. Note that you have already determined the present value of cash inflows when calculating the NPV of each project. Go ahead and calculate the profitability index for each project. Present value of net cash inflows Initial investment Profitability index Project A 222,976 270,000 0.83 Project B 406,800 395,000 1.03 Use the NPV method to determine whether Root Products should invest in the foilowing projects: Project A: Costs $275.000 and offers aight annual net cash infows of $53,000. Root Products requires an annual return of 12% on investments of this nature. Project B Costs $385,000 and offers 9 annual net cash inflows of $71,000. Root Products demands an annual retum of t10% on investments of this nature. (Click the icon to view Present Value of $1 tabie.) Clck the icon to view Present Value of Ordinary Annuity of $1 table.) Read the teauirements Requirement 1. What is the NPV of each project? Assume neher project has a residual value. Round to two decimal places. (Enter any factor amounts to three decimal places, XXXX Use parentheses or a minus sign for a negative net present value) Caclulate the NPV (net present value) of each project. Begin by calculating the NPV of Project A Project A: Net Cash Annuity PV Factor Present Years Inflow G12%, n8) Value 1-8 Present value of annuity Investment Net present value of Project A neth Reference Cost Cost icon Present Value of $1 Periods 1% 2% 3% 15% 16% 18% 20% 0.833 0.694 0.579 0.482 0.402 4% 5% 6% 0.943 7% 8% 9% 10% 12% 14% irem 0.870 0.990 0.980 0.971 0.961 0.980 0.961 0.942 0.971 0.943 0.915 0.962 0.925 0.889 0.855 0.823 0.952 0.907 0.864 0935 0.925 0.873 0816 0.792 0.763 0.713 0.909 0.826 0.751 0.683 0.621 0.893 0.877 0.797 0.769 0.712 0.675 0.636 0.562 0.862 0.743 0.917 0.847 2 0.890 0.857 0.756 0.718 0.342 0.772 0.708 0.650 mal places 1. W ses o 0.609 0.516 0.437 3 0.840 0794 0.658 0.641 0.572 0.552 0.497 0476 4. 0.924 0.888 0.735 0.681 0.951 0.906 0.863 0.822 0.784 0.747 0.567 0.519 NPV 0.942 0 933 0.923 0.914 0.905 0.868 0.871 0.853 0.837 0.820 0.837 0.813 0.789 0.766 0.744 0.790 0.760 0.731 0.746 0.711 0.677 0.705 0.666 0.630 0.665 0.623 0.627| 0.582 0.645 0.592 0.544 0.614 0.558 0.508 0.507 0.452 0.404 0.361 0.322 0.456 0.400 0.351 0.308 0.270 0432 | 0.410 0.376 0.327 0.370 0.335 0.279 0.233 0.194 0.162 0.596 0.564 0.513 0.467 0.424 7. 0.354 0.314 0.583 0.540 0.500 0.547 0.305 0.502 0.460 0.266 0.263 | 0.225 0227 0.191 0.703 0.284 10 0.676 0.463 0.422 0.386 0247 resen 0.722 0.650 0625 0.601 0.577 0.55 0.585 0.527 0.475 0.557 0.530 0.469 0.505 0.442 0.481 0417 11 0.896 0.804 0.429 0.397 0.368 0.388 0.356 0.326 0.299 0275 0.350 0.319 0.290 0.263 0.239 0.287 0.257 0.229 0.205 0.183 0.237 0208 0.182 0.160 0.140 0215 0.195 0.135 0.112 0.116 0.093 0.099 0.078 0.084 0.065 0.162 0 497 0.444 0.415 0.388 0.362 vestn 12 0.887 0.788 0.701 0.187 0.168 0.137 13 0,879 0.870 0.861 0.773 0.681 0.661 0.642 0.163 0.145 0.125 et pre 14 0.758 0.340 0.141 15 0.743 0.315 0.123 0.108 0.458 0.394 0.436 0.371 0.416 0350 0.396 0331 0.377 0312 0.163 0.123 0.146 0.130 0.116 16 0.853 0.728 0.623 0.534 0.339 0.292 0252 0218 0.107 0.093 0.071 0.060 0.051 0.043 0.037 0.054 0.045 0.038 17 0.844 0,714 0.605 0.513 0.317 0.296 0270 0.250 0231 0212 0.198 0.180 0.164 0.149 0.108 0.093 0.080 18 0.836 0.700 0.587 0.494 0.095 0.081 0 828 0.686 0.820 0.673 0.554 0.069 0.060 0.051 19 0.570 0.475 0277 0232 0.194 0.083 0.073 0.070 0.031 20 0.456 0.258 0215 0.178 0.104 0.061 0.025 0.660 0.647 0.795 0.634 0.622 0.610 0.359 0.294 0.342 0.326 | 0.262 0310 0247 0295 0.233 0.093 0.064 0.083 0.056 0.074 0.049 0.066 21 0.811 0.538 0.439 0.422 0.406 0.390 0.375 0.242 0.199 0.164 0.150 0.135 0.053 0.044 0.031 0.022 22 0.278 0.226 0.184 0.170 0.123 0.112 0.102 0.092 0803 0.522 0.038 0.033 0.028 0.059 0.038 0.030 0.024 0.016 0.010 0.046 0.507 0.492 0.478 0.026 0.022 0.019 0.018 0.015 0.013 23 0.211 0.138 0.040 24 0.788 0.780 0.197 0.184 0.043 0.035 0.158 0.126 0.116 25 0.146 0.281 0220 0.207 0.196 0.185 26 0.772 0.598 0.586 0.574 0.563 0.552 0.464 0.361 0.172 0.161 0.150 0.141 0.131 0.135 0.106 0.084 0.076 0.053 0.047 0.042 0.037 0.033 0.033 0.026 0.029 0.021 0.014 0.009 27 0.764 0.268 0.450 0.437 0.424 0.347 0.333 0.321 0.308 0.125 0.098 0.090 0.082 0.075 0.023 0.018 0.016 0.014 0020 0015 0.012 0.007 0.004 0.004 0.003 0.001 0.011 0.010 0.008 0.007 0.006 0.005 28 0.757 0.749 0255 0.116 0.069 0.026 0.020 0.022 0.017 29 0243 0231 0.107 0.099 0.063 0.057 30 0.742 0.412 0.174 40 0.672 0.453 0.307 0.208 0.142 0.097 0,067 0.046 0.032 0.022 0.011 0.005 0.001 50 0.608 0.372 0.228 0.141 0.087 0.054 0.034 0.021 0.013 009 0.003 0.001 0.001 0.001 umber Print Done CearA Check Answer ng MacBook Pro Reference Present Value of Ordinary Annuity of $1 4% 6% 7% 8% 9% 10% 12% 14% 15% 16% 18% 20% 2% 0.980 Periods 1% 3% 5% 0.935 0.862 0.847 0.833 0.926 1.783 0.917 1.759 0.893 1.690 0.877 0.870 1.626 0.909 0.962 1.886 0.952 1.859 0.943 1.833 0.971 0.990 1.970 2.941 3.902 1.605 2246 1.566 2.174 1.647 1.528 1.736 2.487 1.942 1.913 1.808 2283 2.855 2.106 2.589 2.884 2.531 2.402 2.322 2.723 3.546 2.673 2.624 2.577 2.829 3.717 4.580 2.775 3.630 4.452 3 2.690 3.127 3.170 2.798 3.037 3.605 2.914 3.465 4 212 3.240 3.890 4 3.808 3.387 3.312 4.713 4.100 3.993 3.791 3.433 3.352 3.274 2.991 5. 4.853 4.329 3.784 3.685 3.498 3.326 4.917 5.582 6210 4.767 5.389 5.971 6.515 7.024 3.889 4.288 5.601 5.417 5.242 5.076 4.623 4.486 4.355 4.111 5.795 6.728 4.564 4.160 4.039 3.812 3.605 6.472 7.652 7.325 8.162 8.983 7 6.230 6.002 5.786 5.206 5.033 4.868 3.837 4.344 4.607 4.078 4.303 4.639 5.535 5.995 6.418 4.487 4.772 5.335 6.463 7.108 4.968 5.328 7.020 5.747 6.733 7.435 4.031 4.192 8.566 5.759 4.946 6.802 7.360 7.786 6.247 9. 10 8.530 8.111 6.710 6.145 5.650 5.216 5.019 4.833 4.494 9.471 7.722 4.656 4.327 4.439 4.533 4.611 6.805 6.495 5.453 5.234 5.029 5.938 6.194 6.424 6.628 10.368 9.787 9.253 7.499 7.139 8.760 9.385 11 8.306 7.887 5.197 5.342 5.468 4.793 11.255 10.575 9.954 12.134 11.348 10.635 9.986 13.004 12.106 11.296 10.563 9.899 13.865 12.849 11.938 11.118 10.380 9.712 5.660 5.842 6.002 6.142 5.421 5.583 5.724 12 8.863 8.384 7.943 7.536 7.161 6.814 7.904 4.910 7,487 7.786 8.061 8.853 7.103 8.358 8.745 9.108 13 9.394 7.367 7.606 5.008 5.092 14 9.295 8.244 8.559 6.811 5.847 5.575 4.675 15 6.265 6.373 6.467 6.550 5.669 5.162 5.222 5.273 5.316 6.974 4.730 5.954 6.047 6.128 6.198 6.259 8.313 8544 7.824 8.022 8.201 8.365 8.514 16 14.718 13.578 12.561 11.652| 10.838 10.106 9447 8.851 15.562 14.292 13.166 12.166 11.274 10.477 9.763 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 5.749 5.818 5.877 5.929 4.775 4.812 4.844 4.870 17 9.122 7.120 18 8.756 7.250 19 17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 8.950 7.366 20 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.129 7.469 6.623 5.353 6.312 6.359 6.399 6.434 6.464 5.973 6.011 6.044 6.073 6.097 5.384 4.891 5.410 4.909 4.925 4.937 4.948 8.649 7.562 6.687 21 18.857 17.011 15.415 14.029 12.821 11.764 10.836 10.017 9.292 7.645 6.743 8.772 8.883 22 19.660 17.658 15.937 14.451 13.163 12.042 11.061 10.201 9.442 23 20.456 18.292 16.444 14.857 13.489 12.303 11.272 10.371 9.580 7.718 6.792 5.432 5.451 21.243 18.914 16.936 15.247 13.799 12.550 11.469 10.529 9.707 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 | 9.823 8.985 7.784 6.835 24 9.077 7.843 6.873 5.467 25 6.906 6.935 6.961 6.983 7.003 5.480 5.492 5.502 5.510 6.177 5.517 4.956 6.491 6.514 6.534 6.551 6.566 26 22.795 20.121 17.877 15.983 14.375 13.003 11.826 10.810 9.929 9.161 7.896 6.118 27 23.560 20.707 18.327 16.330 14.643 13.211 11.987 10.935 10.027 9.237 7.943 6.136 4.964 4.970 4.975 4.979 24.316 21.281 18.764 16.663 14.898 13.406 12.137 11.051 10.116 9.307 7.984 6.152 28 29 25.066 21.844 19.188 16.984 15.141 13.591 12.278 11.158 10.198 9.370 8.022 6.166 30 25.808 22.396 19.600 17.292 15.372 13.765 12.409 11.258 10.274 9.427 8.055 6.233 5.548 6.246 5.554 32.835 27.355 23.115 19.793 17.159 15.046 13.332 11.925 10.757 9.779 8.244 7.105 6.642 4.997 40 50 39.196 31.424 25.730 21.482 18.256 15.762 13.801 12.233 10.962 9.915 8.304 7.133 6.661 4.999 or Print Done Clear All Check Answ 123 S O Help Me Solve This Question Help Use the NPV method to determine whether Root Products should invest in the following projects: mal places, XXI Project A: Costs $275,000 and offers eight annual net cash inflows of $53,000. Root Products requires an annual returm of 12% on investments of this nature. Project B: Costs $385,000 and offers 9 annual net cash inflows of $77,000. Root Products demands an annual return of 10% on investments of this nature. (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) Read the requirements. Requirement 1. What is the NPV of each project? Assume neither project has a residual value. Round to two decimal places. The net present value (NPV) method of capital investment analysis incorporates the time value of money. NPV measures the net difference between the present value of the investment's net cash inflows and the investment's cost (cash outflows). We discount the net cash inflows using the company's minimum required rate of return. This rate is called the discount rate because it is the interest rate used for the present value calculations. The discount rate is the interest rate that discounts or reduces future amounts to their lesser value in the present (today). It is also called the required rate of return or hurdle rate because the investment must meet or exceed this rate to be acceptable. The discount rate depends on the riskiness of investments. The higher the risk, the higher the discount rate. White Products is analyzing two projects. Each project requires an initial investment (cash outflow) and will result in a series of equal annual cash inflows over a certain period of time. A stream of equal payments made at equal time intervals is called an annuity. To calculate the present value (PV) of an annuity, we must multiply the expected annual cash inflow by an annuity PV factor. Let's begin with Project A. Use the Present Value of Ordinary Annuity of $1 factor table provided, and identify the factorihat intersects the 14% column and the 7 period (years) row. (Enter the factor to three decimal places. XXXX) 4.288 Project A The present value of an annuity of $1 received each year for seven years, discounted at 14% per year is Wa multiply the net cash inflow for Project A by the annuity PV factor to calculate the PV of the annuity. Then, to calculate the net present We multiply the net cash inflow for Project A by the annuity PV factor to calculate the PV of the annuity. Then, to calculate the net present value of Project A, we must subtract the present value of the cash outflow for the investment (which is already stated in present value terms) from the total PV of cash inflows. Use the following table to calculate the net present value of Project A. (Use parentheses or a minus sign for a negative net present value.) Net presi Project A: Net Cash Annuity PV Factor Present Inflow (i=14%, n=7) Years Value 1-7. Present value of annuity 222,976 52,000 4.288 (270,000) Investment (47,024) Net present value of Project A Now, use the Present Value of Ordinary Annuity of $1 factor table provided, and identify the factor needed calculate the PV of the cash inflows for Project B. Enter the factor that intersects the 12% column and the 10 period (years) row. (Enter the factor to three decimal places. X.XXX.) estme Project B: The present value of an annuity of $1 received each year for ten years, discounted at 12% per year is 5.650 t presi Use the following tabile to calculate the net present value of ProjectB. (Use parentheses or a minus sign for a negative net present value.) Project B: Net Cash Annuity PV Factor Present (i=12%, n=10) Years Inflow Value 1-10 Present value of annuity 72,000 5.650 $ 406,800 (395,000) Investment $4 11.800 Net presont value of Project B Requirement 2. What is the maximum acceptable price to pay for each project? t pres Another way managers can use present value analysis is to start the capital budeting process by computing the total present value of the net cash inflows from the project to determine the maximum the company can invest in the project and still earn the required rate of return. For example, if White invests $222,976 (the present value of the cash inflows from Project A), the NPV will be $0 and the retum will be exactly 14%. Using this reasoning, determine the maximum acceptable price for each project. Maximum Acceptable Price Project A 222.976 Project B 406,800 Requirement 3. What is the profitability index of each project? Round to two decimal places. What happens if a company has more than one investment option and more than one option appears to be an attractive investment? Assuming the company can only invest in one project at this time, which one should it choose? The company may want to compute the profitablity index (also known as the present value index) to assist in the decision. The profitability index computes the number of dollars Requirement 3. What is the profitability index of each project? Round to two decimal places. What happens if a company has more than one investment option and more than one option appears to be an attractive investment? Assuming the company can only invest in one project at this time, which one should it choose? The company may want to compute the profitability index (also known as the present value index) to assist in the decision. The profitability index computes the number of dollars returned for every dollar invested, with all calculations performed in present value dollars. The profitability index is computed by dividing the present value of net cash inflows by the initial investment. Note that you have already determined the present value of cash inflows when calculating the NPV of each project. Go ahead and calculate the profitability index for each project. Present value of net cash inflows Initial investment Profitability index Project A 222,976 270,000 0.83 Project B 406,800 395,000 1.03 Use the NPV method to determine whether Root Products should invest in the foilowing projects: Project A: Costs $275.000 and offers aight annual net cash infows of $53,000. Root Products requires an annual return of 12% on investments of this nature. Project B Costs $385,000 and offers 9 annual net cash inflows of $71,000. Root Products demands an annual retum of t10% on investments of this nature. (Click the icon to view Present Value of $1 tabie.) Clck the icon to view Present Value of Ordinary Annuity of $1 table.) Read the teauirements Requirement 1. What is the NPV of each project? Assume neher project has a residual value. Round to two decimal places. (Enter any factor amounts to three decimal places, XXXX Use parentheses or a minus sign for a negative net present value) Caclulate the NPV (net present value) of each project. Begin by calculating the NPV of Project A Project A: Net Cash Annuity PV Factor Present Years Inflow G12%, n8) Value 1-8 Present value of annuity Investment Net present value of Project A neth Reference Cost Cost icon Present Value of $1 Periods 1% 2% 3% 15% 16% 18% 20% 0.833 0.694 0.579 0.482 0.402 4% 5% 6% 0.943 7% 8% 9% 10% 12% 14% irem 0.870 0.990 0.980 0.971 0.961 0.980 0.961 0.942 0.971 0.943 0.915 0.962 0.925 0.889 0.855 0.823 0.952 0.907 0.864 0935 0.925 0.873 0816 0.792 0.763 0.713 0.909 0.826 0.751 0.683 0.621 0.893 0.877 0.797 0.769 0.712 0.675 0.636 0.562 0.862 0.743 0.917 0.847 2 0.890 0.857 0.756 0.718 0.342 0.772 0.708 0.650 mal places 1. W ses o 0.609 0.516 0.437 3 0.840 0794 0.658 0.641 0.572 0.552 0.497 0476 4. 0.924 0.888 0.735 0.681 0.951 0.906 0.863 0.822 0.784 0.747 0.567 0.519 NPV 0.942 0 933 0.923 0.914 0.905 0.868 0.871 0.853 0.837 0.820 0.837 0.813 0.789 0.766 0.744 0.790 0.760 0.731 0.746 0.711 0.677 0.705 0.666 0.630 0.665 0.623 0.627| 0.582 0.645 0.592 0.544 0.614 0.558 0.508 0.507 0.452 0.404 0.361 0.322 0.456 0.400 0.351 0.308 0.270 0432 | 0.410 0.376 0.327 0.370 0.335 0.279 0.233 0.194 0.162 0.596 0.564 0.513 0.467 0.424 7. 0.354 0.314 0.583 0.540 0.500 0.547 0.305 0.502 0.460 0.266 0.263 | 0.225 0227 0.191 0.703 0.284 10 0.676 0.463 0.422 0.386 0247 resen 0.722 0.650 0625 0.601 0.577 0.55 0.585 0.527 0.475 0.557 0.530 0.469 0.505 0.442 0.481 0417 11 0.896 0.804 0.429 0.397 0.368 0.388 0.356 0.326 0.299 0275 0.350 0.319 0.290 0.263 0.239 0.287 0.257 0.229 0.205 0.183 0.237 0208 0.182 0.160 0.140 0215 0.195 0.135 0.112 0.116 0.093 0.099 0.078 0.084 0.065 0.162 0 497 0.444 0.415 0.388 0.362 vestn 12 0.887 0.788 0.701 0.187 0.168 0.137 13 0,879 0.870 0.861 0.773 0.681 0.661 0.642 0.163 0.145 0.125 et pre 14 0.758 0.340 0.141 15 0.743 0.315 0.123 0.108 0.458 0.394 0.436 0.371 0.416 0350 0.396 0331 0.377 0312 0.163 0.123 0.146 0.130 0.116 16 0.853 0.728 0.623 0.534 0.339 0.292 0252 0218 0.107 0.093 0.071 0.060 0.051 0.043 0.037 0.054 0.045 0.038 17 0.844 0,714 0.605 0.513 0.317 0.296 0270 0.250 0231 0212 0.198 0.180 0.164 0.149 0.108 0.093 0.080 18 0.836 0.700 0.587 0.494 0.095 0.081 0 828 0.686 0.820 0.673 0.554 0.069 0.060 0.051 19 0.570 0.475 0277 0232 0.194 0.083 0.073 0.070 0.031 20 0.456 0.258 0215 0.178 0.104 0.061 0.025 0.660 0.647 0.795 0.634 0.622 0.610 0.359 0.294 0.342 0.326 | 0.262 0310 0247 0295 0.233 0.093 0.064 0.083 0.056 0.074 0.049 0.066 21 0.811 0.538 0.439 0.422 0.406 0.390 0.375 0.242 0.199 0.164 0.150 0.135 0.053 0.044 0.031 0.022 22 0.278 0.226 0.184 0.170 0.123 0.112 0.102 0.092 0803 0.522 0.038 0.033 0.028 0.059 0.038 0.030 0.024 0.016 0.010 0.046 0.507 0.492 0.478 0.026 0.022 0.019 0.018 0.015 0.013 23 0.211 0.138 0.040 24 0.788 0.780 0.197 0.184 0.043 0.035 0.158 0.126 0.116 25 0.146 0.281 0220 0.207 0.196 0.185 26 0.772 0.598 0.586 0.574 0.563 0.552 0.464 0.361 0.172 0.161 0.150 0.141 0.131 0.135 0.106 0.084 0.076 0.053 0.047 0.042 0.037 0.033 0.033 0.026 0.029 0.021 0.014 0.009 27 0.764 0.268 0.450 0.437 0.424 0.347 0.333 0.321 0.308 0.125 0.098 0.090 0.082 0.075 0.023 0.018 0.016 0.014 0020 0015 0.012 0.007 0.004 0.004 0.003 0.001 0.011 0.010 0.008 0.007 0.006 0.005 28 0.757 0.749 0255 0.116 0.069 0.026 0.020 0.022 0.017 29 0243 0231 0.107 0.099 0.063 0.057 30 0.742 0.412 0.174 40 0.672 0.453 0.307 0.208 0.142 0.097 0,067 0.046 0.032 0.022 0.011 0.005 0.001 50 0.608 0.372 0.228 0.141 0.087 0.054 0.034 0.021 0.013 009 0.003 0.001 0.001 0.001 umber Print Done CearA Check Answer ng MacBook Pro Reference Present Value of Ordinary Annuity of $1 4% 6% 7% 8% 9% 10% 12% 14% 15% 16% 18% 20% 2% 0.980 Periods 1% 3% 5% 0.935 0.862 0.847 0.833 0.926 1.783 0.917 1.759 0.893 1.690 0.877 0.870 1.626 0.909 0.962 1.886 0.952 1.859 0.943 1.833 0.971 0.990 1.970 2.941 3.902 1.605 2246 1.566 2.174 1.647 1.528 1.736 2.487 1.942 1.913 1.808 2283 2.855 2.106 2.589 2.884 2.531 2.402 2.322 2.723 3.546 2.673 2.624 2.577 2.829 3.717 4.580 2.775 3.630 4.452 3 2.690 3.127 3.170 2.798 3.037 3.605 2.914 3.465 4 212 3.240 3.890 4 3.808 3.387 3.312 4.713 4.100 3.993 3.791 3.433 3.352 3.274 2.991 5. 4.853 4.329 3.784 3.685 3.498 3.326 4.917 5.582 6210 4.767 5.389 5.971 6.515 7.024 3.889 4.288 5.601 5.417 5.242 5.076 4.623 4.486 4.355 4.111 5.795 6.728 4.564 4.160 4.039 3.812 3.605 6.472 7.652 7.325 8.162 8.983 7 6.230 6.002 5.786 5.206 5.033 4.868 3.837 4.344 4.607 4.078 4.303 4.639 5.535 5.995 6.418 4.487 4.772 5.335 6.463 7.108 4.968 5.328 7.020 5.747 6.733 7.435 4.031 4.192 8.566 5.759 4.946 6.802 7.360 7.786 6.247 9. 10 8.530 8.111 6.710 6.145 5.650 5.216 5.019 4.833 4.494 9.471 7.722 4.656 4.327 4.439 4.533 4.611 6.805 6.495 5.453 5.234 5.029 5.938 6.194 6.424 6.628 10.368 9.787 9.253 7.499 7.139 8.760 9.385 11 8.306 7.887 5.197 5.342 5.468 4.793 11.255 10.575 9.954 12.134 11.348 10.635 9.986 13.004 12.106 11.296 10.563 9.899 13.865 12.849 11.938 11.118 10.380 9.712 5.660 5.842 6.002 6.142 5.421 5.583 5.724 12 8.863 8.384 7.943 7.536 7.161 6.814 7.904 4.910 7,487 7.786 8.061 8.853 7.103 8.358 8.745 9.108 13 9.394 7.367 7.606 5.008 5.092 14 9.295 8.244 8.559 6.811 5.847 5.575 4.675 15 6.265 6.373 6.467 6.550 5.669 5.162 5.222 5.273 5.316 6.974 4.730 5.954 6.047 6.128 6.198 6.259 8.313 8544 7.824 8.022 8.201 8.365 8.514 16 14.718 13.578 12.561 11.652| 10.838 10.106 9447 8.851 15.562 14.292 13.166 12.166 11.274 10.477 9.763 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 5.749 5.818 5.877 5.929 4.775 4.812 4.844 4.870 17 9.122 7.120 18 8.756 7.250 19 17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 8.950 7.366 20 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.129 7.469 6.623 5.353 6.312 6.359 6.399 6.434 6.464 5.973 6.011 6.044 6.073 6.097 5.384 4.891 5.410 4.909 4.925 4.937 4.948 8.649 7.562 6.687 21 18.857 17.011 15.415 14.029 12.821 11.764 10.836 10.017 9.292 7.645 6.743 8.772 8.883 22 19.660 17.658 15.937 14.451 13.163 12.042 11.061 10.201 9.442 23 20.456 18.292 16.444 14.857 13.489 12.303 11.272 10.371 9.580 7.718 6.792 5.432 5.451 21.243 18.914 16.936 15.247 13.799 12.550 11.469 10.529 9.707 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 | 9.823 8.985 7.784 6.835 24 9.077 7.843 6.873 5.467 25 6.906 6.935 6.961 6.983 7.003 5.480 5.492 5.502 5.510 6.177 5.517 4.956 6.491 6.514 6.534 6.551 6.566 26 22.795 20.121 17.877 15.983 14.375 13.003 11.826 10.810 9.929 9.161 7.896 6.118 27 23.560 20.707 18.327 16.330 14.643 13.211 11.987 10.935 10.027 9.237 7.943 6.136 4.964 4.970 4.975 4.979 24.316 21.281 18.764 16.663 14.898 13.406 12.137 11.051 10.116 9.307 7.984 6.152 28 29 25.066 21.844 19.188 16.984 15.141 13.591 12.278 11.158 10.198 9.370 8.022 6.166 30 25.808 22.396 19.600 17.292 15.372 13.765 12.409 11.258 10.274 9.427 8.055 6.233 5.548 6.246 5.554 32.835 27.355 23.115 19.793 17.159 15.046 13.332 11.925 10.757 9.779 8.244 7.105 6.642 4.997 40 50 39.196 31.424 25.730 21.482 18.256 15.762 13.801 12.233 10.962 9.915 8.304 7.133 6.661 4.999 or Print Done Clear All Check Answ 123 S O Help Me Solve This Question Help Use the NPV method to determine whether Root Products should invest in the following projects: mal places, XXI Project A: Costs $275,000 and offers eight annual net cash inflows of $53,000. Root Products requires an annual returm of 12% on investments of this nature. Project B: Costs $385,000 and offers 9 annual net cash inflows of $77,000. Root Products demands an annual return of 10% on investments of this nature. (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) Read the requirements. Requirement 1. What is the NPV of each project? Assume neither project has a residual value. Round to two decimal places. The net present value (NPV) method of capital investment analysis incorporates the time value of money. NPV measures the net difference between the present value of the investment's net cash inflows and the investment's cost (cash outflows). We discount the net cash inflows using the company's minimum required rate of return. This rate is called the discount rate because it is the interest rate used for the present value calculations. The discount rate is the interest rate that discounts or reduces future amounts to their lesser value in the present (today). It is also called the required rate of return or hurdle rate because the investment must meet or exceed this rate to be acceptable. The discount rate depends on the riskiness of investments. The higher the risk, the higher the discount rate. White Products is analyzing two projects. Each project requires an initial investment (cash outflow) and will result in a series of equal annual cash inflows over a certain period of time. A stream of equal payments made at equal time intervals is called an annuity. To calculate the present value (PV) of an annuity, we must multiply the expected annual cash inflow by an annuity PV factor. Let's begin with Project A. Use the Present Value of Ordinary Annuity of $1 factor table provided, and identify the factorihat intersects the 14% column and the 7 period (years) row. (Enter the factor to three decimal places. XXXX) 4.288 Project A The present value of an annuity of $1 received each year for seven years, discounted at 14% per year is Wa multiply the net cash inflow for Project A by the annuity PV factor to calculate the PV of the annuity. Then, to calculate the net present We multiply the net cash inflow for Project A by the annuity PV factor to calculate the PV of the annuity. Then, to calculate the net present value of Project A, we must subtract the present value of the cash outflow for the investment (which is already stated in present value terms) from the total PV of cash inflows. Use the following table to calculate the net present value of Project A. (Use parentheses or a minus sign for a negative net present value.) Net presi Project A: Net Cash Annuity PV Factor Present Inflow (i=14%, n=7) Years Value 1-7. Present value of annuity 222,976 52,000 4.288 (270,000) Investment (47,024) Net present value of Project A Now, use the Present Value of Ordinary Annuity of $1 factor table provided, and identify the factor needed calculate the PV of the cash inflows for Project B. Enter the factor that intersects the 12% column and the 10 period (years) row. (Enter the factor to three decimal places. X.XXX.) estme Project B: The present value of an annuity of $1 received each year for ten years, discounted at 12% per year is 5.650 t presi Use the following tabile to calculate the net present value of ProjectB. (Use parentheses or a minus sign for a negative net present value.) Project B: Net Cash Annuity PV Factor Present (i=12%, n=10) Years Inflow Value 1-10 Present value of annuity 72,000 5.650 $ 406,800 (395,000) Investment $4 11.800 Net presont value of Project B Requirement 2. What is the maximum acceptable price to pay for each project? t pres Another way managers can use present value analysis is to start the capital budeting process by computing the total present value of the net cash inflows from the project to determine the maximum the company can invest in the project and still earn the required rate of return. For example, if White invests $222,976 (the present value of the cash inflows from Project A), the NPV will be $0 and the retum will be exactly 14%. Using this reasoning, determine the maximum acceptable price for each project. Maximum Acceptable Price Project A 222.976 Project B 406,800 Requirement 3. What is the profitability index of each project? Round to two decimal places. What happens if a company has more than one investment option and more than one option appears to be an attractive investment? Assuming the company can only invest in one project at this time, which one should it choose? The company may want to compute the profitablity index (also known as the present value index) to assist in the decision. The profitability index computes the number of dollars Requirement 3. What is the profitability index of each project? Round to two decimal places. What happens if a company has more than one investment option and more than one option appears to be an attractive investment? Assuming the company can only invest in one project at this time, which one should it choose? The company may want to compute the profitability index (also known as the present value index) to assist in the decision. The profitability index computes the number of dollars returned for every dollar invested, with all calculations performed in present value dollars. The profitability index is computed by dividing the present value of net cash inflows by the initial investment. Note that you have already determined the present value of cash inflows when calculating the NPV of each project. Go ahead and calculate the profitability index for each project. Present value of net cash inflows Initial investment Profitability index Project A 222,976 270,000 0.83 Project B 406,800 395,000 1.03 Use the NPV method to determine whether Root Products should invest in the foilowing projects: Project A: Costs $275.000 and offers aight annual net cash infows of $53,000. Root Products requires an annual return of 12% on investments of this nature. Project B Costs $385,000 and offers 9 annual net cash inflows of $71,000. Root Products demands an annual retum of t10% on investments of this nature. (Click the icon to view Present Value of $1 tabie.) Clck the icon to view Present Value of Ordinary Annuity of $1 table.) Read the teauirements Requirement 1. What is the NPV of each project? Assume neher project has a residual value. Round to two decimal places. (Enter any factor amounts to three decimal places, XXXX Use parentheses or a minus sign for a negative net present value) Caclulate the NPV (net present value) of each project. Begin by calculating the NPV of Project A Project A: Net Cash Annuity PV Factor Present Years Inflow G12%, n8) Value 1-8 Present value of annuity Investment Net present value of Project A neth Reference Cost Cost icon Present Value of $1 Periods 1% 2% 3% 15% 16% 18% 20% 0.833 0.694 0.579 0.482 0.402 4% 5% 6% 0.943 7% 8% 9% 10% 12% 14% irem 0.870 0.990 0.980 0.971 0.961 0.980 0.961 0.942 0.971 0.943 0.915 0.962 0.925 0.889 0.855 0.823 0.952 0.907 0.864 0935 0.925 0.873 0816 0.792 0.763 0.713 0.909 0.826 0.751 0.683 0.621 0.893 0.877 0.797 0.769 0.712 0.675 0.636 0.562 0.862 0.743 0.917 0.847 2 0.890 0.857 0.756 0.718 0.342 0.772 0.708 0.650 mal places 1. W ses o 0.609 0.516 0.437 3 0.840 0794 0.658 0.641 0.572 0.552 0.497 0476 4. 0.924 0.888 0.735 0.681 0.951 0.906 0.863 0.822 0.784 0.747 0.567 0.519 NPV 0.942 0 933 0.923 0.914 0.905 0.868 0.871 0.853 0.837 0.820 0.837 0.813 0.789 0.766 0.744 0.790 0.760 0.731 0.746 0.711 0.677 0.705 0.666 0.630 0.665 0.623 0.627| 0.582 0.645 0.592 0.544 0.614 0.558 0.508 0.507 0.452 0.404 0.361 0.322 0.456 0.400 0.351 0.308 0.270 0432 | 0.410 0.376 0.327 0.370 0.335 0.279 0.233 0.194 0.162 0.596 0.564 0.513 0.467 0.424 7. 0.354 0.314 0.583 0.540 0.500 0.547 0.305 0.502 0.460 0.266 0.263 | 0.225 0227 0.191 0.703 0.284 10 0.676 0.463 0.422 0.386 0247 resen 0.722 0.650 0625 0.601 0.577 0.55 0.585 0.527 0.475 0.557 0.530 0.469 0.505 0.442 0.481 0417 11 0.896 0.804 0.429 0.397 0.368 0.388 0.356 0.326 0.299 0275 0.350 0.319 0.290 0.263 0.239 0.287 0.257 0.229 0.205 0.183 0.237 0208 0.182 0.160 0.140 0215 0.195 0.135 0.112 0.116 0.093 0.099 0.078 0.084 0.065 0.162 0 497 0.444 0.415 0.388 0.362 vestn 12 0.887 0.788 0.701 0.187 0.168 0.137 13 0,879 0.870 0.861 0.773 0.681 0.661 0.642 0.163 0.145 0.125 et pre 14 0.758 0.340 0.141 15 0.743 0.315 0.123 0.108 0.458 0.394 0.436 0.371 0.416 0350 0.396 0331 0.377 0312 0.163 0.123 0.146 0.130 0.116 16 0.853 0.728 0.623 0.534 0.339 0.292 0252 0218 0.107 0.093 0.071 0.060 0.051 0.043 0.037 0.054 0.045 0.038 17 0.844 0,714 0.605 0.513 0.317 0.296 0270 0.250 0231 0212 0.198 0.180 0.164 0.149 0.108 0.093 0.080 18 0.836 0.700 0.587 0.494 0.095 0.081 0 828 0.686 0.820 0.673 0.554 0.069 0.060 0.051 19 0.570 0.475 0277 0232 0.194 0.083 0.073 0.070 0.031 20 0.456 0.258 0215 0.178 0.104 0.061 0.025 0.660 0.647 0.795 0.634 0.622 0.610 0.359 0.294 0.342 0.326 | 0.262 0310 0247 0295 0.233 0.093 0.064 0.083 0.056 0.074 0.049 0.066 21 0.811 0.538 0.439 0.422 0.406 0.390 0.375 0.242 0.199 0.164 0.150 0.135 0.053 0.044 0.031 0.022 22 0.278 0.226 0.184 0.170 0.123 0.112 0.102 0.092 0803 0.522 0.038 0.033 0.028 0.059 0.038 0.030 0.024 0.016 0.010 0.046 0.507 0.492 0.478 0.026 0.022 0.019 0.018 0.015 0.013 23 0.211 0.138 0.040 24 0.788 0.780 0.197 0.184 0.043 0.035 0.158 0.126 0.116 25 0.146 0.281 0220 0.207 0.196 0.185 26 0.772 0.598 0.586 0.574 0.563 0.552 0.464 0.361 0.172 0.161 0.150 0.141 0.131 0.135 0.106 0.084 0.076 0.053 0.047 0.042 0.037 0.033 0.033 0.026 0.029 0.021 0.014 0.009 27 0.764 0.268 0.450 0.437 0.424 0.347 0.333 0.321 0.308 0.125 0.098 0.090 0.082 0.075 0.023 0.018 0.016 0.014 0020 0015 0.012 0.007 0.004 0.004 0.003 0.001 0.011 0.010 0.008 0.007 0.006 0.005 28 0.757 0.749 0255 0.116 0.069 0.026 0.020 0.022 0.017 29 0243 0231 0.107 0.099 0.063 0.057 30 0.742 0.412 0.174 40 0.672 0.453 0.307 0.208 0.142 0.097 0,067 0.046 0.032 0.022 0.011 0.005 0.001 50 0.608 0.372 0.228 0.141 0.087 0.054 0.034 0.021 0.013 009 0.003 0.001 0.001 0.001 umber Print Done CearA Check Answer ng MacBook Pro Reference Present Value of Ordinary Annuity of $1 4% 6% 7% 8% 9% 10% 12% 14% 15% 16% 18% 20% 2% 0.980 Periods 1% 3% 5% 0.935 0.862 0.847 0.833 0.926 1.783 0.917 1.759 0.893 1.690 0.877 0.870 1.626 0.909 0.962 1.886 0.952 1.859 0.943 1.833 0.971 0.990 1.970 2.941 3.902 1.605 2246 1.566 2.174 1.647 1.528 1.736 2.487 1.942 1.913 1.808 2283 2.855 2.106 2.589 2.884 2.531 2.402 2.322 2.723 3.546 2.673 2.624 2.577 2.829 3.717 4.580 2.775 3.630 4.452 3 2.690 3.127 3.170 2.798 3.037 3.605 2.914 3.465 4 212 3.240 3.890 4 3.808 3.387 3.312 4.713 4.100 3.993 3.791 3.433 3.352 3.274 2.991 5. 4.853 4.329 3.784 3.685 3.498 3.326 4.917 5.582 6210 4.767 5.389 5.971 6.515 7.024 3.889 4.288 5.601 5.417 5.242 5.076 4.623 4.486 4.355 4.111 5.795 6.728 4.564 4.160 4.039 3.812 3.605 6.472 7.652 7.325 8.162 8.983 7 6.230 6.002 5.786 5.206 5.033 4.868 3.837 4.344 4.607 4.078 4.303 4.639 5.535 5.995 6.418 4.487 4.772 5.335 6.463 7.108 4.968 5.328 7.020 5.747 6.733 7.435 4.031 4.192 8.566 5.759 4.946 6.802 7.360 7.786 6.247 9. 10 8.530 8.111 6.710 6.145 5.650 5.216 5.019 4.833 4.494 9.471 7.722 4.656 4.327 4.439 4.533 4.611 6.805 6.495 5.453 5.234 5.029 5.938 6.194 6.424 6.628 10.368 9.787 9.253 7.499 7.139 8.760 9.385 11 8.306 7.887 5.197 5.342 5.468 4.793 11.255 10.575 9.954 12.134 11.348 10.635 9.986 13.004 12.106 11.296 10.563 9.899 13.865 12.849 11.938 11.118 10.380 9.712 5.660 5.842 6.002 6.142 5.421 5.583 5.724 12 8.863 8.384 7.943 7.536 7.161 6.814 7.904 4.910 7,487 7.786 8.061 8.853 7.103 8.358 8.745 9.108 13 9.394 7.367 7.606 5.008 5.092 14 9.295 8.244 8.559 6.811 5.847 5.575 4.675 15 6.265 6.373 6.467 6.550 5.669 5.162 5.222 5.273 5.316 6.974 4.730 5.954 6.047 6.128 6.198 6.259 8.313 8544 7.824 8.022 8.201 8.365 8.514 16 14.718 13.578 12.561 11.652| 10.838 10.106 9447 8.851 15.562 14.292 13.166 12.166 11.274 10.477 9.763 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 5.749 5.818 5.877 5.929 4.775 4.812 4.844 4.870 17 9.122 7.120 18 8.756 7.250 19 17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 8.950 7.366 20 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.129 7.469 6.623 5.353 6.312 6.359 6.399 6.434 6.464 5.973 6.011 6.044 6.073 6.097 5.384 4.891 5.410 4.909 4.925 4.937 4.948 8.649 7.562 6.687 21 18.857 17.011 15.415 14.029 12.821 11.764 10.836 10.017 9.292 7.645 6.743 8.772 8.883 22 19.660 17.658 15.937 14.451 13.163 12.042 11.061 10.201 9.442 23 20.456 18.292 16.444 14.857 13.489 12.303 11.272 10.371 9.580 7.718 6.792 5.432 5.451 21.243 18.914 16.936 15.247 13.799 12.550 11.469 10.529 9.707 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 | 9.823 8.985 7.784 6.835 24 9.077 7.843 6.873 5.467 25 6.906 6.935 6.961 6.983 7.003 5.480 5.492 5.502 5.510 6.177 5.517 4.956 6.491 6.514 6.534 6.551 6.566 26 22.795 20.121 17.877 15.983 14.375 13.003 11.826 10.810 9.929 9.161 7.896 6.118 27 23.560 20.707 18.327 16.330 14.643 13.211 11.987 10.935 10.027 9.237 7.943 6.136 4.964 4.970 4.975 4.979 24.316 21.281 18.764 16.663 14.898 13.406 12.137 11.051 10.116 9.307 7.984 6.152 28 29 25.066 21.844 19.188 16.984 15.141 13.591 12.278 11.158 10.198 9.370 8.022 6.166 30 25.808 22.396 19.600 17.292 15.372 13.765 12.409 11.258 10.274 9.427 8.055 6.233 5.548 6.246 5.554 32.835 27.355 23.115 19.793 17.159 15.046 13.332 11.925 10.757 9.779 8.244 7.105 6.642 4.997 40 50 39.196 31.424 25.730 21.482 18.256 15.762 13.801 12.233 10.962 9.915 8.304 7.133 6.661 4.999 or Print Done Clear All Check Answ 123 S O Help Me Solve This Question Help Use the NPV method to determine whether Root Products should invest in the following projects: mal places, XXI Project A: Costs $275,000 and offers eight annual net cash inflows of $53,000. Root Products requires an annual returm of 12% on investments of this nature. Project B: Costs $385,000 and offers 9 annual net cash inflows of $77,000. Root Products demands an annual return of 10% on investments of this nature. (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) Read the requirements. Requirement 1. What is the NPV of each project? Assume neither project has a residual value. Round to two decimal places. The net present value (NPV) method of capital investment analysis incorporates the time value of money. NPV measures the net difference between the present value of the investment's net cash inflows and the investment's cost (cash outflows). We discount the net cash inflows using the company's minimum required rate of return. This rate is called the discount rate because it is the interest rate used for the present value calculations. The discount rate is the interest rate that discounts or reduces future amounts to their lesser value in the present (today). It is also called the required rate of return or hurdle rate because the investment must meet or exceed this rate to be acceptable. The discount rate depends on the riskiness of investments. The higher the risk, the higher the discount rate. White Products is analyzing two projects. Each project requires an initial investment (cash outflow) and will result in a series of equal annual cash inflows over a certain period of time. A stream of equal payments made at equal time intervals is called an annuity. To calculate the present value (PV) of an annuity, we must multiply the expected annual cash inflow by an annuity PV factor. Let's begin with Project A. Use the Present Value of Ordinary Annuity of $1 factor table provided, and identify the factorihat intersects the 14% column and the 7 period (years) row. (Enter the factor to three decimal places. XXXX) 4.288 Project A The present value of an annuity of $1 received each year for seven years, discounted at 14% per year is Wa multiply the net cash inflow for Project A by the annuity PV factor to calculate the PV of the annuity. Then, to calculate the net present We multiply the net cash inflow for Project A by the annuity PV factor to calculate the PV of the annuity. Then, to calculate the net present value of Project A, we must subtract the present value of the cash outflow for the investment (which is already stated in present value terms) from the total PV of cash inflows. Use the following table to calculate the net present value of Project A. (Use parentheses or a minus sign for a negative net present value.) Net presi Project A: Net Cash Annuity PV Factor Present Inflow (i=14%, n=7) Years Value 1-7. Present value of annuity 222,976 52,000 4.288 (270,000) Investment (47,024) Net present value of Project A Now, use the Present Value of Ordinary Annuity of $1 factor table provided, and identify the factor needed calculate the PV of the cash inflows for Project B. Enter the factor that intersects the 12% column and the 10 period (years) row. (Enter the factor to three decimal places. X.XXX.) estme Project B: The present value of an annuity of $1 received each year for ten years, discounted at 12% per year is 5.650 t presi Use the following tabile to calculate the net present value of ProjectB. (Use parentheses or a minus sign for a negative net present value.) Project B: Net Cash Annuity PV Factor Present (i=12%, n=10) Years Inflow Value 1-10 Present value of annuity 72,000 5.650 $ 406,800 (395,000) Investment $4 11.800 Net presont value of Project B Requirement 2. What is the maximum acceptable price to pay for each project? t pres Another way managers can use present value analysis is to start the capital budeting process by computing the total present value of the net cash inflows from the project to determine the maximum the company can invest in the project and still earn the required rate of return. For example, if White invests $222,976 (the present value of the cash inflows from Project A), the NPV will be $0 and the retum will be exactly 14%. Using this reasoning, determine the maximum acceptable price for each project. Maximum Acceptable Price Project A 222.976 Project B 406,800 Requirement 3. What is the profitability index of each project? Round to two decimal places. What happens if a company has more than one investment option and more than one option appears to be an attractive investment? Assuming the company can only invest in one project at this time, which one should it choose? The company may want to compute the profitablity index (also known as the present value index) to assist in the decision. The profitability index computes the number of dollars Requirement 3. What is the profitability index of each project? Round to two decimal places. What happens if a company has more than one investment option and more than one option appears to be an attractive investment? Assuming the company can only invest in one project at this time, which one should it choose? The company may want to compute the profitability index (also known as the present value index) to assist in the decision. The profitability index computes the number of dollars returned for every dollar invested, with all calculations performed in present value dollars. The profitability index is computed by dividing the present value of net cash inflows by the initial investment. Note that you have already determined the present value of cash inflows when calculating the NPV of each project. Go ahead and calculate the profitability index for each project. Present value of net cash inflows Initial investment Profitability index Project A 222,976 270,000 0.83 Project B 406,800 395,000 1.03

Step by Step Solution

★★★★★

3.30 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

REQUIREMENT 1 part a FOR PROJECT A CASH PV FACTOR PRESENT INFLOW VALUE FRO...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started