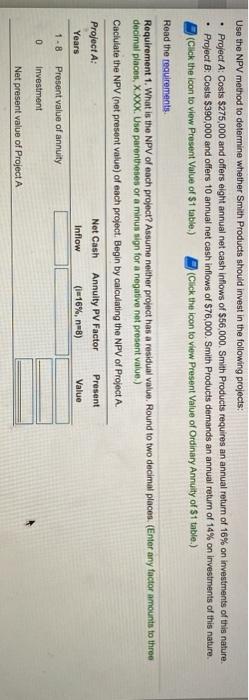

Use the NPV method to determine whether Smith Products should invest in the following projects: Project A Costs $275,000 and offers eight annual net cash inflows of $56,000. Smith Products requires an annual return of 16% on investments of this nature. Project B: Costs $390,000 and offers 10 annual net cash inflows of $76,000. Smith Products demands an annual return of 14% on investments of this nature (Click the icon to view Present Value of $1 table) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) Read the requirements Requirement 1. What is the NPV of each project? Assumonother project has a residunt value. Round to two decimal places. (Enter any factor amounts to three decimal placen, X.XXX. Use parentheses or a minus sign for a negative net present value.) Caciulate the NPV (net present value) of each project. Begin by calculating the NPV of Project A. Project A: Net Cash Annuity PV Factor Present Years Inflow (1-16%, n=8) Value Present value of annuity 1.8 0 Investment Net present value of Project A Present Value of $1 6% 9% 4% 3% 10% 7% 8% 5% 18% 12% 15% 14% 1% 20% 2% 16% Periods 0.926 0.917 0.9090.893 0.877 0.870 0.862 0.847 0.833 Period 1 10.990 0.9800.971 0.962 0.952 0.943 0.935 Period 2 0.980 0.961 0.943 0.925 0.9070.890 0.873 0.857 0.842 0.826 0.797 0.769 0.756 0.743 0.7180.694 Period 3 0.658 0.641 0.609 0.579 0.840 0.816 0.971 0.942 0.915 0.889 0.864 0.794 0.772 0.751 0.712 0.675 Period 4 10.961 0.924 0.888 0.855 0.823 0.792 0.763 0.735 0.708 0.683 0.636 0.592 0.572 0.552 0.516 0.482 Period 5 0.951 0.906 0.863 0.822 0.784 0.747 0.713 0.681 0.650 0.621 0.567 0.519 0.497 0.476 0.437 0.402 Period 6 0.942 0.888 0.837 0.790 0.746 0.705 0.6660.630 0.596 0.564 0.507 0.456 0.432 0.410 0.370 0.335 Period 7 0.933 0.871 0.813 0.750 0.711 0.665 0.623 0.583 0.547 0.513 0.452 0.400 0.376 0.354 0.314 0.279 Period 8 0.923 0.853 0.789 0.731 0.677 0.627 0.582 0.540 0.502 0.467 0.404 0.351 0.327 0.305 0.266 0.233 Period 9 0.914 0.837 0.766 0.703 0.6450.592 0.544 0.500 0.460 0.424 0.361 0.308 0.284 0.263 0.225 0.194 Period 10 0.905 0.820 0.744 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0.322 0.270 0.247 0.227 0.191 0.162 Period 11 10.896 0.804 0.722 0.650 0.585 0.527 0.475 0.429 0.388 0.350 0.287 0.237 0.215 0.1950.162 0.135 Period 12 0.887 0.788 0.701 0.625 0.557 0.497 0.444 0.397 0.356 0.31 0.257 0.208 0.187 0.168 0.137 0.112 Period 13 0,879 0.773 0.681 0.601 0.530 0.469 0.415 0.368 0.326 0.290 0.229 0.182 0.163 0.145 0.116 0.093 Period 14 0.870 0.758 0.661 0.577 0.505 0.442 0.388 0.340 0.299 0.263 0.2050.160 0.141 0.125 0.099 0.078 Period 15 0.861 0.743 0.642 0.555 0.481 0.417 0.362 0.315 0.275 0.239 0.183 0.140 0.123 0.108 0.084 0.065 Period 16 0.853 0.7280.623 0.534 0.458 0.394 0.3390.292 0.252 0218 0.163 0.123 0.107 0.093 0.071 0.054 Period 17 0.844 0.714 0.605 0.513 0.436 0.371 0.317 0.270 0.2310.1980.146 0.108 0.093 0.080 0.060 | 0.045 Period 18 0.836 0.7000.587 0.494 0.416 0.350 0.296 0.250 0.212 0.180 0.130 0.095 0.081 0.069 0.051 0.038 Period 19 10.828 0.686 0.570 0.475 0.396 0.331 0277 0.232 0.194 0.164 0.116 0.083 0.070 0.060 0.043 0.031 Period 20 10.820 0.673 0.554 0.456 0.377 0.3120 258 0.215 0.178 0.149 0.104 0.073 | 0.061 0.051 0.037 0.026 Period 21 10.811 0.660 0.538 0.439 0.359 0.294 0242 0.1990.1640.135 0.093 0.064 0.053 0.044 0.031 0.022 Period 22 0.8030.547 0.522 0.422 0.342 0.278 0.226 0.184 0.150 0.123 0.083 0.056 0.046 0.038 0.026 0.018 Period 23 0.795 0.634 0.507 0.4060.326 0.262 0.211 0.170 0.138 0.112 0.074 0.049 0.040 0.033 0.022 0.015 Period 24 0.788 0.622 0.492 0.390 0.310 0.2470.197 0.158 0.126 0.1020.066 0.043 0.035 Period 25 0.780 0.610 0.478 0.375 0.295 0.233 0.184 0.146 0.116 0.092 0.059 0.038 0.030 0.028 0.019 0.013 0.024 0.0160.010 Period 26 0.772 0.588 0.464 0.361 0.281 0.220 0.172 0.135 0.106 0.084 0.053 0.033 0.026 Period 27 0.764 0.586 0.450 0.347 0.268 0.207 0.161 0.021 0.014 0.009 0.125 0.098 0.076 0.047 0.029 0.023 Period 28 10.757 0.574 0437 0.333 0.255 0.1960.150 0.0180.0110.007 0.116 Period 29 0.7490.563 0424 0.321 0.243 0.185 0.141 0.090 0.069 0.042 0.026 0.020 0.0160.010 0.006 Period 30 0.742 0.5620.412 0.308 0.231 0.174 0.131 0.107 0.082 0.063 0.037 0.022 0.017 0.014 0.008 0.005 0.099 0.075 0.057 0.033 0.0200.015 0.012 0.007 0.004 Period 40 06720463 0.30702080.142 0.097 0.067 0.046 0.032 0.022 0.011 Period 50 0.608 0.372 0228 0.141 0.087 0.054 0.034 0.005 0.0040.003 0.001 0.001 0.021 0.013 0.0090.003 0.001 0.001 0.001 I.com/Student/Player Homework.aspx?homeworkld=574015670&quest NO Refera Present Value of Ordinary Annuity of $1 Periods 1 25 4N 5 6% 7% 8% 9% 10% 12% 14% 15% 16% 18% 20% Period 1 0.99009800977 0.962 0.9520.943 093609260.917 0.909 0.893 0.877 0.870 085208470.833 Period 2 1.970 1942 1913 1886 1859 1833 1808 1.7601.759 1.736 1.690 1647 1626 1.605 1.565 1.528 Period 3 2.9412.8842829 2.775 2.7232.03 2624 2.5772.531 2487 2.40223222283 2246 2.174 2.106 Period 4 3.902 3.808 3.717 3.630 3.5463465 3.387 3.312 3240 3.170 3.037 2.914 2.855 2798 2690 2.589 Period 5 4.8534.713 4.5804452 4.3294212 4.100 3.999 3.890 3.791 3.6053433 3.3523274 3.127 2 991 Period 6 5.750 5.601 5417 5242 5.076 4917 4.767 4623 4.4864.355 4.111 3889 3.784 368 3.498 3.326 Period 7 6.7286.472 6230 6.0025786 55825.389 5.206 5.033 486845644.288 4.15040393.812 3.606 Period 7.652 7.3257.020 6.739 6.463 6210 5.971 5.7475 535 533549684639 4.487 4 344 4.078 3837 Period 9 5.5668 1627.786 7435 7.108 6.802 6.5156247 5.995 5759 532849464772 4.607 4303 4031 Period 10 9.4718.983 8.530 8.111 7.722 7.360 7.0246.710 6.418 6.145 5.65052165.019 4833 4.494 4.192 Period 11 10.368 9.78792538760 8.3067.8877.499 7.139 6.805 6.495 5.938 54535.234 5.029 4656 4327 Period 12 11 255 10.575 9.9549.3858.8638.384 7.9437.5367.1616.814 6.1945.660 5.421 5.1974.793 4.439 Period 13 12 134 11.348 10.6359.986 9.3948.853 8.3587.9047.487 7.103 6.424 5.8425.583 5.3424.910 4.533 Period 14 13.004 12.106 11.296 10.563 9.899 9.295 8.74582447.7867.3676.6286.0025.724 5.4685.0084611 Period 15 13.865 12.849 11.93811.118 10.3809712 9.108 8.5598.061 7606 6.811 6.142 5.8475.575 5.092 4.675 Period 16 14.718 13.57812561 11.652 10.838 10.105 9.4478851 8.313 7.82469746.265 59545.669 5.1624.730 Period 17 15.562 14 292 13.166 12 166 11.27410.4771 9.763 9.12285448.022 7.1206.373 6.047 5.749 5.222 4.775 Period 10 16.398 14.982 13.754 1265911.690 10.828 10.0599.3728.756 8 2017 250 6.467 | 6.128 5.818 5.273 4812 Period 19 17 226 15.6781432413.13412085 11.15 10.33696048950 8.3667.366 | 6.5506.1985.8775.316 4844 Period 20 18.046 16.35 14.877 13.590 12.462 11.470 10.5949.818 9.129 8.5147.469 6.623 6.259 5.9295.353 4.870 Period 21 18.857 17.01115415 14.029 12.821 11.764 10.836 10.017 929286497.562 | 6.687 6.3125.9735.384 4.891 Period 22 19.660 17.658 15,93714451 13.163 12.042 11.061 10.2019.442 8.772 7.645 6.743 6.359 6.0115.410 4.909 Period 23 20 456 18.292 16.44414857 13.489 12.303 11 272 10.371 9.5808.8837.718 6.792 6.3996044 5.432 4.925 Period 24 21.24318.914 16.936 15.247 13.7991255011469 10.529 9.7078.9857.784 6.835 6.4346.0735.451 4937 Period 25 22.023 195231741315.622 14.094 12.783 11.654 10.675 9.8239.07778436.8736.464 6.097 5.467 4.948 Period 26 22.795 20.1211787715.983 14.375 13.003 11.828 10.810 9.929 9.1617.896 6.906 6.491 6.118 5.480 4.956 Period 27 23.560 20.70718-32716.33014643 13.211 11.987 10.935 10.027 9.237 7.943 6.935 6.514 6.1365.492 | 4.964 Period 28 24 316 21.28118.764 16.663 14.898 13.406 12.13711051 10.116 9.307 7.984 6.961 6.5346.1525.5024970 Period 29 25.066 21.844 19 188 16.984 15.141 13.591 12 278 11.158 10.1989.3708.022 6.9836.561 6.166 5510 4.975 Period 30 25 808 22 396 19.600 17.292 15.372 13.765 12.409 11.258 10 274 9.4278.0567.003 6.566 6.1775517 4.979 Period 40 32,835 27.355 23.115 19.793 17.159 15.046 13.332 11.925 10.7579.7798.244 7.105 6.642 6.233 5.548 4.997 Period 50 39.195 3142425730 21.482 18 256 15.762 13.801 12 233 10.962 9.915 8.304 7.133 6.661 6.246 5.5544999