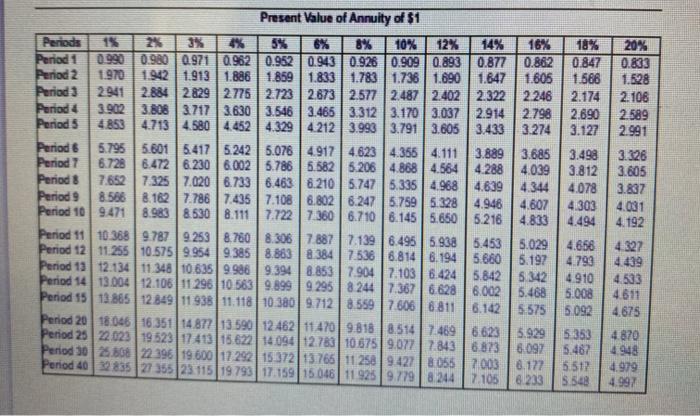

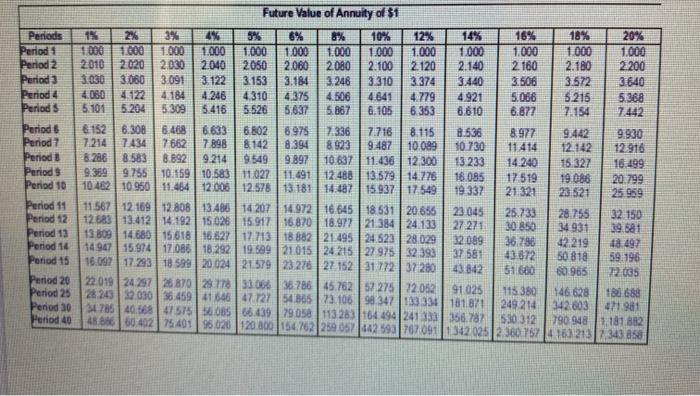

Use the NPV method to determine whether Vargas Products should invest in the following projects Project A costs $265,000 and offers seven annual net cash inflows of $60,000 Vargas Products requires an annual return of 12% on projects like Project 8 costs $395,000 and offers ton annual net cash inflows of $67,000 Vargas Products demands an annual return of 14% on investments of this nature (Click the icon to view the present value annuity table) (Click the icon to view the present value table (Click the icon to view the future value annuity table.) (Click the icon to view the future value table.) Requirement What is the NPV of each project? What is the maximum acceptable price to pay for each project? Calculate the NPV of each project. (Round your answers to the nearest whole dollar, Use parentheses or a minus sign for negative nut present values.) The NPV of Project Als The NPV of Project is Now calculate the maximum acceptable price to pay for each project (Round your answers to the nearest whole dollar) Project As Project BS Present Value of Annuity of $1 Periods 5% 6% 8% 10% 12% 14% 16% 18% Period 1 0.990 0.980 0.971 0.962 0.9520.943 0.928 0.909 0.893 0.877 0.882 0.847 Period 2 1.970 1.942 1.9131.886 1.859 1.833 | 1.783 1.736 1.690 1.847 1.605 1566 Period 3 2941 2.8842829 2775 2.723 2.673 2.577 2.487 2.4022.322 2.246 2.174 Period 4 3.902 3.808 3.717 3.630 3.546 3.465 3.312 3.170 3.037 2.914 | 2.798 2.690 Period 5 4853 4.713 4.580 4.452 4.329 4 212 3.993 3.791 3.605 3.433 3.274 3.127 Period 6 5.795 5.601 5.417 5.2425.076 | 4.917 4.623 4.356 4.111 3.889 3.685 3.498 Period 7 6.728 6.472 6.230 6.0025.786 5.582 5.20 4.868 4.564 4.288 4.039 3.812 Period 8 7.652 7.3257.020 6.733 6.463 6.210 5.7475.335 4.9684.639 4.344 4.078 Period 9 8566 8. 1627.786 7.435 7.108 6.8026.247 5.75953284.948 4.607 4.303 Period 10 9.471 8.983 8.530 8.111 7.722 7.360 6.710 6.145 5.6505.216 4.833 4.494 Period 1110.368 9.787 9253 8.760 8.306788771396.495 5938 5.4535.029 4.656 Period 12 11.255 10.575 99549.3858.8638.384 7.536 6.814 6.1945.660 5.197 4.793 Period 1312.13411.348 10.6359.986 9.3948.853 7.904 7.103 6.424 5.842 5.342 4910 Period 14 13.00412.1061129610 563 9.8999 2958 244 7,367 | 6.6286.002 5.468 5.008 Period 15 13.865128491193811.11810 380 9.712 8.559 7.606 6 811 6.142 5.575 5.092 Period 201804616 3511487713 590 12.46211470 9.818 8.5142.4696 623 5.9295353 Period 25 22.023 195231741315.6221409412.783 10 675 9.077 7.8436.8736.097 5.462 Period 30 25 808 22 396 19.600 17.292 15.372 13765 11258942780557.003 6.177 Period 4022835 27 355|2371519793 17.15915046 11 925 9 779 8 244 7.1056 233 5.548 5.517 20% 0.833 1.528 2106 2.589 2.991 3.326 3.605 3.837 4.031 4.192 4327 4.439 4.533 4.811 4.875 4.870 4948 4.979 4.997