Answered step by step

Verified Expert Solution

Question

1 Approved Answer

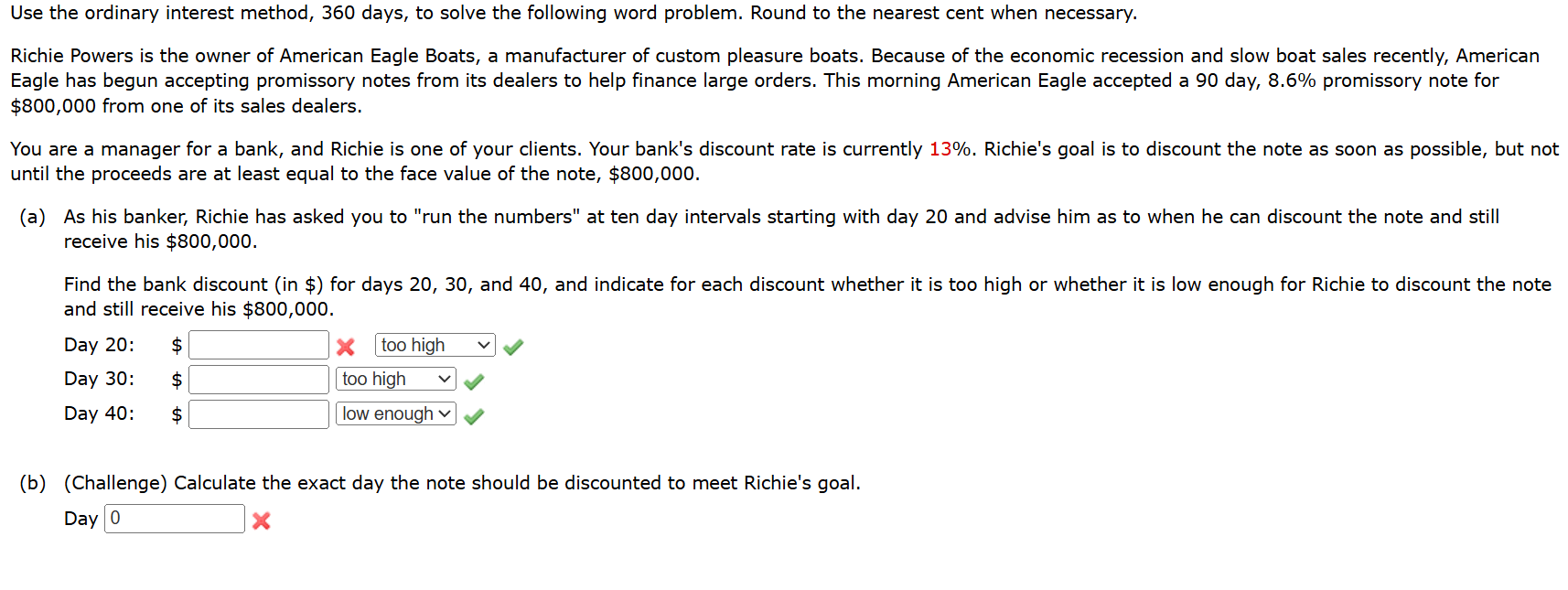

Use the ordinary interest method, 3 6 0 days, to solve the following word problem. Round to the nearest cent when necessary. Richie Powers is

Use the ordinary interest method, days, to solve the following word problem. Round to the nearest cent when necessary.

Richie Powers is the owner of American Eagle Boats, a manufacturer of custom pleasure boats. Because of the economic recession and slow boat sales recently, American

Eagle has begun accepting promissory notes from its dealers to help finance large orders. This morning American Eagle accepted a day, promissory note for

$ from one of its sales dealers.

You are a manager for a bank, and Richie is one of your clients. Your bank's discount rate is currently Richie's goal is to discount the note as soon as possible, but not

until the proceeds are at least equal to the face value of the note, $

a As his banker, Richie has asked you to "run the numbers" at ten day intervals starting with day and advise him as to when he can discount the note and still

receive his $

Find the bank discount in $ for days and and indicate for each discount whether it is too high or whether it is low enough for Richie to discount the note

and still receive his $

Day : $

Day : $

Day : $

too high

low enough

bChallenge Calculate the exact day the note should be discounted to meet Richie's goal.

Day

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started