Answered step by step

Verified Expert Solution

Question

1 Approved Answer

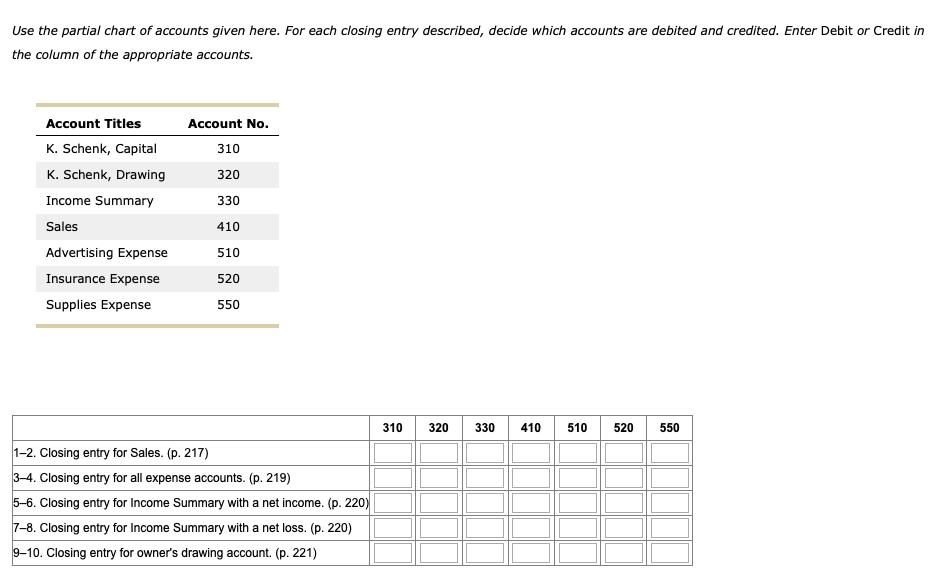

Use the partial chart of accounts given here. For each closing entry described, decide which accounts are debited and credited. Enter Debit or Credit

Use the partial chart of accounts given here. For each closing entry described, decide which accounts are debited and credited. Enter Debit or Credit in the column of the appropriate accounts. Account Titles Account No. K. Schenk, Capital 310 K. Schenk, Drawing 320 Income Summary 330 Sales 410 Advertising Expense 510 Insurance Expense 520 Supplies Expense 550 310 320 330 410 510 520 550 1-2. Closing entry for Sales. (p. 217) 3-4. Closing entry for all expense accounts. (p. 219) 5-6. Closing entry for Income Summary with a net income. (p. 220) 7-8. Closing entry for Income Summary with a net loss. (p. 220) 9-10. Closing entry for owner's drawing account. (p. 221) Use the partial chart of accounts given here. For each closing entry described, decide which accounts are debited and credited. Enter Debit or Credit in the column of the appropriate accounts. Account Titles Account No. K. Schenk, Capital 310 K. Schenk, Drawing 320 Income Summary 330 Sales 410 Advertising Expense 510 Insurance Expense 520 Supplies Expense 550 310 320 330 410 510 520 550 1-2. Closing entry for Sales. (p. 217) 3-4. Closing entry for all expense accounts. (p. 219) 5-6. Closing entry for Income Summary with a net income. (p. 220) 7-8. Closing entry for Income Summary with a net loss. (p. 220) 9-10. Closing entry for owner's drawing account. (p. 221) Use the partial chart of accounts given here. For each closing entry described, decide which accounts are debited and credited. Enter Debit or Credit in the column of the appropriate accounts. Account Titles Account No. K. Schenk, Capital 310 K. Schenk, Drawing 320 Income Summary 330 Sales 410 Advertising Expense 510 Insurance Expense 520 Supplies Expense 550 310 320 330 410 510 520 550 1-2. Closing entry for Sales. (p. 217) 3-4. Closing entry for all expense accounts. (p. 219) 5-6. Closing entry for Income Summary with a net income. (p. 220) 7-8. Closing entry for Income Summary with a net loss. (p. 220) 9-10. Closing entry for owner's drawing account. (p. 221)

Step by Step Solution

★★★★★

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Closing entry for Sales Income Summary 330 is Credited a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started