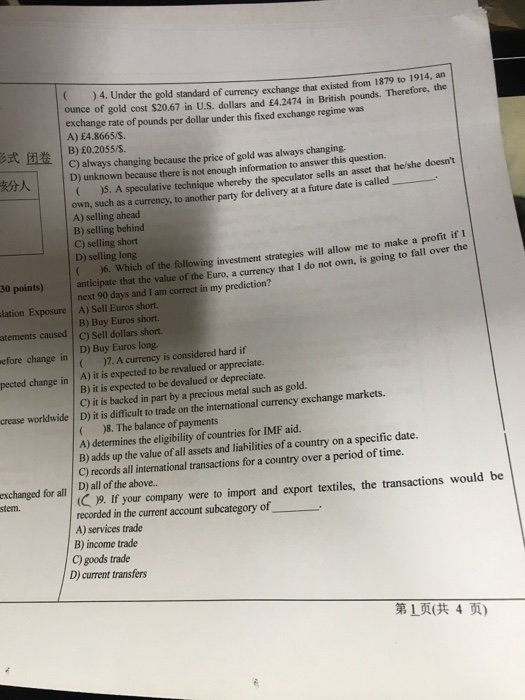

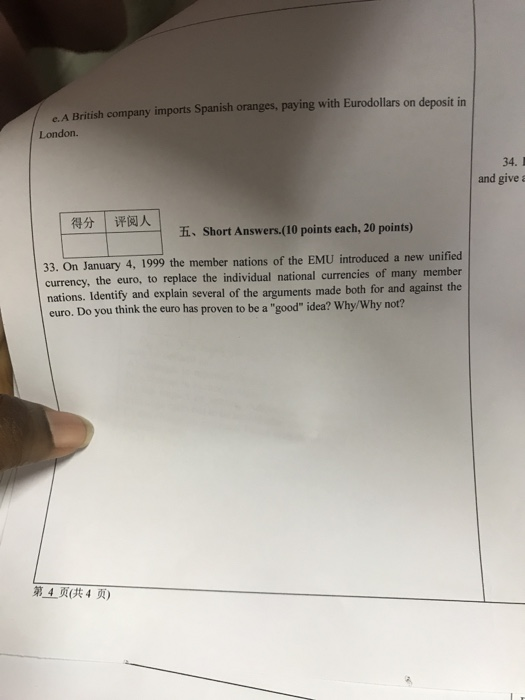

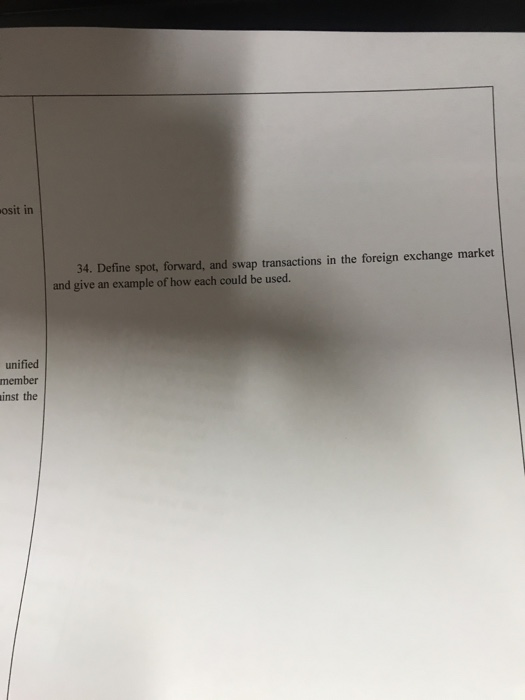

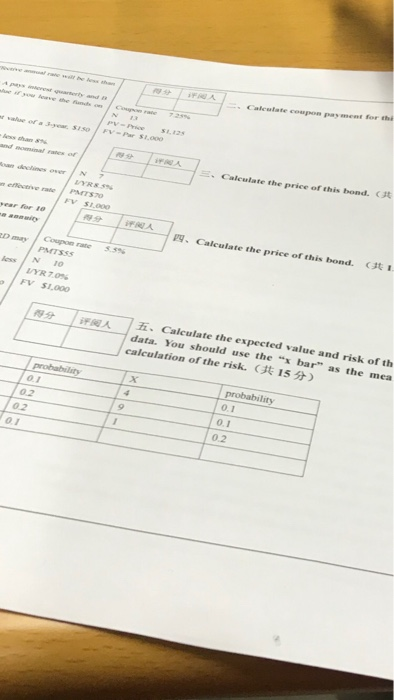

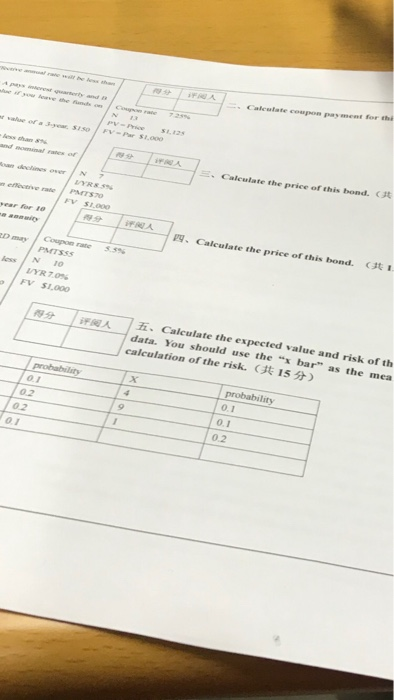

use the price of information.culator sells sate is calle old was always cower this questi ghat he/she C ) 4. Under the gold standard of currency exchange that existed from 1879 to sted from 1879 to 1914, an ounce of gold cost $ unce of gold cost $20.67 in U.S. dollars and 4.2474 in British pounds. Therefore, the exchange rate of pounds per dollar under this fixed exchange regime was A) 4.8665/$. B) 0.2055/S. C) always changing because the price of gold was always changing. D) unknown because there is not enough information to answer this question. 5. A speculative technique whereby the speculator sells an asset that he/she doesn't own, such as a currency, to another party for delivery at a future date is called A) selling ahead B) selling behind C) selling short D) selling long 6. Which of the following investment strategies will allow me to make a profit 30 points) anticipate that the value of the Euro, a currency that I do not own, is going to fall over the next 90 days and I am correct in my prediction? slation Exposure A) Sell Euros short. B) Buy Euros short. atements caused C) Sell dollars short. nefore change in D) Buy Euros long. ( 7. A currency is considered hard if pected change in A) it is expected to be revalued or appreciate. B) it is expected to be devalued or depreciate. C) it is backed in part by a precious metal such as gold. crease worldwide D) it is difficult to trade on the international currency exchange markets. 18. The balance of payments A) determines the eligibility of countries for IMF aid. B) adds up the value of all assets and liabilities of a country on a specific date. C) records all international transactions for a country over a period of time. exchanged for all D) all of the above.. stem. ( 19. If your company were to import and export textiles, the transactions would be recorded in the current account subcategory of A) services trade B) income trade C) goods trade D) current transfers #1 1 4 01) A British company imports Spanish oranges, paying with Eurodollars on deposit in London. 34. and give | fi.. Short Answers (10 points each, 20 points) 33. On January 4, 1999 the member nations of the EMU introduced a new unified currency, the euro, to replace the individual national currencies of many member nations. Identify and explain several of the arguments made both for and against the euro. Do you think the euro has proven to be a "good" idea? Why/Why not? 324 ( 4 ) nosit in 34. Define spot, forward, and swap transactions in the foreign exchange market and give an example of how each could be used. unified member ainst the of a SIF- the price of this bond. Ct fro 19. Calculate the price of this bond. Couporn PATS IN 10 LYR70 FV 1.000 I 7. Calculate the expected value and risk of th data. You should use the "x bar" as the mea calculation of the risk. Cht 15 ) probability O