Answered step by step

Verified Expert Solution

Question

1 Approved Answer

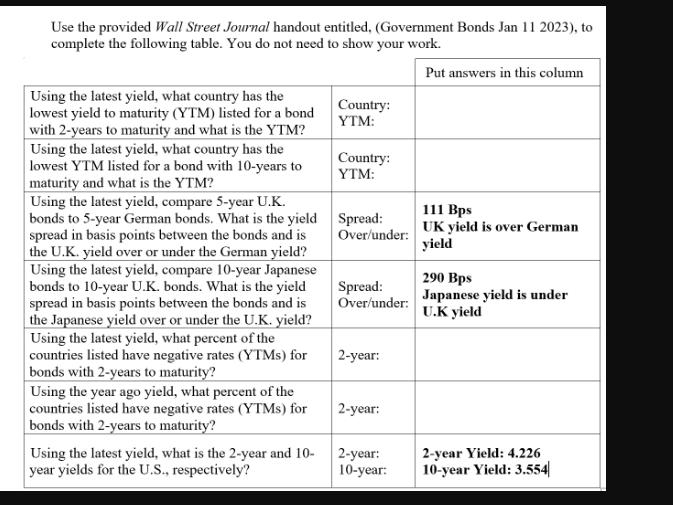

Use the provided Wall Street Journal handout entitled, (Government Bonds Jan 11 2023), to complete the following table. You do not need to show

Use the provided Wall Street Journal handout entitled, (Government Bonds Jan 11 2023), to complete the following table. You do not need to show your work. Put answers in this column Using the latest yield, what country has the lowest yield to maturity (YTM) listed for a bond with 2-years to maturity and what is the YTM? Using the latest yield, what country has the lowest YTM listed for a bond with 10-years to maturity and what is the YTM? Using the latest yield, compare 5-year U.K. bonds to 5-year German bonds. What is the yield spread in basis points between the bonds and is the U.K. yield over or under the German yield? Using the latest yield, compare 10-year Japanese bonds to 10-year U.K. bonds. What is the yield spread in basis points between the bonds and is the Japanese yield over or under the U.K. yield? Using the latest yield, what percent of the countries listed have negative rates (YTMs) for bonds with 2-years to maturity? Using the year ago yield, what percent of the countries listed have negative rates (YTMs) for bonds with 2-years to maturity? Using the latest yield, what is the 2-year and 10- year yields for the U.S., respectively? Country: YTM: Country: YTM: Spread: Over/under: Spread: Over/under: 2-year: 2-year: 2-year: 10-year: 111 Bps UK yield is over German yield 290 Bps Japanese yield is under U.K yield 2-year Yield: 4.226 10-year Yield: 3.554 session. COUPON COUNTRY/MATURITY, (%) IN YEARS 0.250 Australia 2.750 1.750 0.500 0.000 0.350 0.000 France 0.750 2.000 2.200 Germany 1.300 1.700 2.500 Italy 2.650 2.500 0.005 0.100 0.500 2.000 Netherlands 0.750 0.500 5.650 Portugal 0.700 1.650 0.000 Spain 0.800 2.550 2.500 Sweden 0.750 1.750 0.125 U.K. 0.375 4.250 Belgium Japan 4.250 U.S. 3.875 4.125 2 5 10 2 5 10 2 5 10 2 5 10 2 5 10 2 5 10 2 5 10 2 5 10 2 5 10 2 5 10 2 5 10 2 5 10 LATEST 3.279 3.467 3.733 2.635 2.523 2.754 2.728 2.536 2.671 2.590 2.226 2.174 2.972 3.504 4.041 0.026 0.234 0.506 2.639 2.421 2.476 2.690 2.651 3.103 2.849 2.834 3.209 2.450 2.062 1.929 3.503 A 3.335 3.409 4.226 3.668 3.554 Sources: Tullett Prebon, Tradeweb ICE U.S. Treasury Close https://www.wsj.com/market-data/bonds/governmentbonds YIELD (%) PREVIOUS 3.279 3.454 3.733 2.699 2.630 2.892 2.775 2.635 2.805 2.653 2.345 2.311 3.048 3.623 4.205 0.035 0.235 0.512 2.645 2.509 2.608 2.749 2.772 3.247 2.875 2.920 3.329 2.581 2.224 2.086 3.448 3.465 3.562 4.258 3.732 3.618 MONTH AGO 3.048 3.121 3.303 2.224 2.238 2.523 2.166 2.219 2.394 2.153 1.950 1.932 2.646 3.263 3.802 -0.014 0.122 0.256 2.140 2.054 2.200 2.239 2.303 2.850 2.415 2.493 2.937 2.344 1.874 1.693 3.415 3.257 3.183 4.328 3.756 3.567 YEAR AGO 0.698 1.478 1.886 -0.621 -0.277 0.288 -0.639 -0.160 0.297 -0.574 -0.352 -0.024 -0.067 0.502 1.308 -0.076 -0.026 0.155 -0.652 -0.336 0.070 -0.564 -0.150 0.603 -0.498 -0.062 0.668 -0.140 0.246 0.420 0.842 1.009 1.174 0.897 1.506 1.745 SPREAD UNDER/OVER U.S TREASURYS, IN BASIS POINTS LATEST -95.8 -20.5 17.6 -160.2 -114.9 -80.3 -150.9 -113.6 -88.6 -164.7 -144.6 -138.3 -126.5 -16.8 48.4 -421.1 -343.8 -305.1 -159.8 -125.1 -108.1 -154.7 -102.1 -45.4 -138.7 -83.7 -34.8 -178.7 -161.0 -162.7 -73.3 -33.6 -14.8 YEAR AGO -18.9 -2.5 14.4 -150.8 -177.9 -145.4 -152.6 -166.2 -144.5 -146.0 -185.4 -176.6 -95.3 -100.1 -43.4 -96.2 -152.8 -158.7 -153.8 -183.8 -167.2 -145.1 -165.2 -113.9 -138.4 -156.4 -107.4 -102.6 -125.6 -132.2 -4.5 -49.3 -56.8 1/2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

ANSWER Using the latest yield what country has the lowest yield to maturity YTM listed for a bond wi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started