Answered step by step

Verified Expert Solution

Question

1 Approved Answer

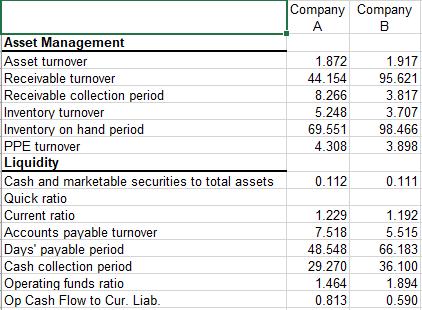

Use the ratios calculated below for Company A and Company B to answer the following questions. According to the Cash Collection Period, which Company

Use the ratios calculated below for Company A and Company B to answer the following questions.

According to the Cash Collection Period, which Company is more liquid?

Which Company sells their inventory more quickly?

Which Company collects their receivables more quickly?

Which Company pays their suppliers more quickly?

Asset Management Asset turnover Receivable turnover Receivable collection period Inventory turnover Inventory on hand period PPE turnover Liquidity Cash and marketable securities to total assets Quick ratio Current ratio Accounts payable turnover Days' payable period Cash collection period Operating funds ratio Op Cash Flow to Cur. Liab. Company Company A B 1.872 1.917 44.154 95.621 8.266 3.817 5.248 3.707 69.551 98.466 4.308 3.898 0.112 1.229 7.518 48.548 29.270 1.464 0.813 0.111 1.192 5.515 66.183 36.100 1.894 0.590

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Company B appears to be more liquid than Company A in terms of the Cash Collection Period This is be...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started