Answered step by step

Verified Expert Solution

Question

1 Approved Answer

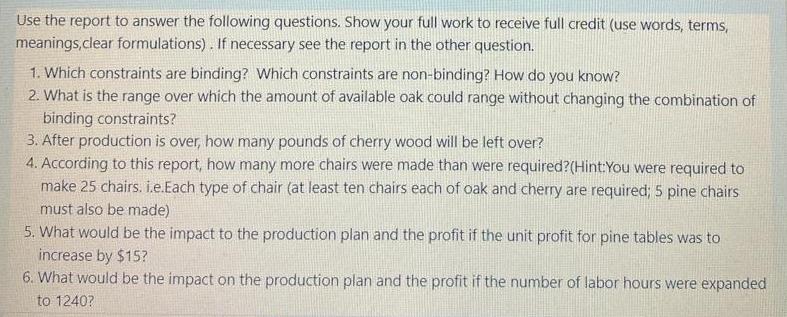

Use the report to answer the following questions. Show your full work to receive full credit (use words, terms, meanings,clear formulations). If necessary see

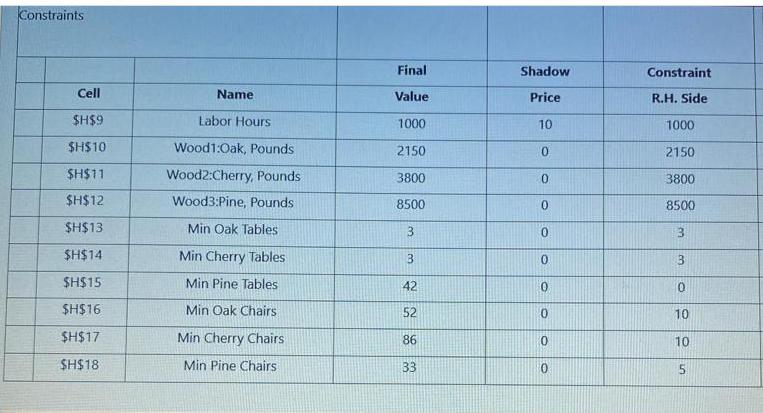

Use the report to answer the following questions. Show your full work to receive full credit (use words, terms, meanings,clear formulations). If necessary see the report in the other question. 1. Which constraints are binding? Which constraints are non-binding? How do you know? 2. What is the range over which the amount of available oak could range without changing the combination of binding constraints? 3. After production is over, how many pounds of cherry wood will be left over? 4. According to this report, how many more chairs were made than were required?(Hint:You were required to make 25 chairs. i.e.Each type of chair (at least ten chairs each of oak and cherry are required; 5 pine chairs must also be made) 5. What would be the impact to the production plan and the profit if the unit profit for pine tables was to increase by $15? 6. What would be the impact on the production plan and the profit if the number of labor hours were expanded to 1240? Constraints Cell $H$9 $H$10 $H$11 $H$12 $H$13 $H$14 $H$15 $H$16 $H$17 $H$18 Name Labor Hours Wood1:Oak, Pounds Wood2:Cherry, Pounds Wood3:Pine, Pounds Min Oak Tables Min Cherry Tables Min Pine Tables Min Oak Chairs Min Cherry Chairs Min Pine Chairs Final Value 1000 2150 3800 8500 3 3 42 52 86 33 Shadow Price 10 0 0 0 0 0 0 0 0 0 Constraint R.H. Side 1000 2150 3800 8500 3 3 0 10 10 5

Step by Step Solution

★★★★★

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started