Answered step by step

Verified Expert Solution

Question

1 Approved Answer

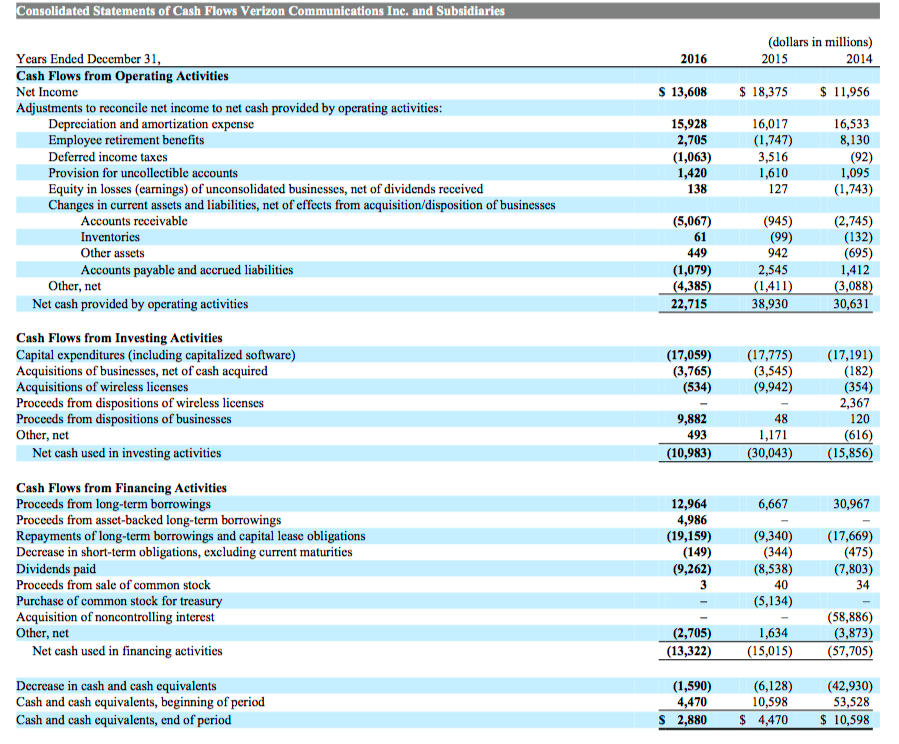

Use the statement of Cash Flow below from Verizon. Then in the post, tell me very briefly, if this company is in good or bad

Use the statement of Cash Flow below from Verizon. Then in the post, tell me very briefly, if this company is in good or bad financial condition. Please try and just use the cash flow statement. Point to at least two items on the statement that help you make that determination (the article might help).

onsolidated Statements of Cash Flows Verizon Communications Inc. and Subsidiaries (dollars in millions) 2015 Years Ended December 31 Cash Flows from Operating Activities Net Income Adjustments to reconcile net income to net cash provided by operating activities: 2016 S 13,608 18,375 $ 11,956 Depreciation and amortization expense Employee retirement benefits Deferred income taxes Provision for uncollectible accounts Equity in losses (earnings) of unconsolidated businesses, net of dividends received Changes in current assets and liabilities, net of effects from acquisition/disposition of businesses 15,928 2,705 (1,063) 1,420 138 6,017 (1,747) 3,516 16,533 8,130 (92) 1,095 (1,743) Accounts receivable Inventories Other assets Accounts payable and accrued liabilities 127 (945) 942 (2,745) 61 449 (1,079) (695) 088) 30,631 Other, net Net cash provided by operating activities 22,715 38,930 Cash Flows from Investing Activities Capital expenditures (including capitalized software) Acquisitions of businesses, net of cash acquired Acquisitions of wireless licenses Proceeds from dispositions of wireless licenses Proceeds from dispositions of businesses Other, net (17,059) (3,765) (17,775) (17,191) (3,545) (9,942) (354) 2,367 120 9,882 493 (10,983) Net cash used in investing activities (30,043 (15,856 Cash Flows from Financing Activities Proceeds from long-term borrowings Proceeds from asset-backed long-term borrowings Repayments of long-term borrowings and capital lease obligations Decrease in short-term obligations, excluding current maturities Dividends paid Proceeds from sale of common stock Purchase of common stock for treasury Acquisition of noncontrolling interest Other, net 12,964 4,986 (19,159) 6,667 30,967 (9,340) (17,669) (475) (7,803) (8,538) 40 (5,134) (9,262) (58,886) Net cash used in financing activities (13,322) (15,015) 57,705) Decrease in cash and cash equivalents Cash and cash equivalents, beginning of period Cash and cash equivalents, end of period (1,590) 4,470 (6,128) (42,930) 53,528 4,470 $ 10,598 10,598 S 2,880Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started