Answered step by step

Verified Expert Solution

Question

1 Approved Answer

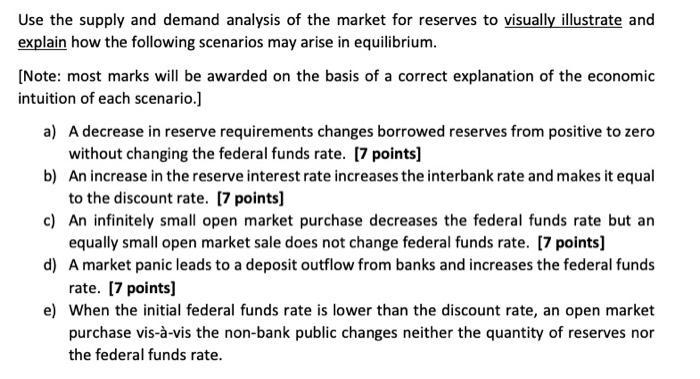

Use the supply and demand analysis of the market for reserves to visually illustrate and explain how the following scenarios may arise in equilibrium.

Use the supply and demand analysis of the market for reserves to visually illustrate and explain how the following scenarios may arise in equilibrium. [Note: most marks will be awarded on the basis of a correct explanation of the economic intuition of each scenario.] a) A decrease in reserve requirements changes borrowed reserves from positive to zero without changing the federal funds rate. [7 points] b) An increase in the reserve interest rate increases the interbank rate and makes it equal to the discount rate. [7 points] c) An infinitely small open market purchase decreases the federal funds rate but an equally small open market sale does not change federal funds rate. [7 points] d) A market panic leads to a deposit outflow from banks and increases the federal funds rate. [7 points] e) When the initial federal funds rate is lower than the discount rate, an open market purchase vis--vis the non-bank public changes neither the quantity of reserves nor the federal funds rate.

Step by Step Solution

★★★★★

3.37 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

a A decrease in reserve requirements changes borrowed reserves from positive to zero without changing the federal funds rate In the market for reserves a decrease in reserve requirements means that ba...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started