Answered step by step

Verified Expert Solution

Question

1 Approved Answer

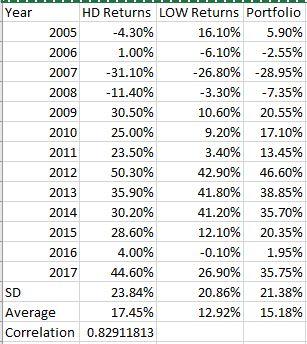

Use the table below for Home Depot (HD) and Lowes (LOW) to create an Excel spreadsheet that calculates the average returns for portfolios that comprise

| Use the table below for Home Depot (HD) and Lowes (LOW) to create an Excel spreadsheet that calculates the average returns for portfolios that comprise HD and LOW using the following, respective, weightings: (1.0, 0.0), (0.9, 0.1), (0.8, 0.2), (0.7, 0.3), (0.6, 0.4), (0.5, 0.5), (0.4, 0.6), (0.3, 0.7), (0.2, 0.8), (0.1, 0.9), and (0.0, 1.0). Also, calculate the standard deviation associated for each portfolio. |

Year HD Returns LOW Returns Portfolio 2005 -4.30% 16.10% 5.90% 2006 1.00% -6.10% -2.55% 2007 -31.10% -26.80% -28.95% 2008 -11.40% -3.30% -7.35% 2009 30.50% 10.60% 20.55% 2010 25.00% 17.10% 9.20% 3.40% 2011 23.50% 13.45% 2012 50.30% 42.90% 46.60% 2013 35.90% 41.80% 38.85% 2014 30.20% 41.20% 35.70% 2015 28.60% 12.10% 20.35% 2016 4.00% -0.10% 1.95% 2017 44.60% 26.90% 35.75% SD 23.84% 20.86% 21.38% 12.92% 15.18% Average 17.45% Correlation 0.82911813 Year HD Returns LOW Returns Portfolio 2005 -4.30% 16.10% 5.90% 2006 1.00% -6.10% -2.55% 2007 -31.10% -26.80% -28.95% 2008 -11.40% -3.30% -7.35% 2009 30.50% 10.60% 20.55% 2010 25.00% 17.10% 9.20% 3.40% 2011 23.50% 13.45% 2012 50.30% 42.90% 46.60% 2013 35.90% 41.80% 38.85% 2014 30.20% 41.20% 35.70% 2015 28.60% 12.10% 20.35% 2016 4.00% -0.10% 1.95% 2017 44.60% 26.90% 35.75% SD 23.84% 20.86% 21.38% 12.92% 15.18% Average 17.45% Correlation 0.82911813

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started