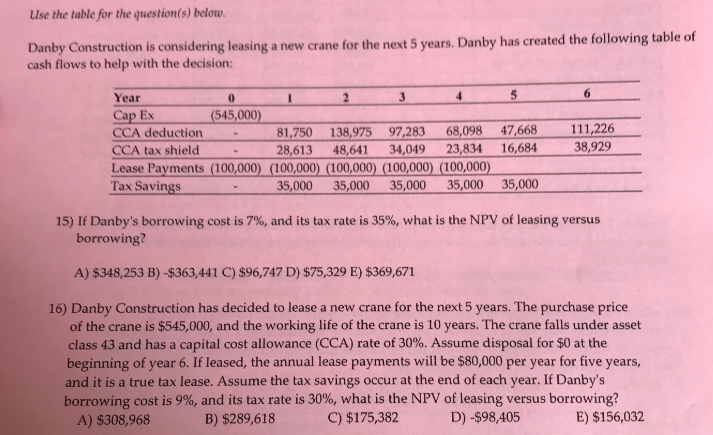

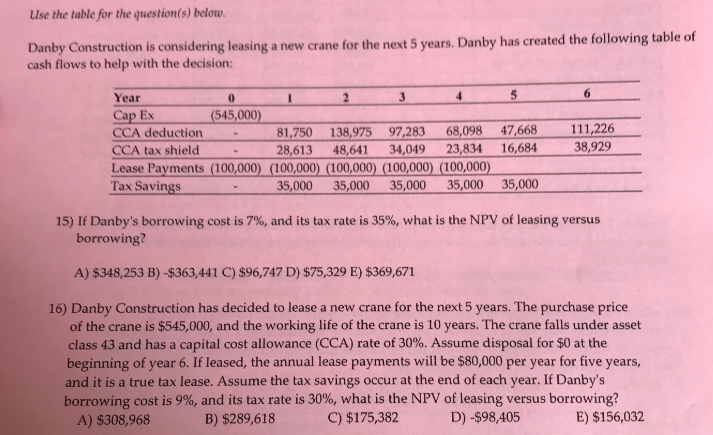

Use the table for the questionts) below table of Danby Construction is considering leasing a new crane for the next 5 years. Danby has created the following cash flows to help with the decision: Year Cap Ex CCA deduction 545,000) 81.750 138,975 97,.283 68,098 47.668 111.226 38,929 A tax shield28,613 48,641 34,049 23,834 16,684 Lease Payments (100,000) (100, Tax Savings 100,000) (100,000) (100,000 35,000 35,000 35,000 35,000 35,000 15) If Danby's borrowing cost is 7%, and its tax rate is 35%, what is the NPV of leasing versus borrowing A) $348,253 B)-$363,441 C) $96,747 D) $75,329 E) 5369,671 16) Danby Construction has decided to lease a new crane for the next 5 years. The purchase price of the crane is $545,000, and the working life of the crane is 10 years. The crane falls under asset class 43 and has a capital cost allowance (CCA) rate of 30%. Assume disposal for $0 at the beginning of year 6. If leased, the annual lease payments will be $80,000 per year for five years, and it is a true tax lease. Assume the tax savings occur at the end of each year. If Danby's borrowing cost is 996, and its tax rate is 30%, what is the NPV of leasing versus borrowing? A) $308,968 B) $289,618C) $175,382 D)-$98,405 E) $156,032 Use the table for the questionts) below table of Danby Construction is considering leasing a new crane for the next 5 years. Danby has created the following cash flows to help with the decision: Year Cap Ex CCA deduction 545,000) 81.750 138,975 97,.283 68,098 47.668 111.226 38,929 A tax shield28,613 48,641 34,049 23,834 16,684 Lease Payments (100,000) (100, Tax Savings 100,000) (100,000) (100,000 35,000 35,000 35,000 35,000 35,000 15) If Danby's borrowing cost is 7%, and its tax rate is 35%, what is the NPV of leasing versus borrowing A) $348,253 B)-$363,441 C) $96,747 D) $75,329 E) 5369,671 16) Danby Construction has decided to lease a new crane for the next 5 years. The purchase price of the crane is $545,000, and the working life of the crane is 10 years. The crane falls under asset class 43 and has a capital cost allowance (CCA) rate of 30%. Assume disposal for $0 at the beginning of year 6. If leased, the annual lease payments will be $80,000 per year for five years, and it is a true tax lease. Assume the tax savings occur at the end of each year. If Danby's borrowing cost is 996, and its tax rate is 30%, what is the NPV of leasing versus borrowing? A) $308,968 B) $289,618C) $175,382 D)-$98,405 E) $156,032