Question

Use the table in the popup window, LOADING... , to answer the problem. Genedak-Hogan (G-H) is an American conglomerate that is actively debating the impacts

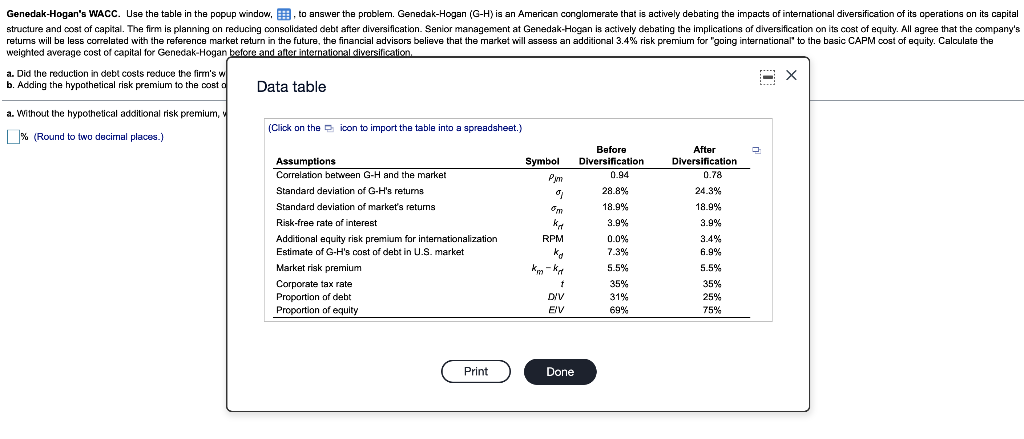

Use the table in the popup window, LOADING... , to answer the problem. Genedak-Hogan (G-H) is an American conglomerate that is actively debating the impacts of international diversification of its operations on its capital structure and cost of capital. The firm is planning on reducing consolidated debt after diversification. Senior management at Genedak-Hogan is actively debating the implications of diversification on its cost of equity. All agree that the company's returns will be less correlated with the reference market return, in the future, the financial the financial advisors believe that the market will assess an additional 3.4% risk premium for "going international" to the basic CAPM cost of equity. Calculate the weighted average cost of.

a. Did the reduction in debt costs reduce the firm's weighted average cost of capital? How would you describe the impact of international diversification on its costs of capital?

b. Adding the hypothetical risk premium to the cost of equity (an added 3.4% to the cost of equity because of international diversification), what is the firm's WACC?

Genedak-Hogan's WACC. Use the table in the popup window, B, to answer the problem. Genedak-Hogan (G-H) is an American conglomerate that is actively debating the impacts of international diversification of its operations on its capital structure and cost of capital. The firm is planning on reducing consolidated debt after diversification. Senior management at Genedak-Hogan is actively debating the implications of diversification on its cost of equity. All agree that the company's retums will be less correlated with the reference market return in the future, the financial advisors believe that the market will assess an additional 3.4% risk premium for "going international to the basic CAPM cost of equity. Calculate the weighted average cost of capital for Genedak-Hogan before and after international diversification a. Did the reduction in debt costs reduce the firm's w X b. Adding the hypothetical risk premium to the cost o Data table a. Without the hypothetical additional risk premium, % (Round to two decimal places.) (Click on the icon to import the table into a spreadsheet.) Symbol Before Diversification 0.94 28.8% After Diversification 0.78 om Assumptions Correlation between G-H and the market Standard deviation of G-H's retums Standard deviation of market's returns Risk-free rate of interest Additional equity risk premium for intemationalization Estimate of G-H's cost of debt in U.S. market Market risk premium Corporate tax rate Proportion of debt Proportion of equity KA RPM ko km-kr 1 DIV EV 18.9% 3.9% 0.0% 7.3% 5.5% 35% 31% 69% 24.3% 18.9% 3.9% 3.4% 6.9% 5.5% 35% 25% 75% Print Done Genedak-Hogan's WACC. Use the table in the popup window, B, to answer the problem. Genedak-Hogan (G-H) is an American conglomerate that is actively debating the impacts of international diversification of its operations on its capital structure and cost of capital. The firm is planning on reducing consolidated debt after diversification. Senior management at Genedak-Hogan is actively debating the implications of diversification on its cost of equity. All agree that the company's retums will be less correlated with the reference market return in the future, the financial advisors believe that the market will assess an additional 3.4% risk premium for "going international to the basic CAPM cost of equity. Calculate the weighted average cost of capital for Genedak-Hogan before and after international diversification a. Did the reduction in debt costs reduce the firm's w X b. Adding the hypothetical risk premium to the cost o Data table a. Without the hypothetical additional risk premium, % (Round to two decimal places.) (Click on the icon to import the table into a spreadsheet.) Symbol Before Diversification 0.94 28.8% After Diversification 0.78 om Assumptions Correlation between G-H and the market Standard deviation of G-H's retums Standard deviation of market's returns Risk-free rate of interest Additional equity risk premium for intemationalization Estimate of G-H's cost of debt in U.S. market Market risk premium Corporate tax rate Proportion of debt Proportion of equity KA RPM ko km-kr 1 DIV EV 18.9% 3.9% 0.0% 7.3% 5.5% 35% 31% 69% 24.3% 18.9% 3.9% 3.4% 6.9% 5.5% 35% 25% 75% Print DoneStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started