Answered step by step

Verified Expert Solution

Question

1 Approved Answer

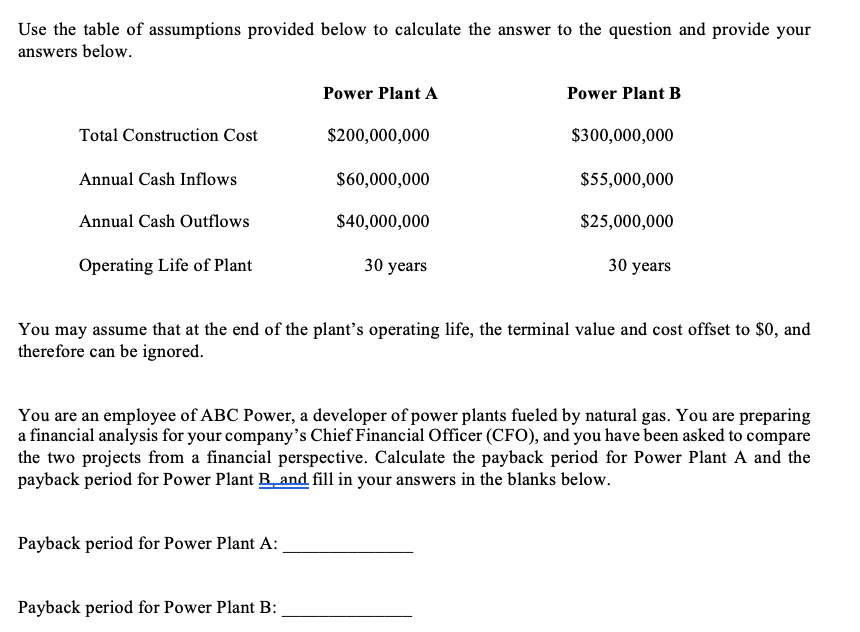

Use the table of assumptions provided below to calculate the answer to the question and provide your answers below. Power Plant A Power Plant

Use the table of assumptions provided below to calculate the answer to the question and provide your answers below. Power Plant A Power Plant B Total Construction Cost $200,000,000 $300,000,000 Annual Cash Inflows $60,000,000 $55,000,000 Annual Cash Outflows $40,000,000 $25,000,000 Operating Life of Plant 30 years 30 years You may assume that at the end of the plant's operating life, the terminal value and cost offset to $0, and therefore can be ignored. You are an employee of ABC Power, a developer of power plants fueled by natural gas. You are preparing a financial analysis for your company's Chief Financial Officer (CFO), and you have been asked to compare the two projects from a financial perspective. Calculate the payback period for Power Plant A and the payback period for Power Plant B and fill in your answers in the blanks below. Payback period for Power Plant A: Payback period for Power Plant B:

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Answer Payback Period of Power Plant A 10 years Payback Period of Power Plant B 10 years We know tha...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started