Question

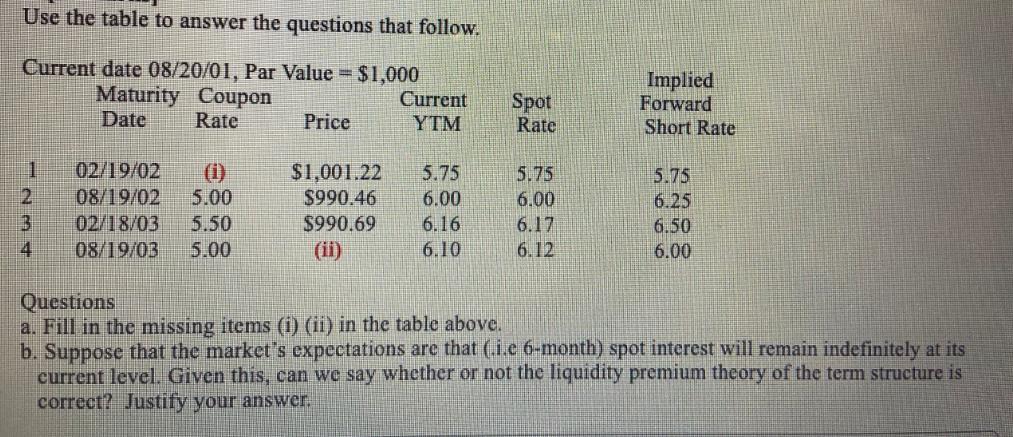

Use the table to answer the questions that follow. Current date 08/20/01, Par Value = $1,000 Maturity Coupon Date Rate 02/19/02 2 08/19/02 5.00

Use the table to answer the questions that follow. Current date 08/20/01, Par Value = $1,000 Maturity Coupon Date Rate 02/19/02 2 08/19/02 5.00 3 02/18/03 5.50 4 08/19/03 5.00 1 Price $1,001,22 $990.46 $990.69 (ii) Current YTM 5.75 6.00 6.16 6.10 Spot Rate 5.75 6.00 6.17 6.12 Implied Forward Short Rate 5.75 6.25 6.50 6.00 Questions a. Fill in the missing items (i) (ii) in the table above. b. Suppose that the market's expectations are that (.i.e 6-month) spot interest will remain indefinitely at its current level. Given this, can we say whether or not the liquidity premium theory of the term structure is correct? Justify your answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer a Missing item i Maturity Date 081902 Coupon Rate 500 Current YTM 600 Missing item ii Coupon ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Taxes And Business Strategy A Planning Approach

Authors: Myron Scholes, Mark Wolfson, Merle Erickson, Michelle Hanlon

5th Edition

132752670, 978-0132752671

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App