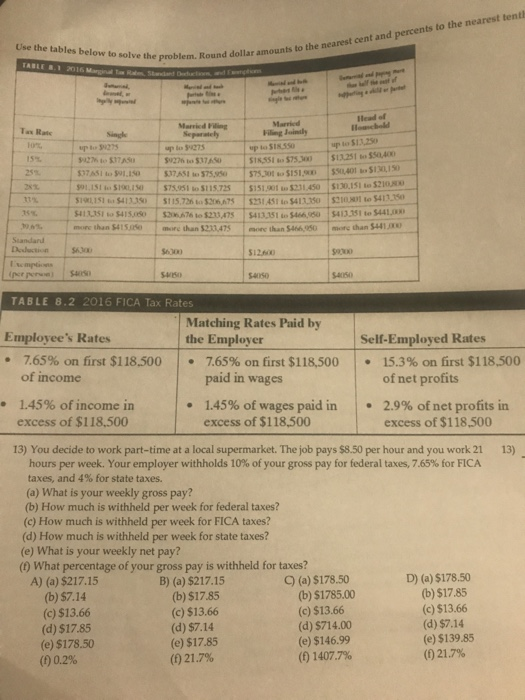

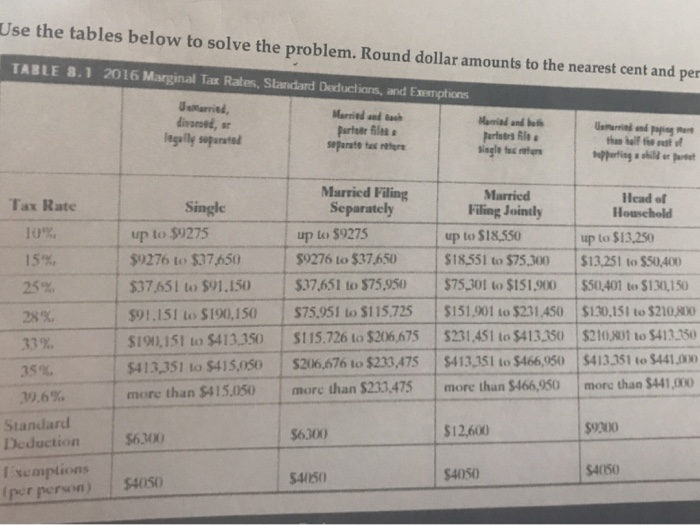

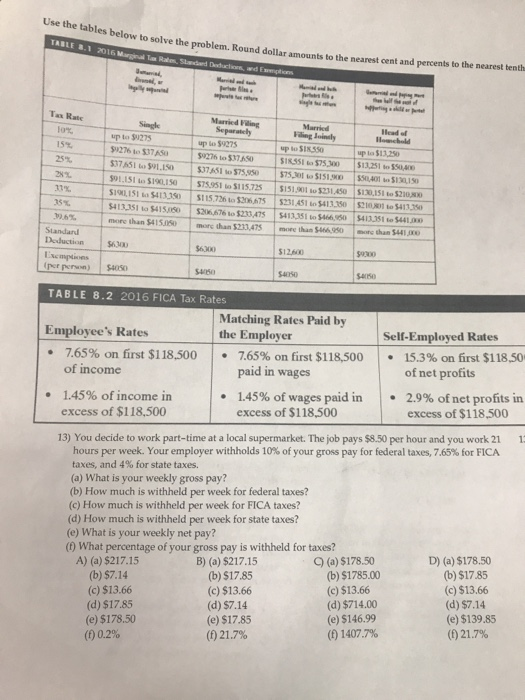

Use the tables below to solve the problem. Round dollar amounts to the nearest cent and percents to the nearest tenth TABLE 31 2016 M artha Tax Rats up SIRSSO up to IAS $37 AST to 10 $91.1ST S INI $191,151 412 SIST 4150 more than $4150 Marding Married Sepanely 4275 up to 20 S 17A SIKSI 575.00 $125 $50,400 307 AS 575 575 SISIE S 01 SIM150 57051 SIIS 72 151 11450 $130,151 210 S115. 7 267 11 451 411 to 541120 7612145411. 151 4 11.151 to $441,000 methan $211.47 has so more than $410 Standard SA SO TABLE 8.2 2016 FICA Tax Rates Matching Rates Paid by Employee's Rates the Employer Self-Employed Rates 7.65% on first $118.500 7.65% on first $118,500 15.3% on first $118,500 of income paid in wages of net profits 1.45% of income in 1.45% of wages paid in 2.9% of net profits in excess of $118.500 excess of $118,500 excess of $118.500 13) You decide to work part-time at a local supermarket. The job pays $8.50 per hour and you work 21 13) hours per week. Your employer withholds 10% of your gross pay for federal taxes, 7.65% for FICA taxes, and 4% for state taxes. (a) What is your weekly gross pay? (b) How much is withheld per week for federal taxes? (C) How much is withheld per week for FICA taxes? (d) How much is withheld per week for state taxes? (e) What is your weekly net pay? (1) What percentage of your gross pay is withheld for taxes? A) (a) $217.15 B) (a) $217.15 (a) $178.50 D) (a) $178.50 (b) $7.14 (b) $17.85 (b) $1785.00 (b) $17.85 (c) $13.66 (c) $13.66 (c) $13.66 (c) $13.66 (d) $17.85 (d) $7.14 (d) $714.00 (d) $7.14 (e) $178.50 (e) $17.85 (e) $146.99 (e) $139.85 (1) 0.2% (1) 21.7% (1) 1407.7% (1) 21.7% Use the tables below to solve the problem. Round dollar amounts to the nearest cent and per TABLE 8.1 2016 Marginal Tax Rates, Standard Decluctions, and Exemptions orid, Married and Back divorced, Parter files legally separated separate texture Married and late partes fils. Single to return Us then all the supporting skill or partiet Tax Rate 10% 15% 25% Single up to $9275 $9276 to $37,650 $37,651 to $91.150 $91.151 to $190,150 $190.151 to $413.350 $413,351 to $415,050 more than $$15.050 Married Filing Separately up to $9275 $9276 to $37,650 $37,651 to $75,950 $75.951 to $115.725 SU15.726 to $206,675 $206,676 to $233,475 more than $233.475 Married Filing Jointly up to $18,550 $18,551 to $75,300 $75,301 to $151,900 5151,901 to $231,450 5231,451 to $413,350 5413,351 to $466,950 more than $466,950 Head of Household up to $13,250 $13,251 to $50,400 $50,401 to $130,150 $130,151 to $210.800 $210,801 to $413.350 $413.351 to $441,000 more than $441,000 28% 35% 39.6% Standard Deduction I'xemptions per person $6.300 $6300 $9300 $12,600 $4050 $4050 $4150 $4050 Use the tables below to solve the problem TABLE 3.1 2016 M . Sad Deductions, w to solve the problem. Round dollar amounts to the nearest cent and percents to the nearest tenth com Tax 1975 15 26 A 5171 SESSO SILISIS190 4 51 415 Murid Merd Seperty up 275 wp SS SS 11 STAO SSSSSSSSS SUTASIN S15 S15 S US 1156151 S115 S e 4111 Standland Dust SA $120 som SAMO TABLE 8.2 2016 FICA Tax Rates Matching Rates Paid by Employee's Rates the Employer Self-Employed Rates 7.65% on first $118,500 7.65% on first $118,500 15.3% on first $118,50 of income paid in wages of net profits 1.45% of income in 1.45% of wages paid in 2.9% of net profits in excess of $118,500 excess of $118,500 excess of $118,500 13) You decide to work part-time at a local supermarket. The job pays $8.50 per hour and you work 21 1 hours per week. Your employer withholds 10% of your gross pay for federal taxes, 7.65% for FICA taxes, and 4% for state taxes. (a) What is your weekly gross pay? (b) How much is withheld per week for federal taxes? (c) How much is withheld per week for FICA taxes? (d) How much is withheld per week for state taxes? (e) What is your weekly net pay? () What percentage of your gross pay is withheld for taxes? A) (a) $217.15 B) (a) $217.15 (a) $178.50 D) (a) $178.50 (b) $7.14 (b) $17.85 (b) $1785.00 (6) $17.85 (c) $13.66 (c) $13.66 (c) $13.66 (c) $13.66 (d) $17.85 (d) $7.14 (d) $714.00 (d) $7.14 (e) $178.50 (e) $17.85 (e) $146.99 (e) $139.85 (10.2% (1) 21.7% (1) 1407.7% (1) 21.7% Use the tables below to solve the problem. Round dollar amounts to the nearest cent and percents to the nearest tenth TABLE 31 2016 M artha Tax Rats up SIRSSO up to IAS $37 AST to 10 $91.1ST S INI $191,151 412 SIST 4150 more than $4150 Marding Married Sepanely 4275 up to 20 S 17A SIKSI 575.00 $125 $50,400 307 AS 575 575 SISIE S 01 SIM150 57051 SIIS 72 151 11450 $130,151 210 S115. 7 267 11 451 411 to 541120 7612145411. 151 4 11.151 to $441,000 methan $211.47 has so more than $410 Standard SA SO TABLE 8.2 2016 FICA Tax Rates Matching Rates Paid by Employee's Rates the Employer Self-Employed Rates 7.65% on first $118.500 7.65% on first $118,500 15.3% on first $118,500 of income paid in wages of net profits 1.45% of income in 1.45% of wages paid in 2.9% of net profits in excess of $118.500 excess of $118,500 excess of $118.500 13) You decide to work part-time at a local supermarket. The job pays $8.50 per hour and you work 21 13) hours per week. Your employer withholds 10% of your gross pay for federal taxes, 7.65% for FICA taxes, and 4% for state taxes. (a) What is your weekly gross pay? (b) How much is withheld per week for federal taxes? (C) How much is withheld per week for FICA taxes? (d) How much is withheld per week for state taxes? (e) What is your weekly net pay? (1) What percentage of your gross pay is withheld for taxes? A) (a) $217.15 B) (a) $217.15 (a) $178.50 D) (a) $178.50 (b) $7.14 (b) $17.85 (b) $1785.00 (b) $17.85 (c) $13.66 (c) $13.66 (c) $13.66 (c) $13.66 (d) $17.85 (d) $7.14 (d) $714.00 (d) $7.14 (e) $178.50 (e) $17.85 (e) $146.99 (e) $139.85 (1) 0.2% (1) 21.7% (1) 1407.7% (1) 21.7% Use the tables below to solve the problem. Round dollar amounts to the nearest cent and per TABLE 8.1 2016 Marginal Tax Rates, Standard Decluctions, and Exemptions orid, Married and Back divorced, Parter files legally separated separate texture Married and late partes fils. Single to return Us then all the supporting skill or partiet Tax Rate 10% 15% 25% Single up to $9275 $9276 to $37,650 $37,651 to $91.150 $91.151 to $190,150 $190.151 to $413.350 $413,351 to $415,050 more than $$15.050 Married Filing Separately up to $9275 $9276 to $37,650 $37,651 to $75,950 $75.951 to $115.725 SU15.726 to $206,675 $206,676 to $233,475 more than $233.475 Married Filing Jointly up to $18,550 $18,551 to $75,300 $75,301 to $151,900 5151,901 to $231,450 5231,451 to $413,350 5413,351 to $466,950 more than $466,950 Head of Household up to $13,250 $13,251 to $50,400 $50,401 to $130,150 $130,151 to $210.800 $210,801 to $413.350 $413.351 to $441,000 more than $441,000 28% 35% 39.6% Standard Deduction I'xemptions per person $6.300 $6300 $9300 $12,600 $4050 $4050 $4150 $4050 Use the tables below to solve the problem TABLE 3.1 2016 M . Sad Deductions, w to solve the problem. Round dollar amounts to the nearest cent and percents to the nearest tenth com Tax 1975 15 26 A 5171 SESSO SILISIS190 4 51 415 Murid Merd Seperty up 275 wp SS SS 11 STAO SSSSSSSSS SUTASIN S15 S15 S US 1156151 S115 S e 4111 Standland Dust SA $120 som SAMO TABLE 8.2 2016 FICA Tax Rates Matching Rates Paid by Employee's Rates the Employer Self-Employed Rates 7.65% on first $118,500 7.65% on first $118,500 15.3% on first $118,50 of income paid in wages of net profits 1.45% of income in 1.45% of wages paid in 2.9% of net profits in excess of $118,500 excess of $118,500 excess of $118,500 13) You decide to work part-time at a local supermarket. The job pays $8.50 per hour and you work 21 1 hours per week. Your employer withholds 10% of your gross pay for federal taxes, 7.65% for FICA taxes, and 4% for state taxes. (a) What is your weekly gross pay? (b) How much is withheld per week for federal taxes? (c) How much is withheld per week for FICA taxes? (d) How much is withheld per week for state taxes? (e) What is your weekly net pay? () What percentage of your gross pay is withheld for taxes? A) (a) $217.15 B) (a) $217.15 (a) $178.50 D) (a) $178.50 (b) $7.14 (b) $17.85 (b) $1785.00 (6) $17.85 (c) $13.66 (c) $13.66 (c) $13.66 (c) $13.66 (d) $17.85 (d) $7.14 (d) $714.00 (d) $7.14 (e) $178.50 (e) $17.85 (e) $146.99 (e) $139.85 (10.2% (1) 21.7% (1) 1407.7% (1) 21.7%