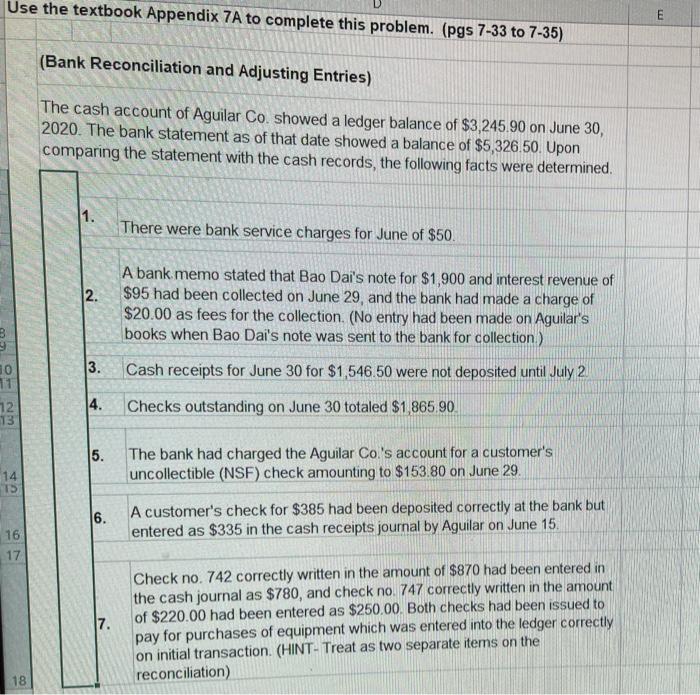

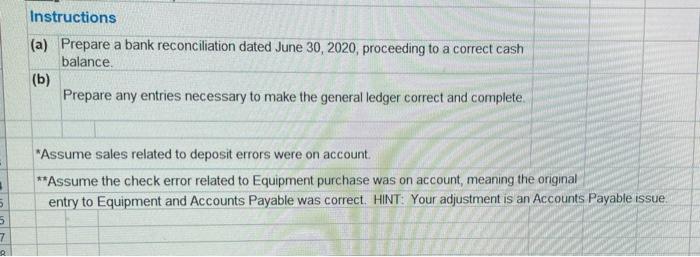

Use the textbook Appendix 7A to complete this problem. (pgs 7-33 to 7-35) E (Bank Reconciliation and Adjusting Entries) The cash account of Aguilar Co. showed a ledger balance of $3,245.90 on June 30, 2020. The bank statement as of that date showed a balance of $5,326.50. Upon comparing the statement with the cash records, the following facts were determined. 1. There were bank service charges for June of $50. 2. A bank memo stated that Bao Dai's note for $1,900 and interest revenue of $95 had been collected on June 29, and the bank had made a charge of $20.00 as fees for the collection. (No entry had been made on Aguilar's books when Bao Dai's note was sent to the bank for collection) B 3. Cash receipts for June 30 for $1,546.50 were not deposited until July 2 4. 12 13 Checks outstanding on June 30 totaled $1,865,90 5. The bank had charged the Aguilar Co.'s account for a customer's uncollectible (NSF) check amounting to $153.80 on June 29 14 15 6. A customer's check for $385 had been deposited correctly at the bank but entered as $335 in the cash receipts journal by Aguilar on June 15. 16 17 17. Check no. 742 correctly written in the amount of $870 had been entered in the cash journal as $780, and check no. 747 correctly written in the amount of $220.00 had been entered as $250.00. Both checks had been issued to pay for purchases of equipment which was entered into the ledger correctly on initial transaction. (HINT- Treat as two separate items on the reconciliation) 18 Instructions (a) Prepare a bank reconciliation dated June 30, 2020, proceeding to a correct cash balance (b) Prepare any entries necessary to make the general ledger correct and complete "Assume sales related to deposit errors were on account **Assume the check error related to Equipment purchase was on account, meaning the original entry to Equipment and Accounts Payable was correct. HINT: Your adjustment is an Accounts Payable issue 1 5 5 7 Aguilar Co. Bank Reconciliation June 30, 2020 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 (b) Be sure to provide descriptions. Journalize each item separately. Date Account Titles Debit Credit - 8 59 40 41 43 44 45 46 47 48 49 50 51 52 53 54 55