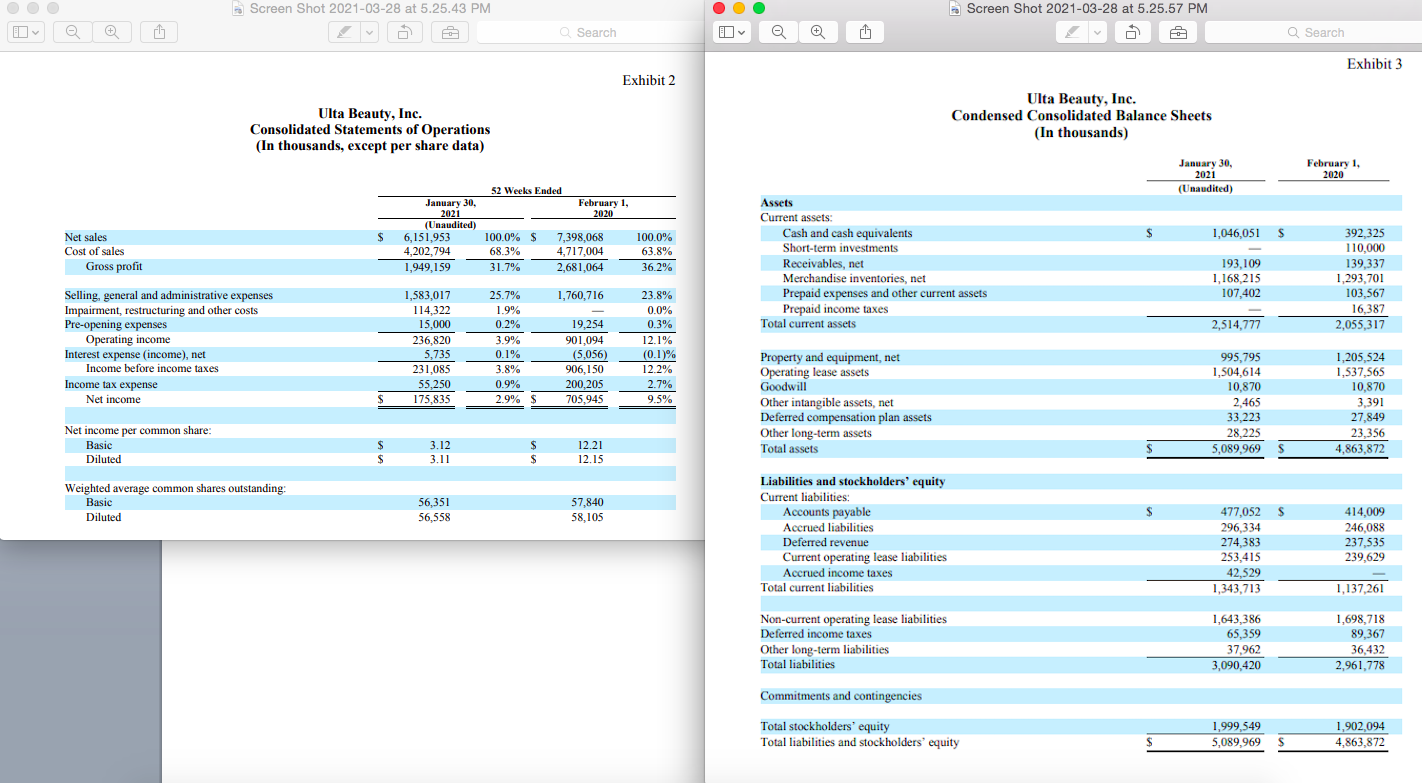

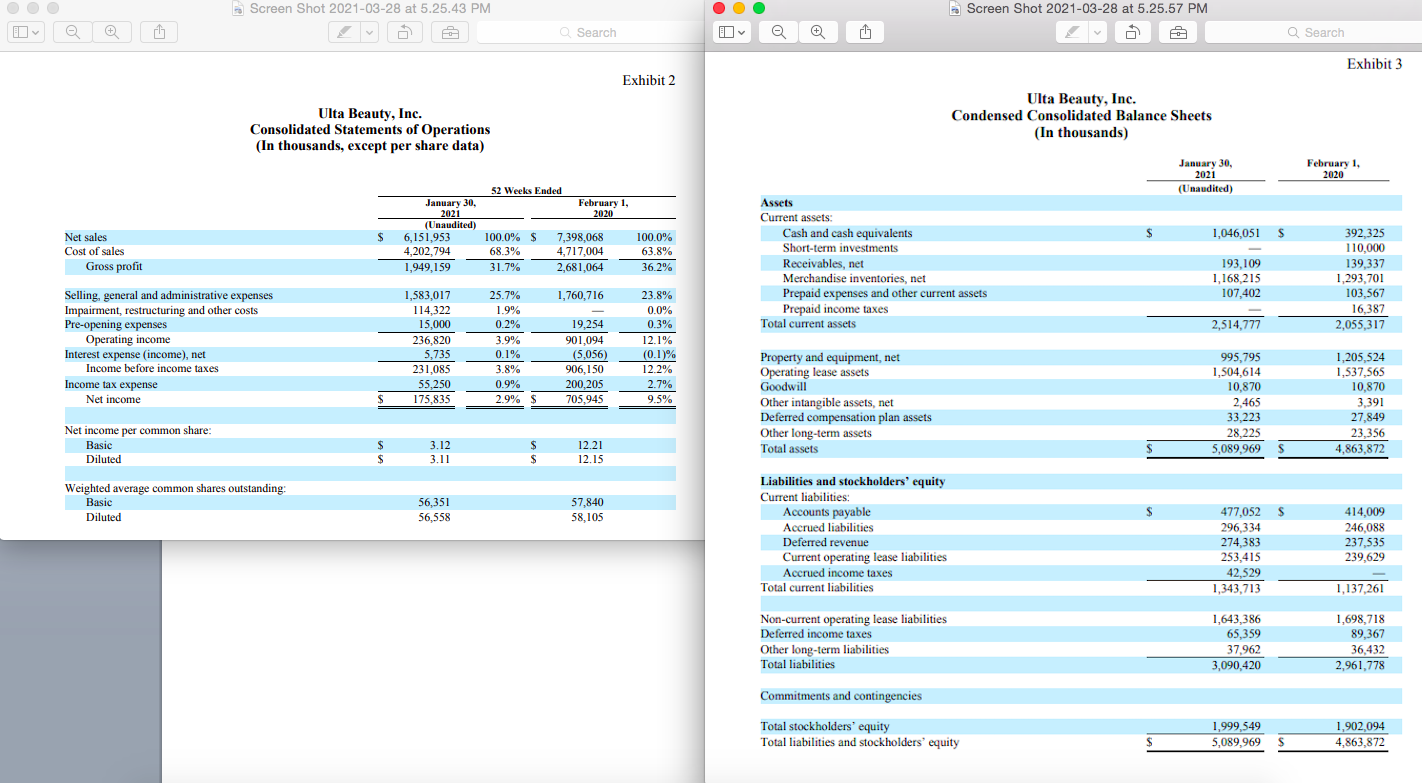

Use the Ulta annual report to calculate profit margin and total debt ratio for the year ending in 2021.

Use the Ulta annual report to calculate profit margin and total debt ratio for the year ending in 2021.

Screen Shot 2021-03-28 at 5.25.43 PM OOO Screen Shot 2021-03-28 at 5.25.57 PM Search @ G Q Search Exhibit 3 Exhibit 2 Ulta Beauty, Inc. Consolidated Statements of Operations (In thousands, except per share data) Ulta Beauty, Inc. Condensed Consolidated Balance Sheets (In thousands) January 30, 2021 (Unaudited) February 1, 2020 52 Weeks Ended February 1, 2020 S January 30, 2021 (Unaudited) 6,151,953 4,202,794 1,949, 159 Net sales Cost of sales Gross profit 1,046,051 S 100.0% $ 68.3% 31.7% 7,398,068 4,717,004 2,681,064 100.0% 63.8% 36.2% Assets Current assets: Cash and cash equivalents Short-term investments Receivables, net Merchandise inventories, net Prepaid expenses and other current assets Prepaid income taxes Total current assets 193,109 1,168 215 107,402 392,325 110,000 139,337 1,293,701 103.567 16,387 2,055,317 1,760,716 2,514,777 Selling, general and administrative expenses Impairment, restructuring and other costs Pre-opening expenses Operating income Interest expense (income), net Income before income taxes Income tax expense Net income 1,583,017 114,322 15,000 236,820 5,735 231,085 55,250 175,835 25.7% 1.9% 0.2% 3.9% 0.1% 3.8% 0.9% 2.9% $ 19.254 901.094 (5,056) 906,150 200,205 705.945 23.8% 0.0% 0.3% 12.1% (0.1) 12.2% 2.7% 9.5% $ Property and equipment, net Operating lease assets Goodwill Other intangible assets, net Deferred compensation plan assets Other long-term assets Total assets 995,795 1,504,614 10,870 2,465 33,223 28,225 5,089,969 1,205,524 1.537,565 10,870 3.391 27,849 23,356 4,863,872 Net income per common share: Basic Diluted $ $ 3.12 3.11 $ $ 12.21 12.15 Weighted average common shares outstanding: Basic Diluted 56,351 56,558 57,840 58,105 Liabilities and stockholders' equity Current liabilities: Accounts payable Accrued liabilities Deferred revenue Current operating lease liabilities Accrued income taxes Total current liabilities 477,052 $ 296,334 414,009 246,088 237,535 239,629 274,383 253,415 42,529 1,343,713 1,137,261 Non-current operating lease liabilities Deferred income taxes Other long-term liabilities Total liabilities 1,643,386 65,359 37,962 3,090,420 1,698,718 89 367 36,432 2,961,778 Commitments and contingencies Total stockholders' equity Total liabilities and stockholders' equity 1,999.549 5,089,969 1,902,094 4,863,872

Use the Ulta annual report to calculate profit margin and total debt ratio for the year ending in 2021.

Use the Ulta annual report to calculate profit margin and total debt ratio for the year ending in 2021.