Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use the up-down binomial pricing method to derive call option values for the following conditions: A. S = 50, K = 54, r =

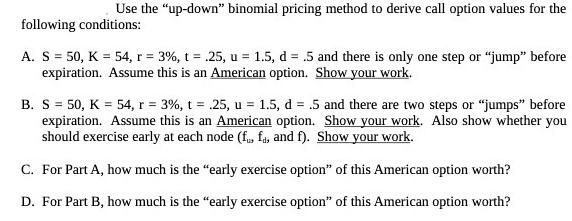

Use the "up-down" binomial pricing method to derive call option values for the following conditions: A. S = 50, K = 54, r = 3%, t = .25, u = 1.5, d = .5 and there is only one step or "jump" before expiration. Assume this is an American option. Show your work. B. S = 50, K = 54, r = 3%, t = .25, u = 1.5, d = .5 and there are two steps or "jumps" before expiration. Assume this is an American option. Show your work. Also show whether you should exercise early at each node (f, fa, and f). Show your work. C. For Part A, how much is the "early exercise option" of this American option worth? D. For Part B, how much is the "early exercise option" of this American option worth?

Step by Step Solution

★★★★★

3.34 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Lets solve each part of the problem step by step A UpDown Binomial Pricing Method with one step Given Current stock price S 50 Strike price K 54 Riskf...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started