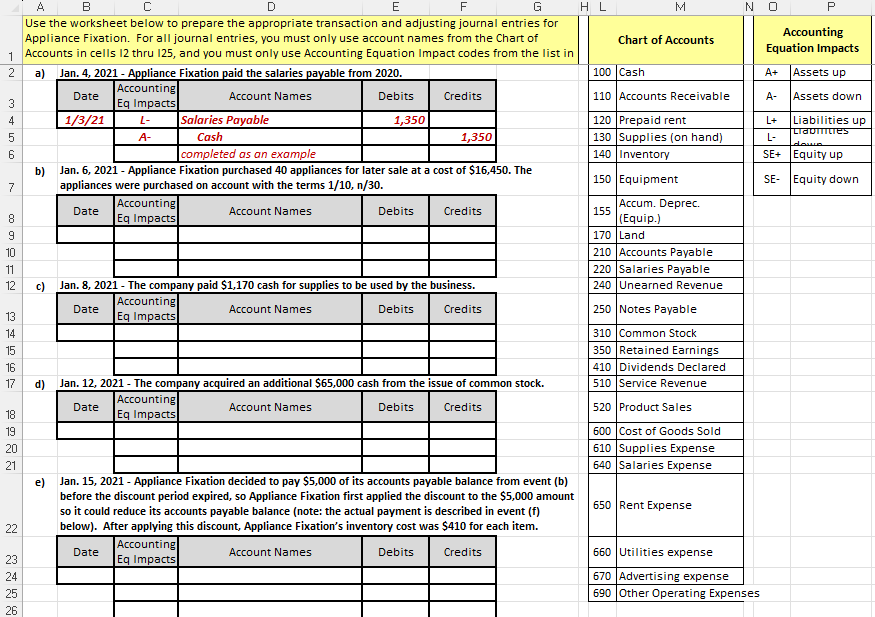

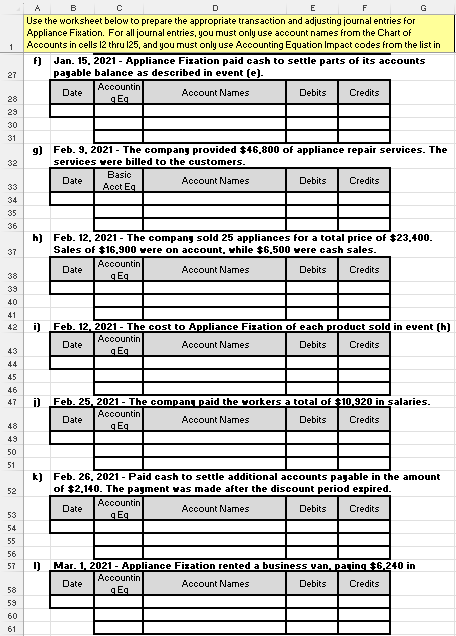

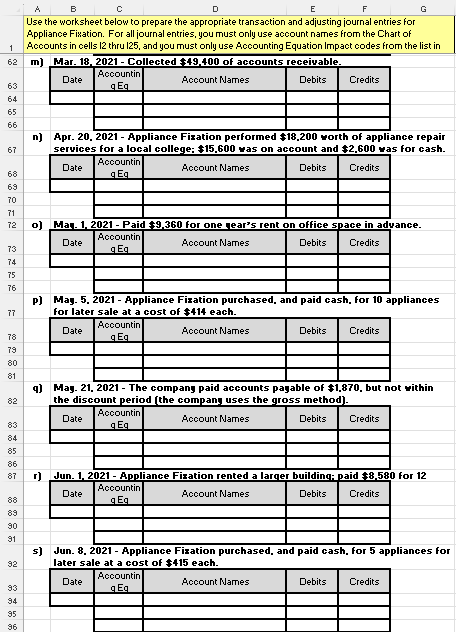

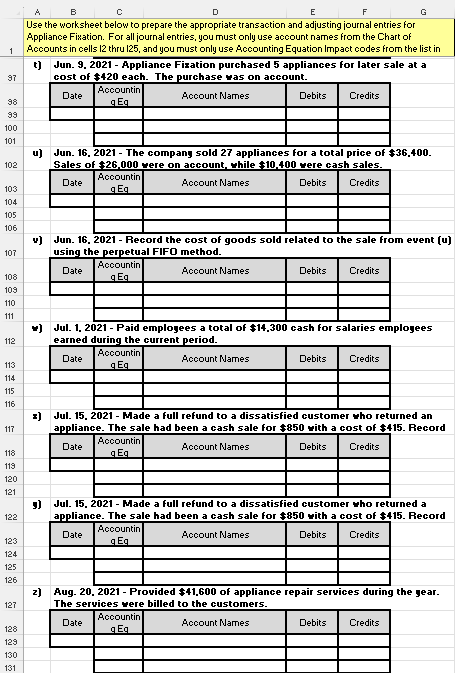

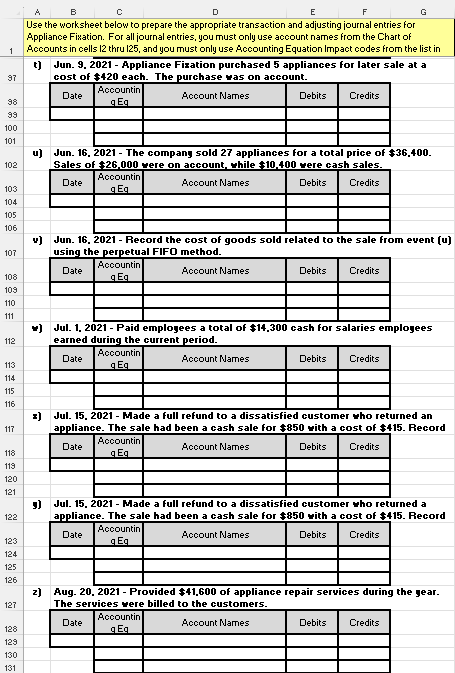

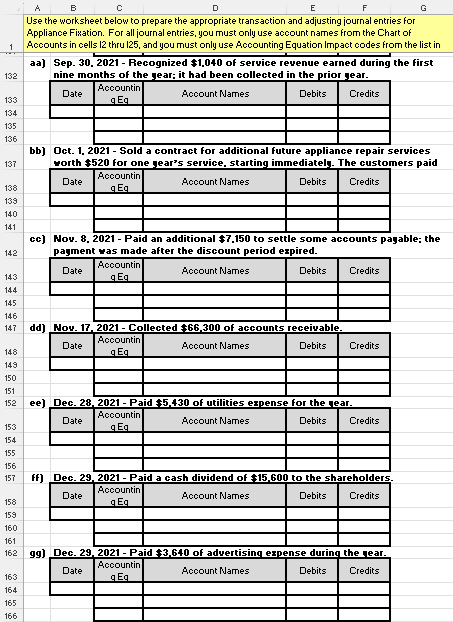

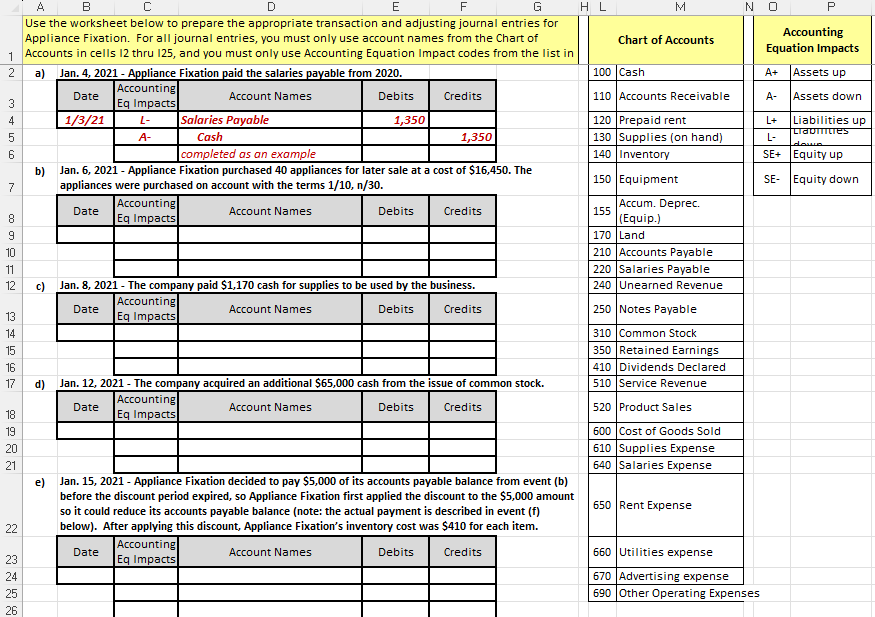

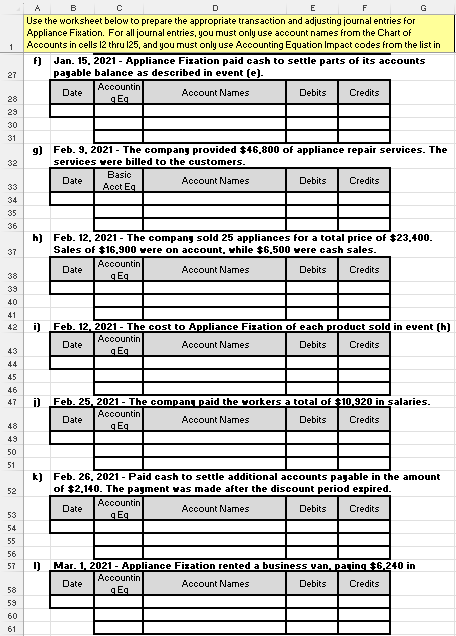

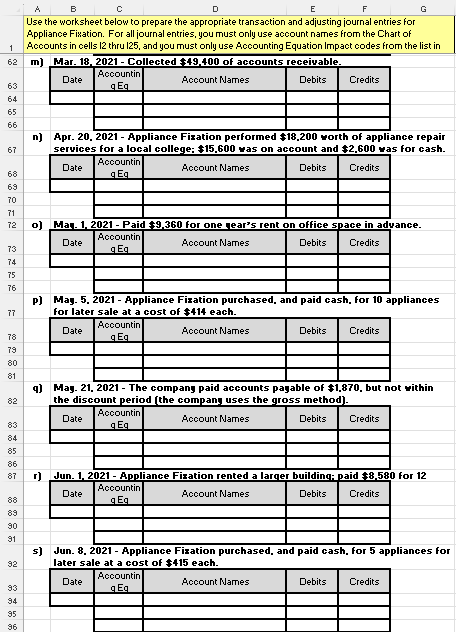

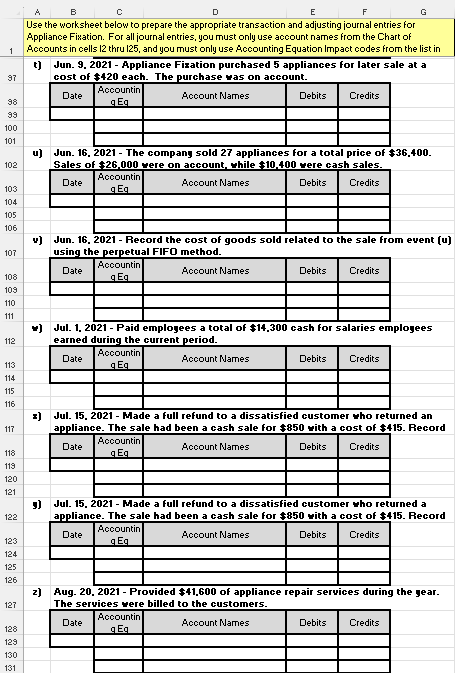

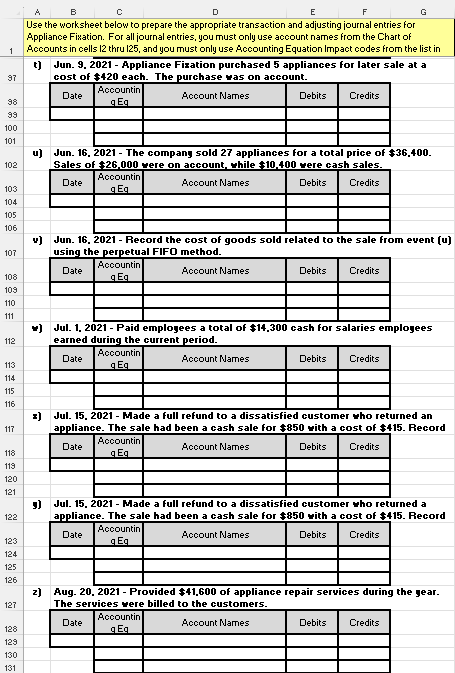

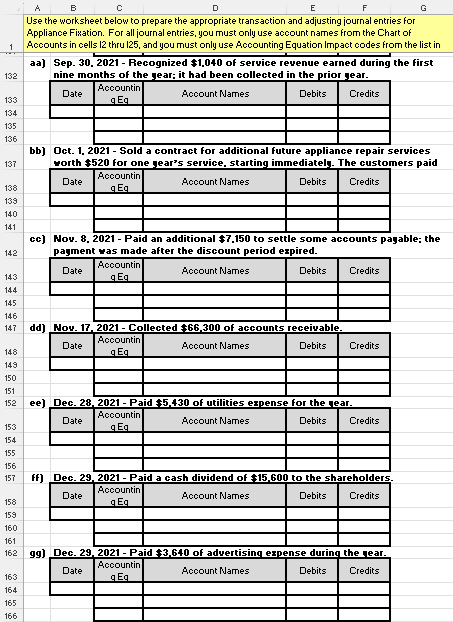

Use the worksheet below to prepare the appropriate transaction and adjusting journal entries for Appliance Fination. For all journal entries, you must only use aceount names from the Chart of Accounts in cells 12 thru 125, and you must only use Accounting Equation Impact codes from the list in f) Jan. 15, 2021 - Appliance Firation paid cash to settle parts of its acoounts pagable balance as described in ewent [e]. 9) Feb. 9. 2021 - The compang provided $46,800 of appliance repair seruices. The seruices were billed to the customers. h) Feb. 12. 2021 - The compang sold 25 appliances for a total price of $23.400. Sales of $16.900 mere on acoount, while $6.500 were cash sales. k) Feb. 26. 2021 - Paid cash to settle additional acoounts pagable in the amount of $2.140. The pagment was made after the discount period eapired. Use the worksheet below to prepare the appropriate transaction and adjusting journal entries for Appliance Firation. For all journal entries, you must only use account names from the Chart of Accounts in cells 12 thru 125, and you must only use Accounting Equation Impact codes from the list in n) Apr. 20. 2021 - Appliance Fixation performed $18,200 worth of appliance repair services for a local college; $15,600 was on account and $2,600 was for cash. 0] ince. p) Mag. 5, 2021 - Appliance Fixation purchased, and paid cash, for 10 appliances for later sale at a cost of $414 each. q) Mag. 21, 2021 - The compang paid accounts pagable of $1,870. but not within the discount period [the company uses the gross method]. 5) Jun. 8, 2021 - Appliance Fixation purchased, and paid cash, for 5 appliances for later sale at a cost of $415 each. Use the worksheet below to prepare the appropriate transaction and adjusting journal entries for Appliance Firation. For all journal entries, you must only use account names from the Chart of Accounts in cells 12 thru 125 , and you must only use Accounting Equation Impact codes from the list in t) Jun. 9. 2021 - Appliance Fixation purchased 5 appliances for later sale at a cost of $420 each. The purchase was on account. u) Jun. 16, 2021 - The compang sold 27 appliances for a total price of $36,400. Sales of $26,000 vere on account, while $10,400 were cash sales. v] Jun. 16. 2021 - Record the cost of goods sold related to the sale from euent [u] using the perpetual FIFO method. v) Jul. 1, 2021 - Paid emplogees a total of $14,300 cash for salaries emplogees earned during the current period. z) Jul. 15. 2021 - Made a full refund to a dissatisfied customer who returned an appliance. The sale had been a cash sale for $850 with a cost of $415. Record g) Jul. 15, 2021 - Made a full refund to a dissatisfied customer wo returned a appliance. The sale had been a cash sale for $850 with a cost of $415. Record z) Aug. 20. 2021 - Provided $41,600 of appliance repair seruices during the gear. The services vere billed to the customers. Use the worksheet below to prepare the appropriate transaction and adjusting journal entries for Appliance Firation. For all journal entries, you must only use account names from the Chart of Accounts in cells 12 thru 125 , and you must only use Accounting Equation Impact codes from the list in t) Jun. 9. 2021 - Appliance Fixation purchased 5 appliances for later sale at a cost of $420 each. The purchase was on account. u) Jun. 16, 2021 - The compang sold 27 appliances for a total price of $36,400. Sales of $26,000 vere on account, while $10,400 were cash sales. v] Jun. 16. 2021 - Record the cost of goods sold related to the sale from euent [u] using the perpetual FIFO method. v) Jul. 1, 2021 - Paid emplogees a total of $14,300 cash for salaries emplogees earned during the current period. z) Jul. 15. 2021 - Made a full refund to a dissatisfied customer who returned an appliance. The sale had been a cash sale for $850 with a cost of $415. Record g) Jul. 15, 2021 - Made a full refund to a dissatisfied customer wo returned a appliance. The sale had been a cash sale for $850 with a cost of $415. Record z) Aug. 20. 2021 - Provided $41,600 of appliance repair seruices during the gear. The services vere billed to the customers. Use the worksheet below to prepare the appropriate transaction and adiusting journal entries for Appliance Firation. For all journal entries, you must only use account names from the Chart of Accounts in cells 12 thru 125, and you must only use Accounting Equation Impact codes from the list in aa) Sep. 30. 2021 - Recognized $1,040 of seruice revenue earned during the first nine months of the gear; it had been collected in the prior gear. bb) Det. 1, 2021 - Sold a contract for additional future appliance repair services worth $520 for one gear's service, starting immediatel. The customers paid cc] Nou. 8. 2021 - Paid an additional $7,150 to settle some accounts pagable; the pagment was made after the discount period expired. Use the worksheet below to prepare the appropriate transaction and adjusting journal entries for Appliance Fination. For all journal entries, you must only use aceount names from the Chart of Accounts in cells 12 thru 125, and you must only use Accounting Equation Impact codes from the list in f) Jan. 15, 2021 - Appliance Firation paid cash to settle parts of its acoounts pagable balance as described in ewent [e]. 9) Feb. 9. 2021 - The compang provided $46,800 of appliance repair seruices. The seruices were billed to the customers. h) Feb. 12. 2021 - The compang sold 25 appliances for a total price of $23.400. Sales of $16.900 mere on acoount, while $6.500 were cash sales. k) Feb. 26. 2021 - Paid cash to settle additional acoounts pagable in the amount of $2.140. The pagment was made after the discount period eapired. Use the worksheet below to prepare the appropriate transaction and adjusting journal entries for Appliance Firation. For all journal entries, you must only use account names from the Chart of Accounts in cells 12 thru 125, and you must only use Accounting Equation Impact codes from the list in n) Apr. 20. 2021 - Appliance Fixation performed $18,200 worth of appliance repair services for a local college; $15,600 was on account and $2,600 was for cash. 0] ince. p) Mag. 5, 2021 - Appliance Fixation purchased, and paid cash, for 10 appliances for later sale at a cost of $414 each. q) Mag. 21, 2021 - The compang paid accounts pagable of $1,870. but not within the discount period [the company uses the gross method]. 5) Jun. 8, 2021 - Appliance Fixation purchased, and paid cash, for 5 appliances for later sale at a cost of $415 each. Use the worksheet below to prepare the appropriate transaction and adjusting journal entries for Appliance Firation. For all journal entries, you must only use account names from the Chart of Accounts in cells 12 thru 125 , and you must only use Accounting Equation Impact codes from the list in t) Jun. 9. 2021 - Appliance Fixation purchased 5 appliances for later sale at a cost of $420 each. The purchase was on account. u) Jun. 16, 2021 - The compang sold 27 appliances for a total price of $36,400. Sales of $26,000 vere on account, while $10,400 were cash sales. v] Jun. 16. 2021 - Record the cost of goods sold related to the sale from euent [u] using the perpetual FIFO method. v) Jul. 1, 2021 - Paid emplogees a total of $14,300 cash for salaries emplogees earned during the current period. z) Jul. 15. 2021 - Made a full refund to a dissatisfied customer who returned an appliance. The sale had been a cash sale for $850 with a cost of $415. Record g) Jul. 15, 2021 - Made a full refund to a dissatisfied customer wo returned a appliance. The sale had been a cash sale for $850 with a cost of $415. Record z) Aug. 20. 2021 - Provided $41,600 of appliance repair seruices during the gear. The services vere billed to the customers. Use the worksheet below to prepare the appropriate transaction and adjusting journal entries for Appliance Firation. For all journal entries, you must only use account names from the Chart of Accounts in cells 12 thru 125 , and you must only use Accounting Equation Impact codes from the list in t) Jun. 9. 2021 - Appliance Fixation purchased 5 appliances for later sale at a cost of $420 each. The purchase was on account. u) Jun. 16, 2021 - The compang sold 27 appliances for a total price of $36,400. Sales of $26,000 vere on account, while $10,400 were cash sales. v] Jun. 16. 2021 - Record the cost of goods sold related to the sale from euent [u] using the perpetual FIFO method. v) Jul. 1, 2021 - Paid emplogees a total of $14,300 cash for salaries emplogees earned during the current period. z) Jul. 15. 2021 - Made a full refund to a dissatisfied customer who returned an appliance. The sale had been a cash sale for $850 with a cost of $415. Record g) Jul. 15, 2021 - Made a full refund to a dissatisfied customer wo returned a appliance. The sale had been a cash sale for $850 with a cost of $415. Record z) Aug. 20. 2021 - Provided $41,600 of appliance repair seruices during the gear. The services vere billed to the customers. Use the worksheet below to prepare the appropriate transaction and adiusting journal entries for Appliance Firation. For all journal entries, you must only use account names from the Chart of Accounts in cells 12 thru 125, and you must only use Accounting Equation Impact codes from the list in aa) Sep. 30. 2021 - Recognized $1,040 of seruice revenue earned during the first nine months of the gear; it had been collected in the prior gear. bb) Det. 1, 2021 - Sold a contract for additional future appliance repair services worth $520 for one gear's service, starting immediatel. The customers paid cc] Nou. 8. 2021 - Paid an additional $7,150 to settle some accounts pagable; the pagment was made after the discount period expired