Answered step by step

Verified Expert Solution

Question

1 Approved Answer

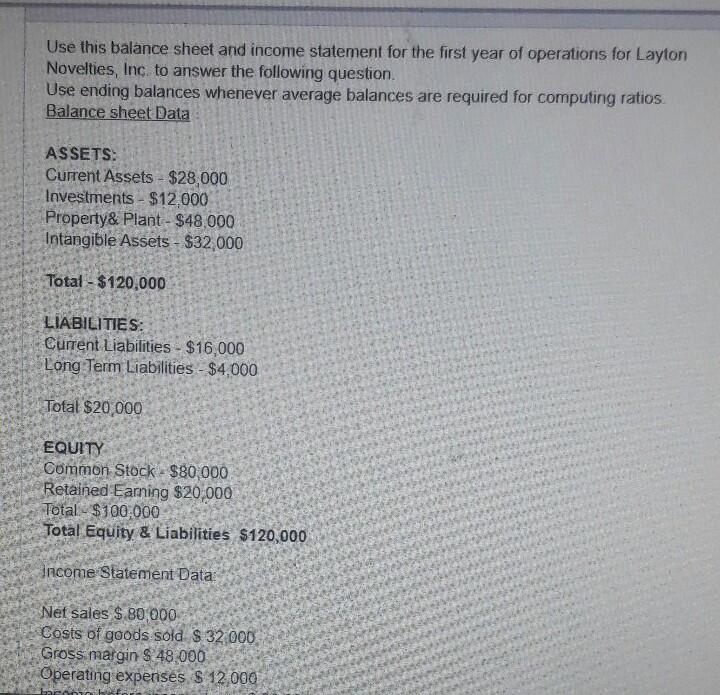

Use this balance sheet and income statement for the first year of operations for Layton Novelties, Inc. to answer the following question. Use ending balances

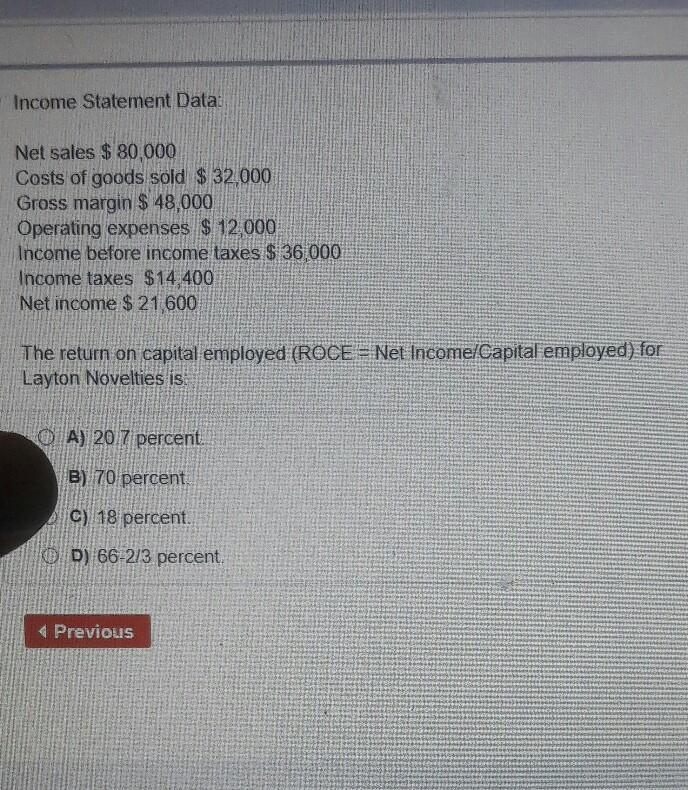

Use this balance sheet and income statement for the first year of operations for Layton Novelties, Inc. to answer the following question. Use ending balances whenever average balances are required for computing ratios. Balance sheet Data ASSETS: Current Assets - $28,000 Investments - $12000 Property& Plant - $48,000 Intangible Assets - $32,000 Total - $120,000 LIABILITIES: Current Liabilities - $16,000 Long Term Liabilities - $4,000 Total $20,000 EQUITY Common Stock - $80,000 Retained Eaming $20,000 Total $100,000 Total Equity & Liabilities $120,000 Income Statement Data: Net sales $ 80.000 Costs of goods sold $ 32.000 Gross margin S 48,000 Operating expenses $ 12,000 Income Statement Data: Net sales $ 80 000 Costs of goods sold $ 32.000 Gross margin $ 48,000 Operating expenses $ 12000 Income before income taxes $ 36,000 Income taxes $14 400 Net income $ 21 600 The return on capital employed (ROCE=Net Income/Capital employed) for Layton Novelties is: OA) 20.7 percent. B) 70 percent c) 18 percent. OD) 66-2/3 percent.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started