Question

Use this data to answer questions 5-13. Rainmaker Inc. earnings next year are predicted to be $7.50 per share. The company currently reinvests 20% of

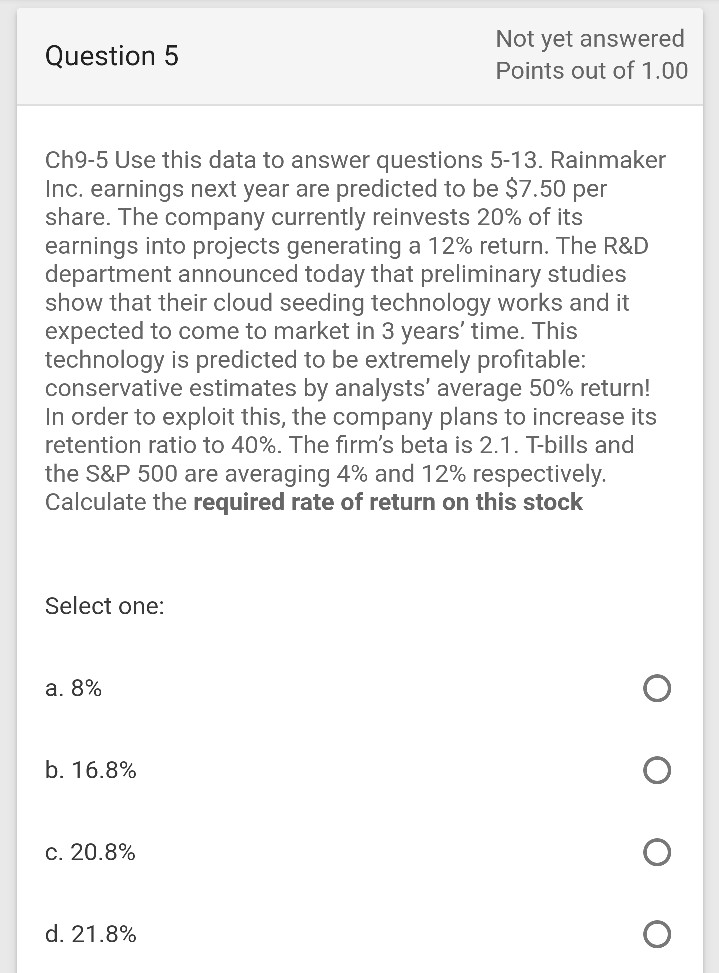

Use this data to answer questions 5-13. Rainmaker Inc. earnings next year are predicted to be $7.50 per share. The company currently reinvests 20% of its earnings into projects generating a 12% return. The R&D department announced today that preliminary studies show that their cloud seeding technology works and it expected to come to market in 3 years time. This technology is predicted to be extremely profitable: conservative estimates by analysts average 50% return! In order to exploit this, the company plans to increase its retention ratio to 40%. The firms beta is 2.1. T-bills and the S&P 500 are averaging 4% and 12% respectively. Calculate the required rate of return on this stock

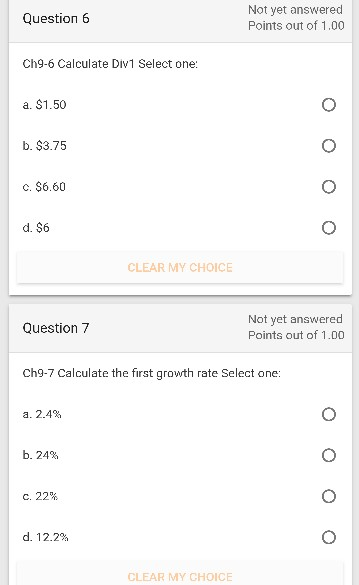

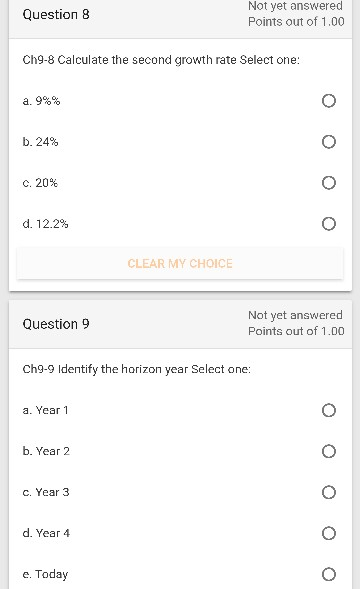

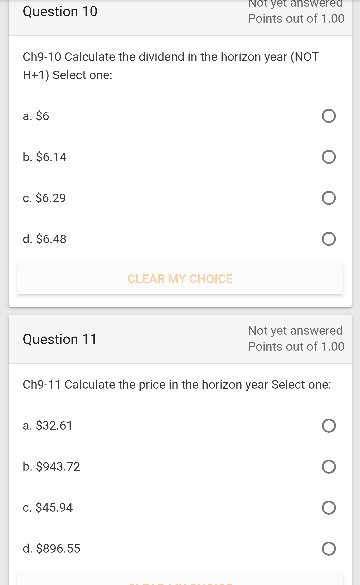

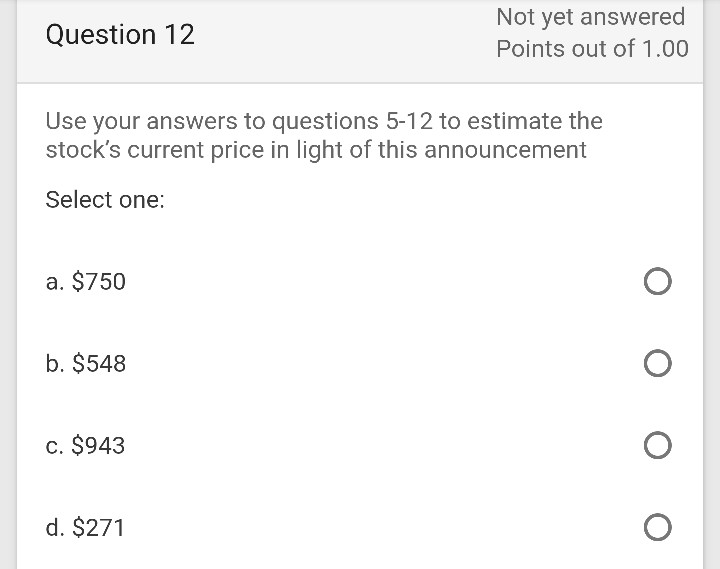

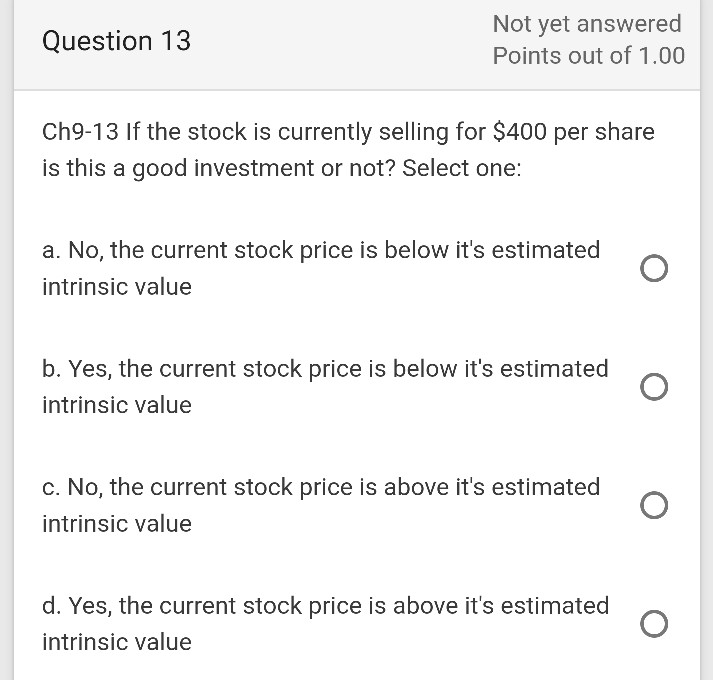

Question 5 Not yet answered Points out of 1.00 Ch9-5 Use this data to answer questions 5-13. Rainmaker Inc. earnings next year are predicted to be $7.50 per share. The company currently reinvests 20% of its earnings into projects generating a 12% return. The R&D department announced today that preliminary studies show that their cloud seeding technology works and it expected to come to market in 3 years' time. This technology is predicted to be extremely profitable: conservative estimates by analysts' average 50% return! In order to exploit this, the company plans to increase its retention ratio to 40%. The firm's beta is 2.1. T-bills and the S&P 500 are averaging 4% and 12% respectively. Calculate the required rate of return on this stock Select one: a. 8% b. 16.8% oooo c. 20.8% d. 21.8% Question 6 Not yet answered Points out of 1.00 Ch9-6 Calculate Div1 Select one: a. 81.50 b. $3.75 . $6.60 d. $6 CLEAR MY CHOICE Question 7 Not yet answered Points out of 1.00 Ch9-7 Calculate the first growth rate Select one: a. 2.4% . 24% . 22% d. 12.24 CLEAR MY CHOICE Question 8 Not yet answered Points out of 1.00 Ch9-8 Calculate the second growth rate Select one: a. 9%% b. 24% c. 20% d. 12.2% CLEAR MY CHOICE Question 9 Not yet answered Points out of 1.00 Ch9-9 Identify the horizon year Select one: a. Year 1 b. Year 2 c. Year 3 d. Year 4 e. Today Question 10 NOT Yet answered Points out of 1.00 Ch9-10 Calculate the dividend in the horizon year (NOT H+1) Select one: a. $6 0 b. $6.14 0 c. $6.29 0 d. $6.48 0 CLEAR MY CHOICE Question 11 Not yet answered Points out of 1.00 Ch9-11 Calculate the price in the horizon year Select one: a $32.61 b. $943.72 oooo c. $45.94 d. $896.55 Question 12 Not yet answered Points out of 1.00 Use your answers to questions 5-12 to estimate the stock's current price in light of this announcement Select one: . $750 o . $548 o . $943 o d. $271 o Question 13 Not yet answered Points out of 1.00 Ch9-13 If the stock is currently selling for $400 per share is this a good investment or not? Select one: a. No, the current stock price is below it's estimated intrinsic value b. Yes, the current stock price is below it's estimated intrinsic value 0 c. No, the current stock price is above it's estimated intrinsic value 0 d. Yes, the current stock price is above it's estimated intrinsic value 0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started